The China Explainer

As an investor in China and specifically their domestic “China A” stock market; I find myself often explaining China to many clients, friends, and family. While surrounded by family and friends this Christmas holiday, China was on the minds of many. With anti-China rhetoric at epic levels in the United States, a simple explanation can appear defensive.

I’m not a China apologist or defender! (How’s that for not being defensive?) However, as an investor using their markets to meet demanding equity return targets, I am certainly a China explainer these days.

In the spirit of good explanations, let’s level set China and see where we stand.

Most important, China is the second-largest single economy in the world. 1

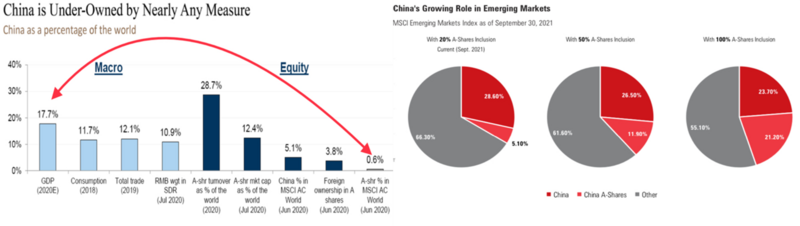

Remarkably, China is vastly underweighted across a whole host of benchmarks; most of all it’s representation in major equity indexes. Simply put, more investor dollars should flow into the China A share market in the years to come. 2

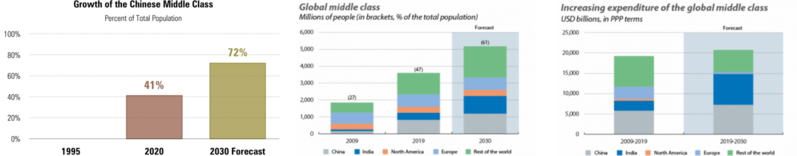

The soon-to-be largest middle class in the world has a desire to improve and modernize their lives so, how can one ignore the opportunity they represent? 3

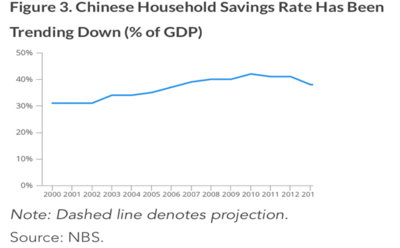

Combine the growing middle class, with spirit to consume, and resources in the form of some of the highest saving rates in the world4 and you get a special recipe for amazing consumption and, therefore, corporate growth. The trend to spend down savings is critical to increasing consumption and becoming less reliant on government spending. 5

That’s the simple version of “the why” in China.

These really aren’t the facts that created any tension around the fireplace over the holiday. The fireside chat bullet points are as follows:

How can you invest in a country that:

- Restricted video game playing for minors to 3 hours a week during the school week.

- Took highly profitable and predatory for-profit after school tutoring companies and made them not-for profit to lower the cost of education for the parents of China.

- Protected their citizens’ data from being moved to other countries by companies doing business in China.

- Regulated their largest tech companies (Alibaba and Tencent) from monopolistic behavior that was driving prices up on the Chinese consumer.

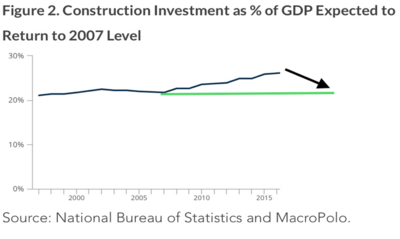

- Put tough limits on property developers’ bank borrowing which was fueling skyrocketing housing prices.

The simple and easily understood answer is straight forward: The Chinese Communist Party (CCP) wants to grow their middle class. Each and every one of the regulatory moves in 2021 supports that effort.

China will spend much of the next decade trying to transition their largely planned investment/infrastructure/housing economy to a US-styled consumption economy. 5

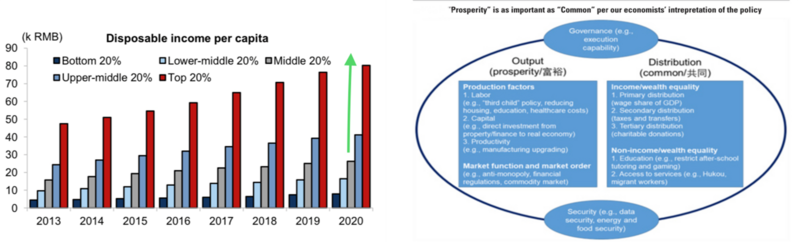

The CCP will spend that same amount supporting a growing middle class under their recently announced initiative of Common Prosperity. They want olive-shaped wealth distribution. 2

Western-style wealth disparity is terribly destabilizing for the ruling CCP as is an Oligarchy-driven, Soviet-style economy. (Reminder: the CCP is only 7% of the population)

Last, but not least, is the CCP’s desire to drive what they call “dual circulation” or simply put, reorient their economy to continue being a strong exporter while creating a more self-reliant, high-quality, domestic-consumption-driven economy. They will continue to use their long-standing Belt and Road Initiative to drive global influence and at the same time improve domestic consumption with improving wages, health care, social security, and education.

All of their regulatory reforms are consistent with improving the lives of the Chinese middle class, giving them more wealth to spend and consume.

The socialist system with Chinese characteristics is an understandable platform to organize a country with 1.4 billion people and a desire to grow a more equitable, thriving middle class. That’s why we invest a small portion of portfolios in China.

Am I a China defender or explainer? You will have to decide.

So, What’s Ahead?

On January 3rd we will publish our Q1 2022 U.S. Look Ahead and our 2022 China Look Ahead. You will get a good look at how we view the two largest economies in the world at that time.

Wishing you and your family a healthy, happy, and prosperous 2022.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.visualcapitalist.com/wp-content/uploads/2021/12/Global-Economy-GDP-by-Country-2021.html

- https://research.gs.com/

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

- https://www.brookings.edu/blog/future-development/2021/04/22/how-chinas-savings-could-help-save-the-planet/

- http://www.stats.gov.cn/english/