The Bumpy Road

The latest readings on inflation and consumer spending confirmed one thing; the road back to a normalized inflationary and interest rate environment is going to be bumpy.

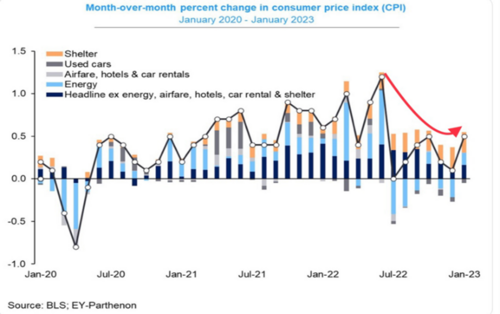

Inflation posted a very modest reduction, and some would characterize it as “sticky.” It’s just not dropping fast enough for some market participants. On a month-over-month basis inflation rose by 0.5%, which reversed a mini-cooling trend over the last 3 months. 1

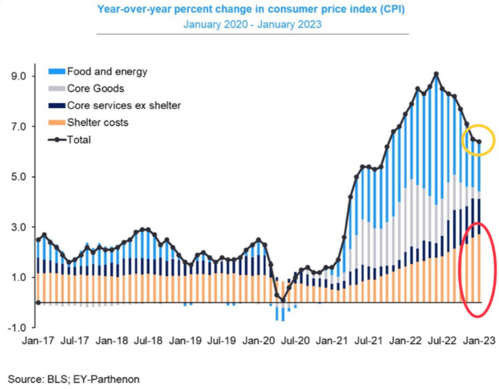

On a year-over-year basis, inflationary trends continue to cool albeit at a very so-so pace. The consumer price index rose by 6.3% annualized in January, a slight drop but almost unnoticeable. 1

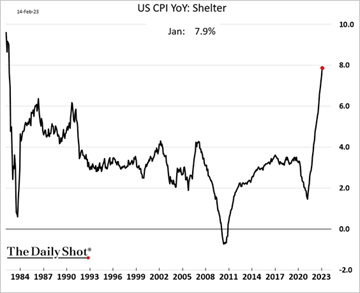

You really have to dig deep into the data to mine for optimism, but it’s there. Shelter inflation is back near record highs, but the methodology on how that segment is measured is dubious. 2

Shelter inflation is counted on an owners’ equivalent basis. In short, it’s a survey asking owners how much they would rent their house for. Let’s face it, if you’ve owned your home for 20 years, you have no idea.

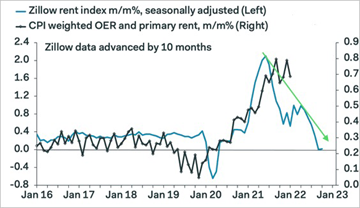

Better data exists for rents, like Zillow for example (a leading residential real estate website). Their reading suggests shelter inflation should moderate. 3

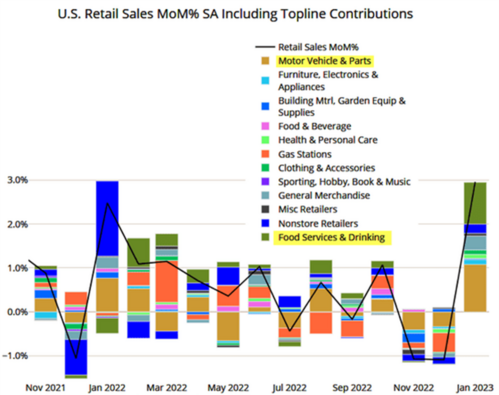

Pivoting to another macroeconomic reading; retail sales came in much stronger than expected in January. The consumer appears to remain resilient even in the face of higher interest rates and inflationary pressures. Retail sales were up a whopping 3% on a month-over-month basis, defying the belief that higher interest rates are impacting consumption. 4

Even after adjusting for inflation, consumption in food service, auto dealerships, and home furnishings continue to explode. 5

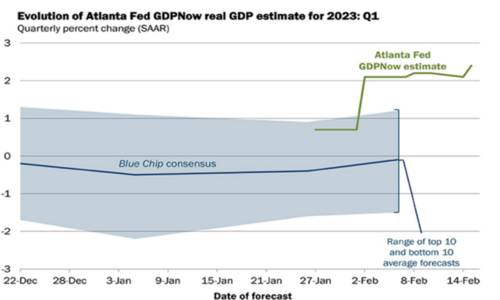

That’s why we see continued improvements in GDP expectations from the Atlanta Fed’s forecast for economic growth in Q1. 6

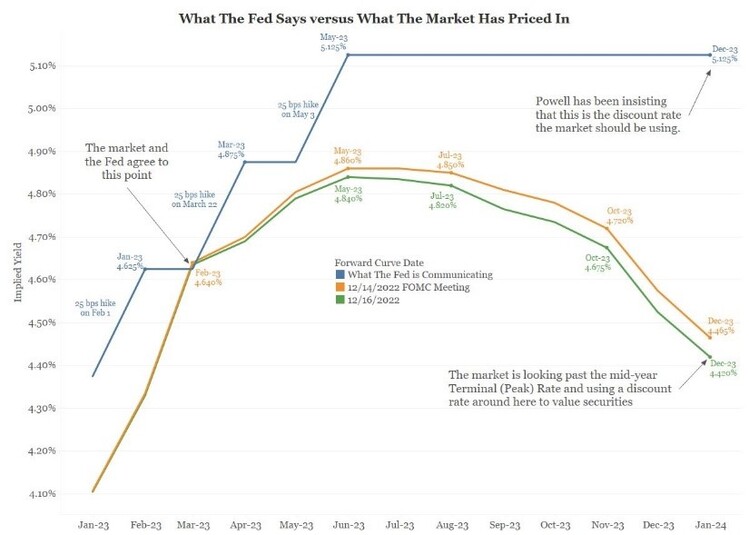

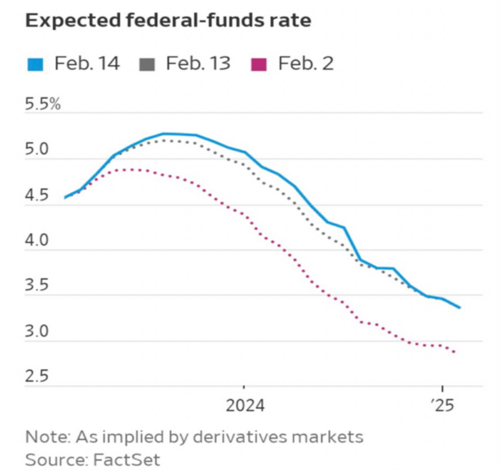

It’s also why we continue to see investor expectations adjust, closer to our view that interest rates will creep above 5% and remain there longer than anticipated compared to expectations at the start of the year. 7

The adjustment in interest rate expectations has been breathtaking since February 2nd. 8

So, what should investors do in light of this ongoing bumpy economic road?

- Capture higher shorter duration yields and keep optionality to adjust in the fall.

- Remain balanced between growth and value/defensive but be ready to pivot. Allocations to Health Care and Consumer Staples along with Technology and Core Growth are good barbells.

Bumpy roads are sure to disappoint along the way, especially as we are all eager to get back to a growth orientation in equity markets.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bls.gov/news.release/cpi.nr0.htm

- https://dailyshotbrief.com/

- https://www.zillow.com/research/data/

- https://www.census.gov/retail/marts/www/marts_current.pdf

- https://www.census.gov/retail/index.html

- https://www.atlantafed.org/cqer/research/gdpnow

- https://www.biancoresearch.com/

- https://www.wsj.com/articles/markets-come-to-grips-with-the-fed-on-interest-rates-733d1ea1