The Bull Is Back!

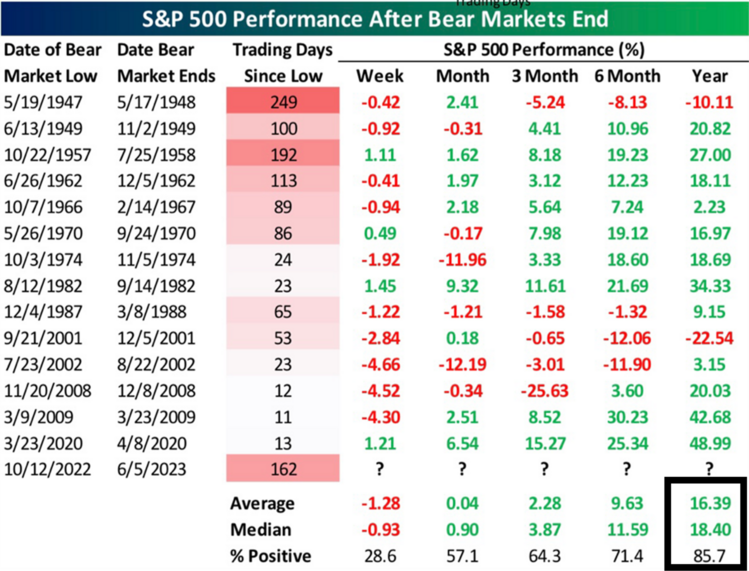

After one of the longest lasting bear markets in history, the S&P 500 closed up 20% off its 10/12/2022 low on Friday to kick off the official start of another bull market. If history is any guide there is more positive market action to come, according to our research friends at Bespoke Investment Group. 1

Over 85% of the time the S&P 500 is up over 16% (on average) one year later.

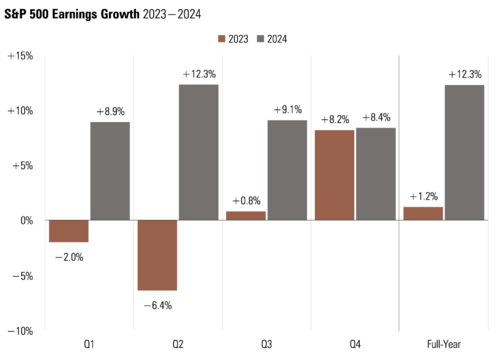

While much of the media and economist class is focused on recessions and interest rate hikes, the real story is future earnings. Yes, current earnings are in negative growth territory, but investors tend to discount the future six months ahead of time. 2

2024 S&P 500 earnings are expected to be strong, with analysts expecting 12.3% growth compared to the anemic 1.2% growth rate for 2023.

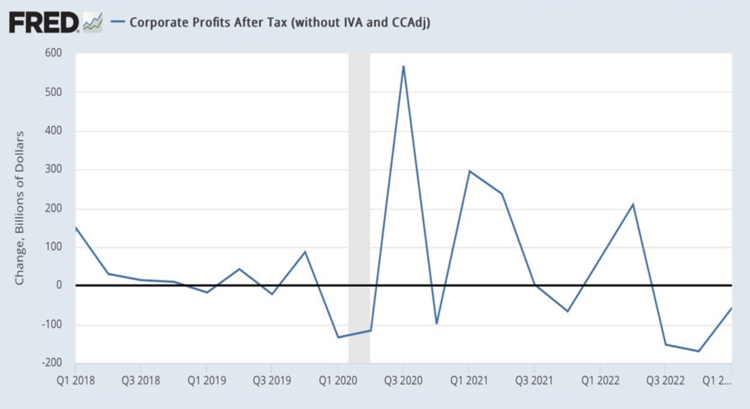

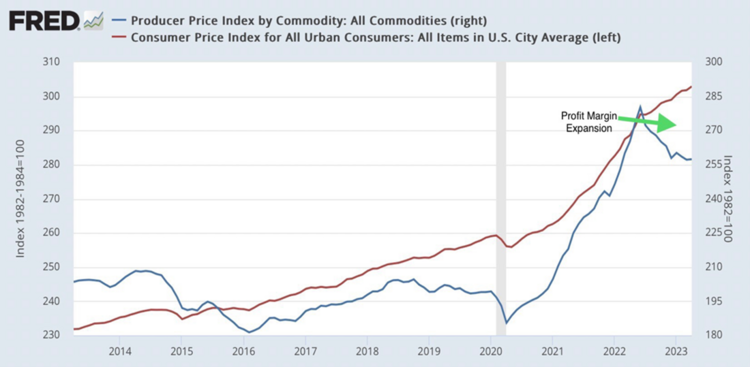

Further, profit margins look to have bottomed and perhaps will expand back to trend from here. 3

It’s not surprising coming off a lengthy period of inflationary price increases. We all know Corporate America is the least benevolent when it comes to normalizing prices after periods of inflation. When you overlay producer prices (what it costs to produce something) compared to consumer prices you can see the implicit margin expansion. 4

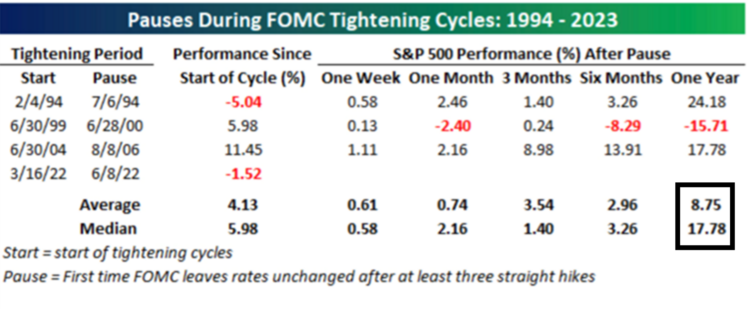

With all this equity market optimism one might expect the Fed to raise rates this coming week. However, that might be a mistake. It’s not been since the Financial Crisis of 2009 that I have seen credit distress in the commercial real estate sector. Money is simply hard to come by these days. It’s for that reason I suspect the Fed will pause the rate hike cycle with some cautionary language of possible hikes to follow. Again, from our friends at Bespoke, a pause in an interest rate cycle is not all that bad for equity returns. 1

Nearly 18% equity returns after a pause in the interest rate cycle is more confirmation that the Bull Is Back!

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: