The Bend but Not Break Economy

Every cycle seems to hand us a phrase that captures the tension of the moment. In the early 1990s, it was the “Jobless Recovery.” In the late 1990s, it was “Irrational Exuberance.” Today? We may be living through the “Bend but Not Break” economy. Jobs are faltering, wage growth is softening, and yet corporate earnings, GDP, and markets keep pressing higher. It’s an economy that creaks under pressure but refuses to collapse — at least not yet.

Earnings: A Big Q2 Upside and Solid Q3 Setup

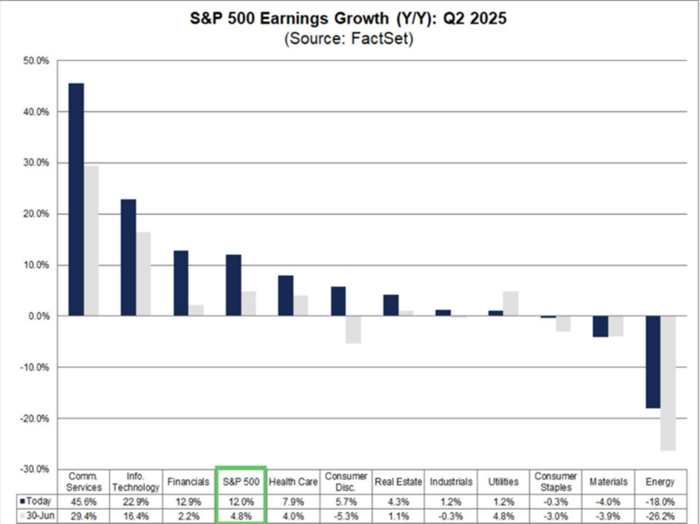

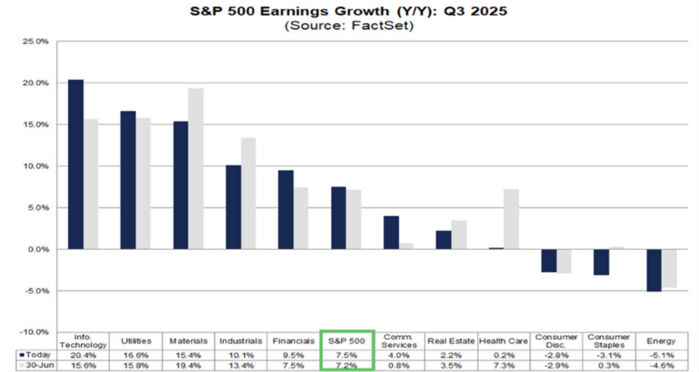

Corporate America just delivered one of the strongest earnings seasons in recent memory — and not just in absolute terms, but relative to expectations. Heading into Q2, analysts were bracing for only about 5% earnings per share (EPS) growth. Instead, companies delivered nearly 11–12% growth, more than double what was expected. Roughly 80% of companies beat EPS estimates, with an average surprise of 8–9%, well above long-run norms. The upside was led by Tech, Communication Services, and Financials, while Energy remained the laggard.

Looking ahead, Q3 expectations remain constructive. The S&P 500 is projected to grow earnings in the mid-to-high single digits, with Tech, Utilities, and Materials leading the charge, and Consumer Staples, Discretionary, and Energy under pressure. This “quality-up” profile — profit growth concentrated in high-productivity sectors — sets a strong backdrop even as labor market data weakens.

The Labor Market Hits a Wall

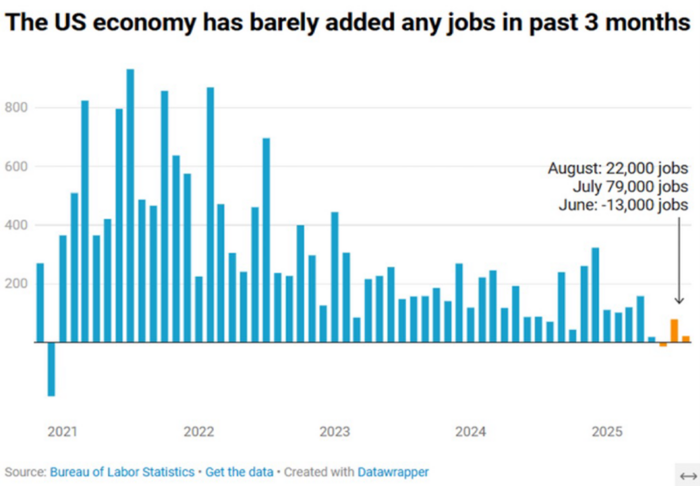

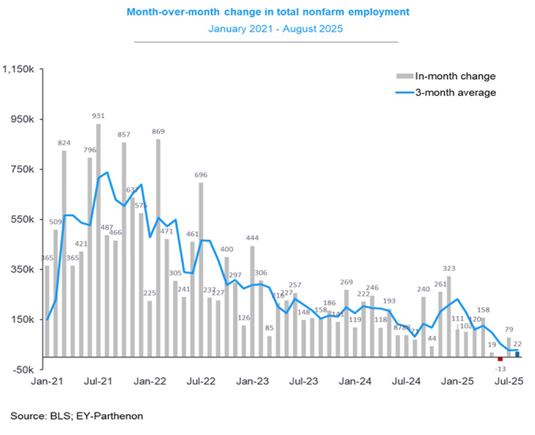

The glow of earnings stands in sharp contrast to the latest jobs data. The August report revealed just 22,000 jobs added, following July’s outright decline of -13,000.

The three-month average has slowed to a crawl compared to the half-million monthly gains seen during the recovery.

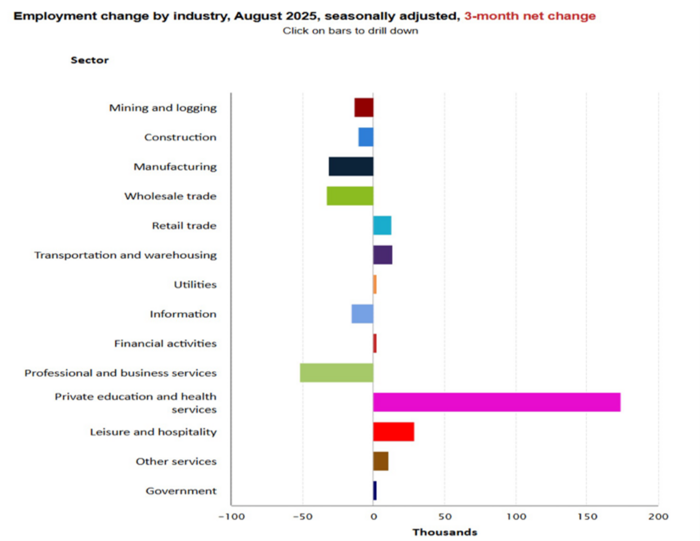

Sector breakdown tells the story:

- Health care and education remain the engines of job creation, adding nearly 170,000 jobs in the past three months.

- Leisure and hospitality continue to add, though modestly.

- Professional and business services, manufacturing, and mining are now in contraction.

The composition matters. Health care and education are across the board higher paying segments of the economy. (See our post on the healthcare economy). They continue to expand.

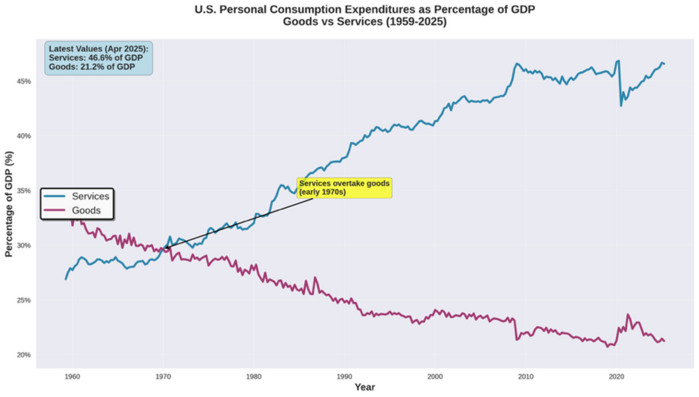

Services Carry the Load

The paradox makes more sense when you zoom out. For decades, the U.S. economy has been tilting steadily toward services. Today, services account for 46.6% of GDP, compared to just 21.2% for goods. That service-heavy tilt means even weak overall job gains don’t derail demand: Americans continue to spend on health care, housing, education, and leisure — categories less dependent on cyclical hiring.

This is why consumer spending, and thus GDP, can remain resilient even as headline job growth weakens.

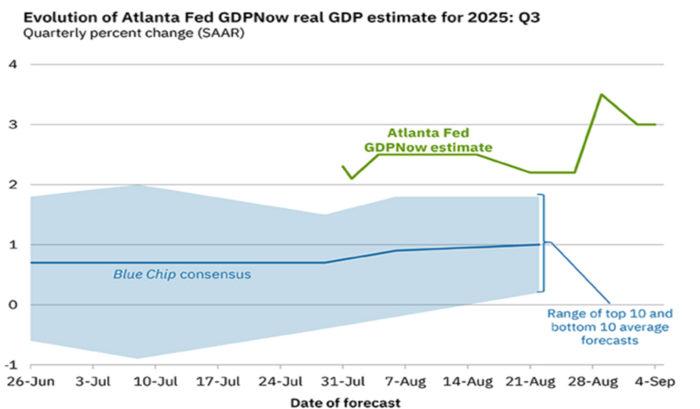

GDP Growth Refuses to Buckle

Sure enough, the Atlanta Fed’s GDPNow tracker is flashing close to 3% growth for Q3. Productivity gains, efficiency, and corporate pricing power are bridging the gap left by weak hiring. The economy is growing — just differently than in past cycles.

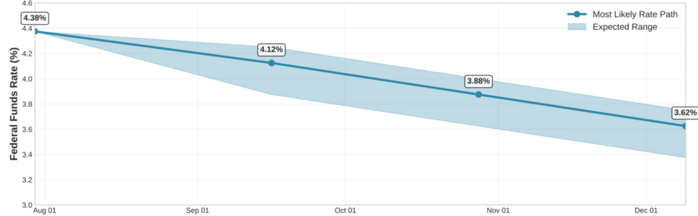

The Fed’s Next Move: Cutting into Strength

With jobs stalling but earnings and GDP holding firm, the Fed is likely to begin cutting rates.

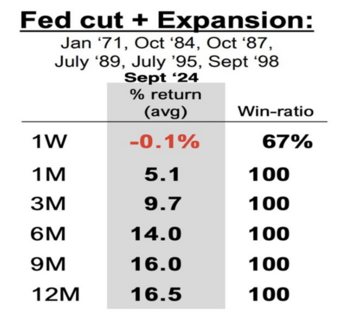

Historically, that’s been rocket fuel for markets. In every instance since 1971 when the Fed cut during an expansion, equities delivered double-digit returns within a year, with near-perfect win ratios.

This isn’t the first time markets have shrugged off weak payrolls while growth and earnings held up.

- Early 1990s: Coming out of the 1990–91 recession, job growth lagged badly (the so-called “jobless recovery”), but productivity and corporate profits surged, and markets ripped higher.

- Late 1990s: Payroll growth slowed in 1998–99, even as GDP and corporate earnings expanded. The Fed cut rates in response to global shocks, and the S&P 500 went on to post outsized gains.

The current moment pairs with those playbooks: weak jobs, strong profits, resilient consumption, and a Fed pivoting toward accommodation. History suggests that’s a bullish cocktail.

The Juxtaposition

So here we are:

- Companies are beating EPS expectations by a wide margin.

- The economy is expanding, led by resilient service spending including healthcare.

- Workers are being left behind, particularly in some lower wage sectors.

It isn’t a contradiction — it’s the new reality of a service-led, capital-intensive economy. Productivity, margins, and services spending are driving growth even as payrolls sputter

And that’s the essence of the Bend but Not Break Economy: an economy that absorbs shocks without snapping, one that bends under weak jobs data but remains upright thanks to corporate resilience, service-driven consumption, and the likely tailwind of Fed rate cuts. If history is any guide, that flexibility could stretch this expansion — and this bull market — further than many imagine.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.