The Economic Bazooka

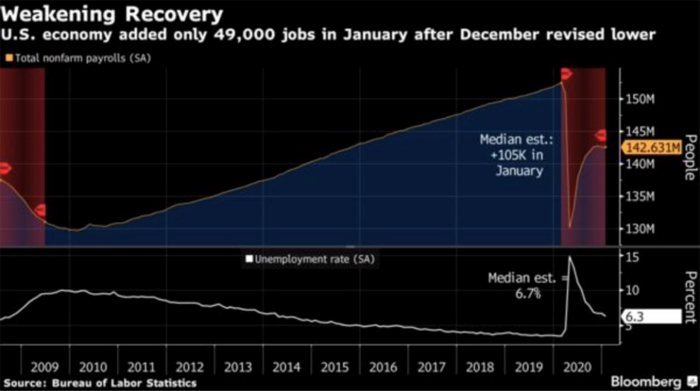

The most recent jobs report suggests the economic recovery is softening. Of course, that seems obvious since we have been in stuck in another “lockdown” phase. Most service sector jobs are in a deep freeze― especially in the travel, leisure, and hospitality industries. In total, we only added 49,000 jobs in January and that certainly does not return us to any form of pre-COVID trends. [i]

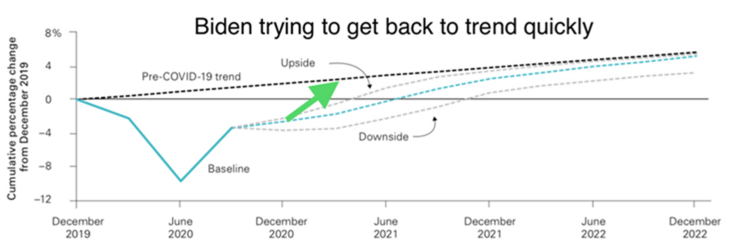

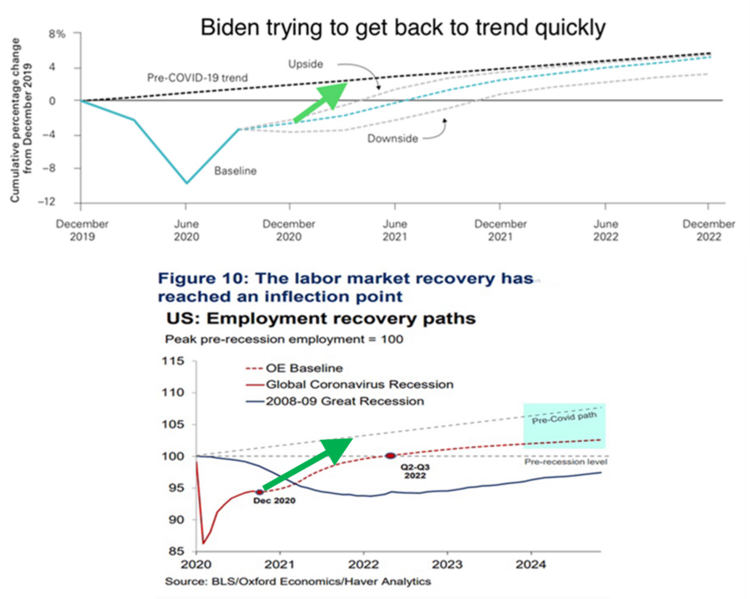

President Biden has clearly signaled he intends to load his economic bazooka in order to work though this soft patch and backfill the loss of the Trump economic growth trend. [ii]

President Biden learned an incredibly valuable lesson during the Great Financial Crisis when then-President Obama negotiated a modest economic package that kept the U.S. economy growing well-below trend; too little stimulus prolongs the economic pain.

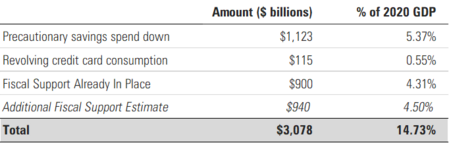

Even before the Biden stimulus package, there was plenty of booze in the punch bowl in the form of economic support.

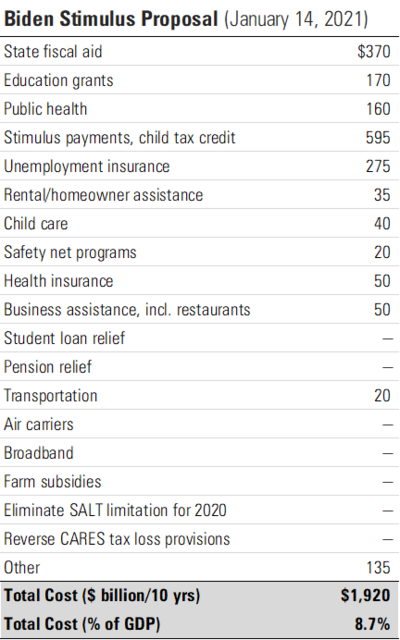

Let’s take a second and review the detail of Biden’s $1.9 trillion stimulus proposal. [iii]

Not all of this is immediately stimulative, however components like direct payments to individuals, unemployment insurance, safety net programs, and business assistance are going to be additive to the already $2.138 trillion seeping its way into our economy. In total, we estimate approximately $940 billion of the proposed $1.9 trillion Biden stimulus package will be immediately stimulative to the economy.

We could go from a potential 10.23% of GDP in dry powder to 14.73% of dry powder, or $3.078 trillion.

Again, all of this is an attempt to get the U.S. economy and jobs growing back to trend.

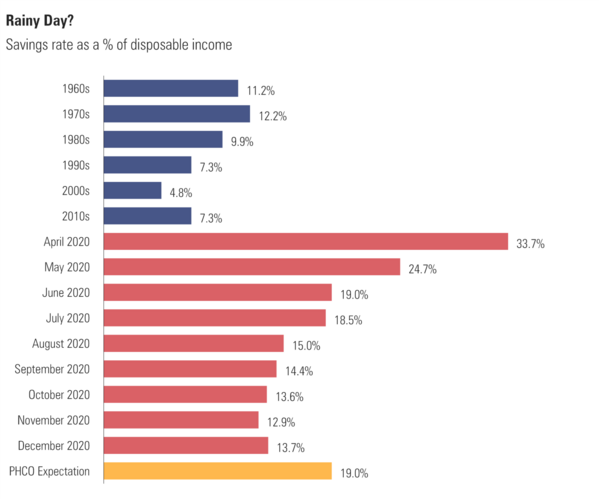

Let us level set expectations on how this might play out. It’s my belief that President Biden’s package will not pass until mid-March. It’s also my view that the first impulse for a shell-shocked consumer will be to rebuild precautionary savings― perhaps back to levels not seen since June 2020. [iv]

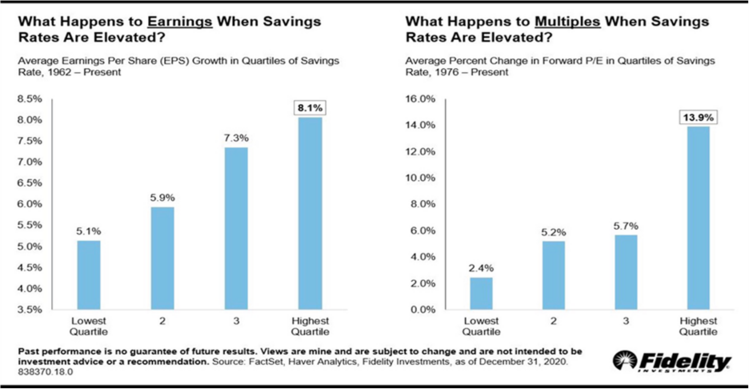

So, what happens to corporate earnings with such high savings levels? When the consumer begins to spend down that savings, historically, corporate earnings growth explodes by 8.1% and multiples expand by 13.9%. [v]

That would translate into 4,806 on the S&P 500, or 28% growth this year. While this is certainly the optimistic view, our base case calls for very modest S&P 500 price appreciation.

When it comes to equity investing, anything can happen and usually does.

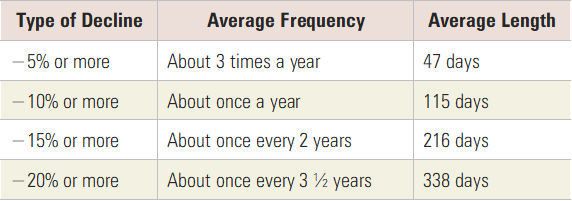

With all the firepower loaded and more gun powder about to be brought onto the field of battle, it’s hard to bet against U.S. equities. It is critical to realize a 20% drawdown is entirely realistic and unpredictable. In fact, they occur with some frequency. [vi]

My view is these potential corrections might be incredibly brief, with plenty of ammunition looking for a target to hit.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/news/articles/2021-02-05/u-s-payrolls-rise-less-than-forecast-after-bigger-december-drop

ii. https://pressroom.vanguard.com/nonindexed/Vanguard-economic-and-market-outlook-report-2021-120920.pdf

iii. https://www.cnn.com/2021/01/14/politics/biden-economic-rescue-package-coronavirus-stimulus/index.html

iv. https://fred.stlouisfed.org/series/PSAVERT

v. https://www.fidelity.com/

vi. https://PHILLIPSANDCO.COM/download_file/3080/