The Fed Giveth and The Fed Taketh Away

Last week, Federal Reserve Chair Jerome Powell signaled willingness to accelerate the pace of interest rate increases during a recent speech he gave to the National Association for Business Economics: 1

“If we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so.”

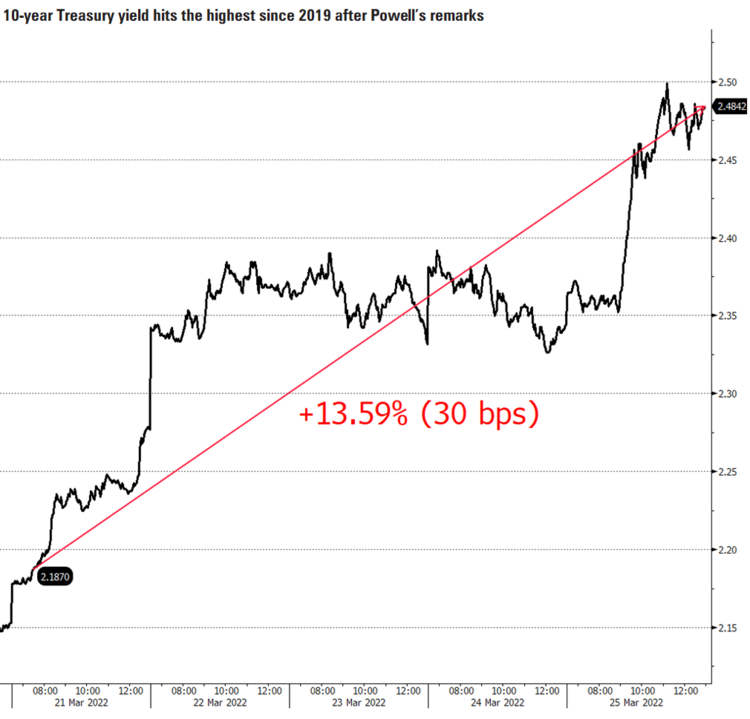

Subsequently, the yields on the 10-year Treasury skyrocketed 13.59% by jumping 30bps to 2.48%. 2

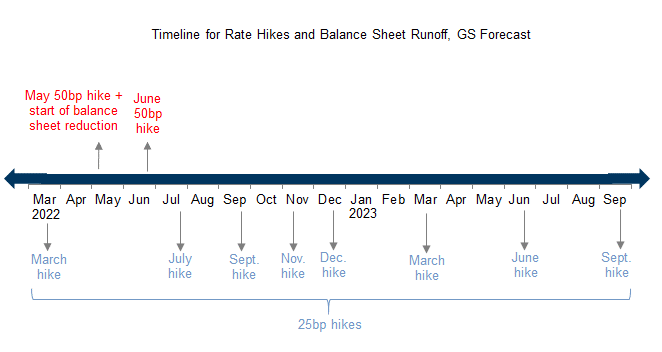

Goldman Sachs adjusted their rate expectations, now forecasting 50bp hikes at both the May and June meetings. After the two 50bp moves, they expect the FOMC to move back to 25bp rate hikes at the four remaining meetings in the back half of 2022, and to further slow the pace next year by delivering three quarterly hikes in Q1-Q3 2023. 3

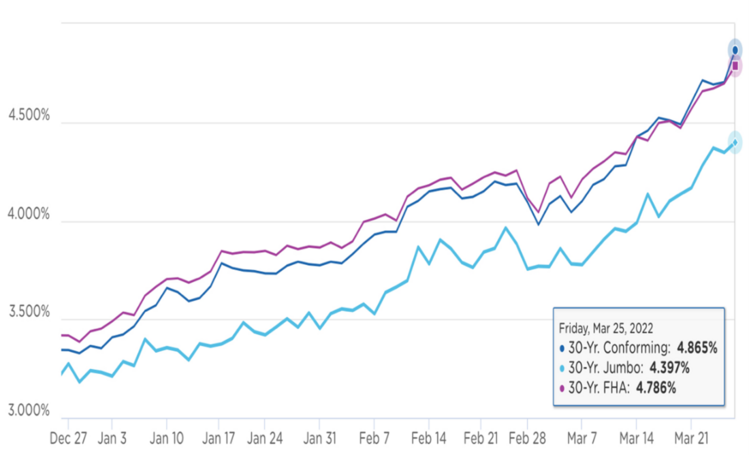

Following the chaos in the Treasury markets last week, the real economy will soon start to feel some contractionary pain. Mortgage rates jumped by 8.4%, with the 30-year Conforming mortgage now sitting at 4.865%. 4

Putting that into context, the average home loan is for $387,500. 5 That monthly payment at the end of December was $1,706 per month and today it’s sitting at $2,048. That is 20% higher.

The ability for the Federal Reserve to signal its intentions is a powerful tool, no doubt.

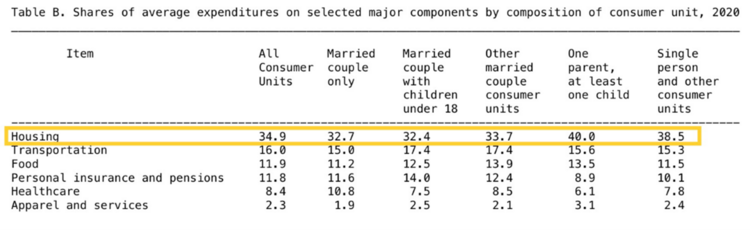

When you consider the largest share of consumer income is spent on housing, even the smallest change to their costs has a ripple effect. 6

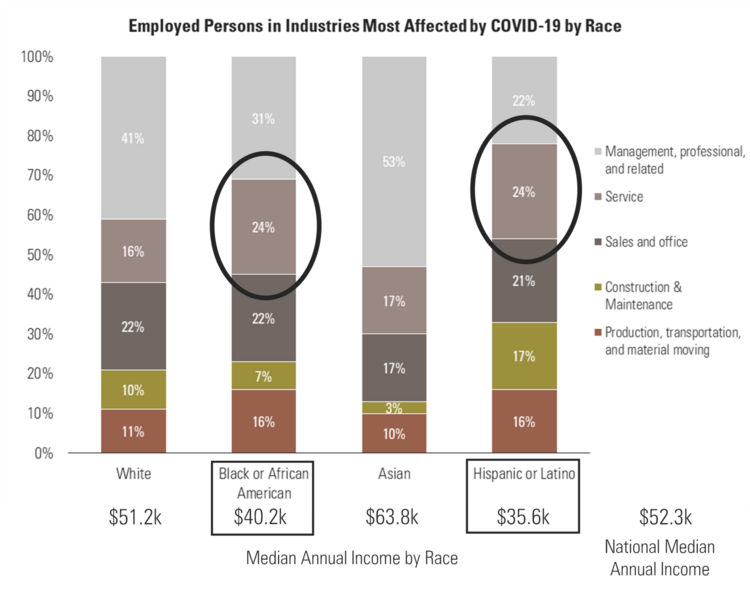

This is the very same Fed Chairman that wanted to support narrowing the gap on income and racial inequalities.

In June 2020, he said the “biggest thing” the Fed can do to combat high black unemployment and other economic inequities is to use its tools to push down unemployment. 7

His point was reiterated in August 2020 at the Kansas Fed’s Jackson Hole Symposium, stating: 89

“Inflation that is persistently low can pose risks…The result can be worse economic outcomes in…both employment and price stability…with the costs likely falling hardest on those least able to bear them.”

Just a few years later, the Fed is now going to crush those same folks they attempted to support by creating some demand destruction, likely starting with housing.

Someone is going to blink—and I suspect it will be the Fed—with lower rates than they are signaling. The Fed can giveth and taketh away but, only for so long.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.federalreserve.gov/newsevents/speech/powell20220321a.htm

- https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

- https://research.gs.com/

- https://www2.optimalblue.com/obmmi/

- https://www.mba.org/news-research-and-resources/research-and-economics

- https://www.bls.gov/news.release/cesan.nr0.htm

- https://www.reuters.com/article/us-usa-fed-inequality/feds-powell-puts-spotlight-on-unequal-u-s-economy-citing-pain-of-racial-injustice

- https://www.federalreserve.gov/newsevents/speech/powell20200827a.htm

- https://www.census.gov/library/publications/2021/demo/p60-273.html