The Behavior Blog

A few times a year I like to call out some bad behavior, but not the normal, everyday type of bad behavior. I’m talking about the bad behavior of investors.

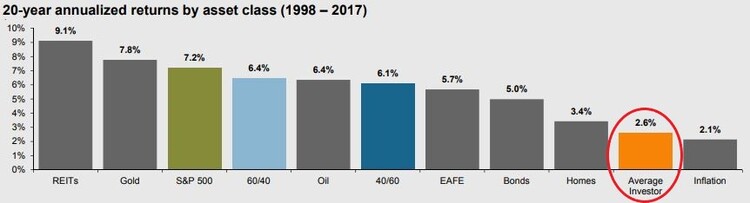

You might wonder what behavior has to do with investing. Investing is simple: buy low and sell high. That’s easier said than done. If behavior were simple, the chart below would look entirely different, wouldn’t you think?

Over a twenty-year period, the average investor produces a return of nearly 60 percent less than a passive 60/40 equity to fixed income portfolio. [i] This is based upon a proxy of using mutual fund redemptions, sales, and exchanges each month for twenty years.

The results show a 2.6 percent return, which is hardly a return that most investors can retire on. [i]

Why is the average investor return so much lower?

It’s my experience that regular investors miss a couple of key data points, as well as exhibit a few common bad behaviors.

The data points are simple: fees and taxes can chew up a tremendous amount of the returns investors need to retire. Just look at the distribution profiles of hypothetical market returns. Costs cause a dramatic shift to a much lower return profile. [ii]

The behavior, on the other hand, is much harder to identify. However, with over thirty years of managing other people’s money, along with my own, I have identified a few key behavioral traits that seem to lead investors astray.

The first behavior I refer to as a bias to action.

Humans are action-oriented. After all, when danger approaches, our fight-or-flight mentality takes over; we aren’t meant to just stand there. It’s instinctive to take some sort of action. Tragically, this type of behavior reminds me of the recent death in Washington State when a cougar attacked two mountain bikers. You can read the full story here, but in summary, one of the bikers ran (which is totally normal and instinctual) and met his demise. The biker that just stood there survived.

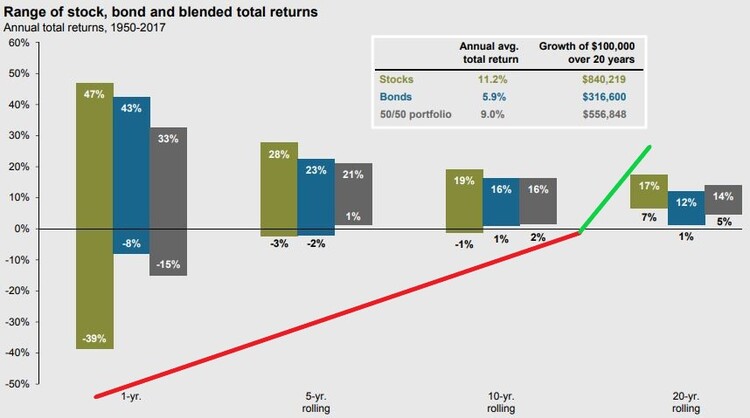

While not making light of a tragic situation, the same can be said about investing. Sometimes the best thing you can do is just stand there. Activity is the devil’s work when it comes to your money; I’ve found this to be true in almost all cases. The chart below summarizes this well. [i]

As you can see, the range of returns on stocks over one year is +47 percent to -39 percent. Compare that to the range of returns over a rolling twenty-year period of +17 percent to +7 percent. This is a huge volatility difference. This is not only a lesson in staying the course over short-sightedness but also in compounding. [i]

When investors react to short-term events, most are likely to bear the brunt of all the downside exposure. It’s important to always remember one of the greatest secrets to investing: time shapes risk.

The second behavior I refer to as complementary interactions.

I often hear from clients that they have friends who are investing in XYZ Fund or some real-estate deal. They say their friends made huge gains. Here are a couple takeaways from this kind of thinking:

- Your friends may be in a different financial situation, and in many cases, playing a different financial game than you are. Sure, they may live in a bigger home or have a nicer car, or they may even have an airplane, but those are not visual cues into their investment acumen. It’s important to remember that you have no idea what their appetite for risk is, or what their overall allocation is.

- I rarely hear investors talk about their losses. It’s simply a matter of self-preservation. We wouldn’t be Americans if we lamented the negatives all the time. We would have never been able to cope with the Great Depression, 1987 stock market crash, 9/11, or the Great Financial Crisis of 2008. (Small footnote: I was investing as a professional in all but one of those events.) Don’t be fooled by how people look or act–you rarely have all the facts.

The third behavior, I refer to as the CNBC bias.

Don’t be fooled by short-term headlines. In almost all ways, we get influenced by news events–especially around money. Financial/market media is a booming industry and it’s booming because investors want to understand and take action. Just take a look at this recent survey. [iii]

Not surprisingly, stock market news far outweighs regular news.

And last, the fourth behavioral trait is risk is a statistic, not a behavior.

Often when things look ugly, I have seen in myself and our clients that fear can replace risk. To put it more simply, behavior replaces data.

For example, if someone invested at the exact bottom of the last financial crisis, they would have been at a very low risk but a very fearful place in time. [iv]

Fear wise, you would have had to overcome a larger than two standard deviation move to the downside on a monthly basis and a -52.5 percent correction in the S&P 500, along with the collapse of several key banks including Washington Mutual, and Lehman Brothers, as well as a bailout of the rest of the major financial institutions. [iv]

If you did invest at the bottom of the financial crisis, you would have made over a 270 percent return, or 8.31 percent on an annualized basis, and learned a valuable lesson while doing so. [iv]

So what’s the solution to your behavior? Same as if you are out of shape, suffering from depression or anxiety, or climbing a mountain for the first time. Use a trainer, coach, or guide. This is certainly a gratuitous promotion for our business, but we try to pride ourselves on understanding these principles mostly when the chips are down and helping you do the same.

In fact, data from Vanguard quantifies a 3 percent potential benefit of using a financial advisor. [vi]

Additionally, using a coach can help you break out of the individual behaviors you might not be able to see in yourself, just as we use coaches to help us in our business. It might just help you improve your returns.

The famed poet T.S. Eliot, while sitting in a bomb shelter in war-torn London wrote,

“We had the experience but missed the meaning.” [v]

I think with all that’s being reshaped in the world right now, we will need to remember these lessons as we move forward with our investment approaches.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can email Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_3Q18_linked.pdf?segment=AMERICAS_US_ADV&locale=en_US

ii. http://www.voyagercapitalmgt.com/why-the-zero-sum-game-gives-indexing-an-edge/

iii. https://morningconsult.com/2018/02/14/stock-market-volatility-dominates-attention-voters-political-headlines/

iv. Bloomberg, L.P.

v. https://www.goodreads.com/quotes/27951-we-had-the-experience-but-missed-the-meaning-and-approach

vi. https://phillipsandco.com/files/7715/3184/7336/PCo_Whitepaper_5_-_Dont_Go_It_Alone.pdf