The Dollar Decline

One of my favorite poets, T.S Elliot, wrote in his seminal poem The Dry Salvages (1941), "We had the experience and missed the meaning."[1] It's quite possible we are about to encounter a global event where we might just miss the meaning.

While much of the world debates the importance of Russia and Crimea, a region with two million people, the GDP 1/7 the size of the state of Vermont and of no real consequence economically; I'm much more focused on a little discussed aspect - the impact on the US dollar.[2][3]

Here are some basic facts to consider:

1) Almost all oil traded in the world is done in US dollars. This was a byproduct of President Nixon cutting a deal with Saudi Arabia to buy their oil as long as it was in dollars, and they in turn bought US debt with our money, aptly named the Petrodollar. This led to the US dollar becoming the primary currency used for international transactions and foreign countries purchasing US dollars in reserve to support those transactions. With about 85% of the world’s foreign exchange transactions involving US dollars, countries worldwide hold nearly $6 trillion in US debt.[4] The top holders are in the table below.[5]

2) Russia currently exports about 126B cubic meters of natural gas to Europe, supplying 30% of Europe’s natural gas demand.[6] In 2012, Russia exported over 3M barrels of oil per day to Europe and 777,400 per day to Asia.[7]

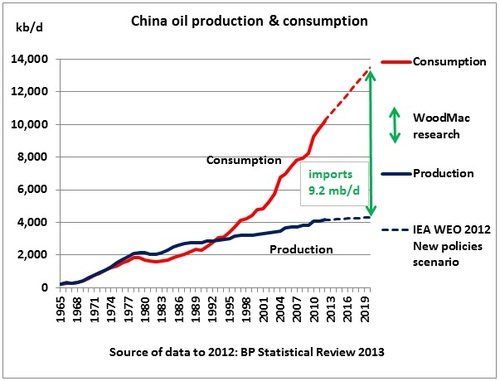

3) This chart on China says it all about China's insatiable demand for fossil energy.[8]

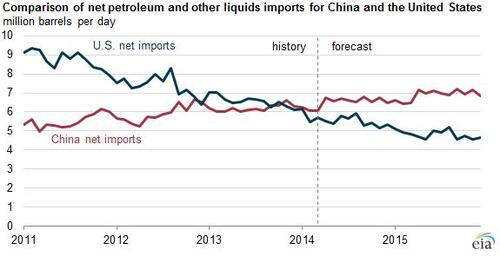

4) China surpassed the US as the world’s largest importer of Oil/Natural Gas in September 2013.[9]

5) Upon his appointment, President Xi Jinping made his first official foreign trip to Russia.

6) President Xi Jinping was at the Olympics side by side with Putin. Our President was nowhere to be seen.

7) Vladimir Putin will be visiting Chinese President Xi Jinping in May and you can bet they’re not sharing recipes for Szechuan Chicken.

Here is the missed meaning part of this little global poem being played out over Cremia.

If Russia and China cut an oil and gas deal, which is highly anticipated, Russia can certainly withstand any European boycott. This transaction, which would likely be one of the world’s largest energy transactions, will most certainly occur in a currency other than the US dollar. Could this become the tipping point for other nations to transact their global trade in something other than the US dollar?

It certainly could be. In fact, dominant currencies have never held the world stage for infinite periods of time.[10]

If so, the US dollar could weaken substantially and here are the consequences of that on investors and our economy.[11]

- With fewer deals done in dollars, higher interest rates would be an immediate consequence. The cost of funding debt would become more expensive, putting more pressure on government spending and home ownership.

- A weaker dollar helps US exporters by making US-produced goods cheaper in foreign markets. Stocks and debt of US Large Cap companies with export exposure may benefit.

- Conversely, goods and resources imported to the US will cost more. US companies may absorb some of the higher input costs initially, but eventually they will have to pass along cost increases, generating higher inflation.

- US travelers to foreign countries will have less purchasing power, as a US dollar will translate into less local currency.

- US investors holding Emerging and Foreign market debt may benefit from the weaker currency exchange, as the local currency will be worth more US dollars.

I don't predict a doomsday dollar scenario, as China still needs to export goods to the US to keep domestic peace and a dramatically weaker dollar makes that much more difficult.

I do anticipate some weakness in the dollar and higher rates for US consumers.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

[1] Eliot, T.S. (1941). Four Quartets. Wikiquote.org.

[2] RT.com. (Mar 15, 2014). Crimea’s economy in numbers and pictures.

[3] USGovernmentSpending.com. (FY 2014). Comparison of State and Local Spending and Debt in the US.

[4] Eichengreen, B. (Mar 2, 2011). Why the Dollar’s Reign Is Near an End. The Wall Street Journal.

[5] US Treasury. (Jan 2014). Major Foreign Holders of Treasury Securities.

[6] Samuelson, R. (Mar 27, 2014). Russia’s natural gas shutoff threat overblown. The Spokesman-Review.

[7] Stratfor Global Intelligence (Jan 22, 2013). Russian Oil Exports to Europe and Asia.

[8] Crude Oil Peak. (Sep 2013). China.

[9] Institute for Energy Research. (Mar 26, 2014). China Exceeds U.S. as Largest Net Importer of Petroleum.

[10] J.P. Morgan. (Jan 1, 2012). Eye on the Market | Outlook 2012. p. 5.

[11] Handley, M. (May 12, 2011). What a Weak Dollar Means for Consumers. US News.