The Earnings Game Begins

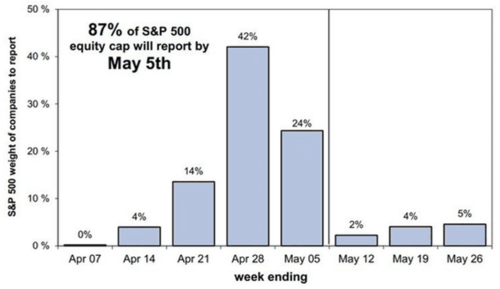

It’s been a long, quiet period between earnings reports and that silence has provided the backdrop for a host of other topics to reign supreme. However, corporate earnings reports will start flooding in this week and by the end of next week we should have a pretty good picture of the earnings environment for Q1. 1

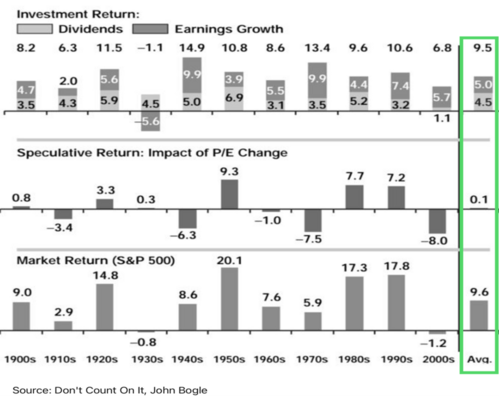

Remember, earnings (and dividends) matter most compared to multiple expansion, according to famed investor John Bogle. His historic data suggests that earnings and dividends drive total investment return compared to changes in the P/E ratio (multiple expansion). If 9.6% is the historic return on stocks, only 0.1% comes from multiple expansion compared to 4.5% from dividends and 5% from earnings growth.2

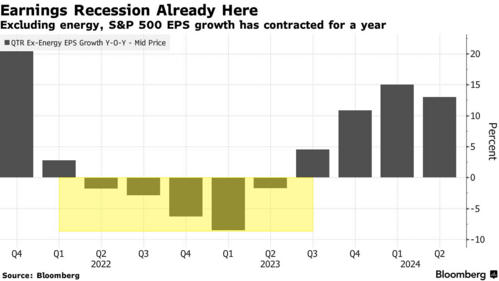

The fact is we’ve been in an earnings recession for several quarters where earnings have not been growing. 3

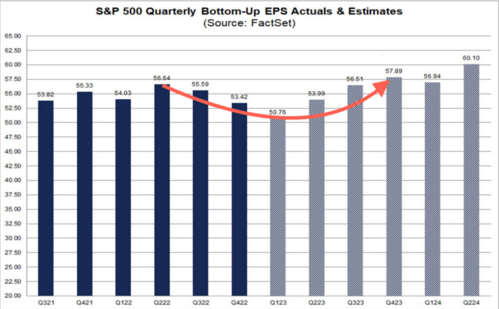

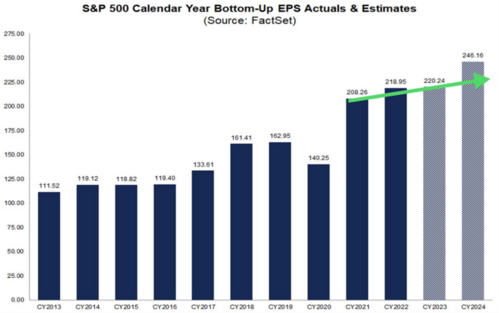

According to FactSet, analysts expect Q1 to be the trough in the earnings recession, with modest growth in Q2 and acceleration in Q3. 4

When we zoom out of the quarterly granularity, the earnings recession might be limited to the narrow bandwidth of quarters – not years. It’s staggering to see the quantum leap in earnings from 2019 to 2021. It’s also noteworthy to see, on an annual basis, we have not experienced any down years since 2020. What earnings recession? 4

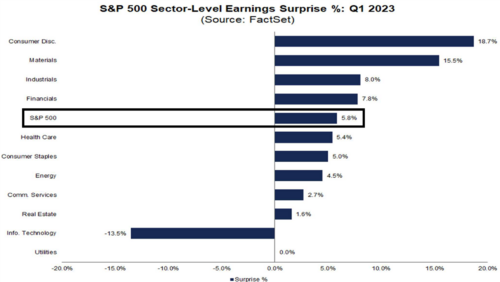

Results during the first reporting week suggest companies are beating expectations, albeit only slightly. In aggregate, companies have reported earnings that are 5.8% above expectations, which is below the 5-year average of 8.4% and the 10-year average of 6.4%. 4

Over the last several quarters companies have consistently beat expectations and perhaps that’s by design. Managing expectations is probably a primary duty for any skilled CFO. That’s why over 60% of companies report beats versus misses. Q1 looks to be even better. 3

The earnings game begins in full stride this week and that will make a difference in equity returns. Earnings matter most.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: