The Fed’s Confused – Not the Economy

In the most recent Federal Reserve interest rate setting meeting and accompanying press conference, the Fed sent some subtle signals and ambiguities.

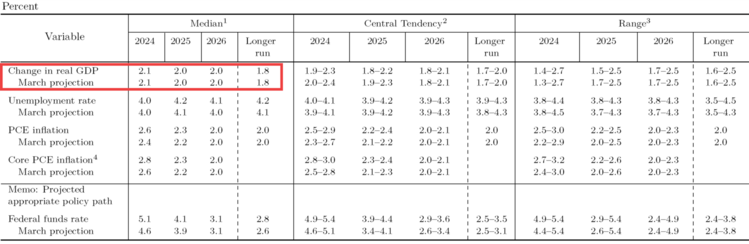

First, the Fed continues to believe that the economy is on a growth path, with GDP projections matching their March projections. In fact, an examination of the trends for 2025 and 2026 reveals no difference compared to what they believed in March. 1

Second, the Chair made some comments suggesting they understood inflation was cooling yet their interest rate projections were for fewer cuts. 2

- “Inflation has eased substantially from a peak of 7 percent to 2.7 percent but is still too high.”

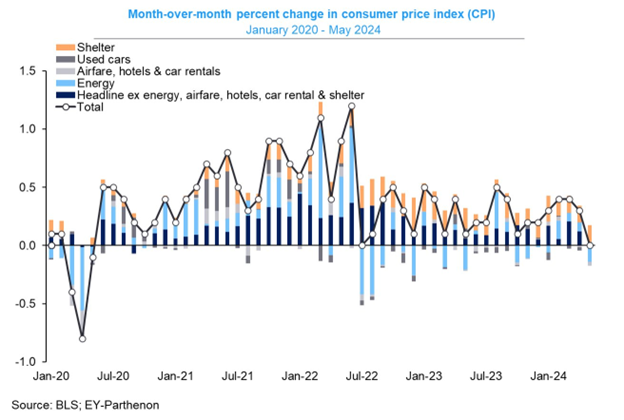

- “The inflation data received earlier this year were higher than expected, though more recent monthly readings have eased somewhat.”

- “The most recent inflation readings have been more favorable than earlier in the year, however, and there has been modest further progress toward our inflation objective.”

- “We need to see more good data to bolster our confidence that inflation is moving sustainably toward 2 percent.”

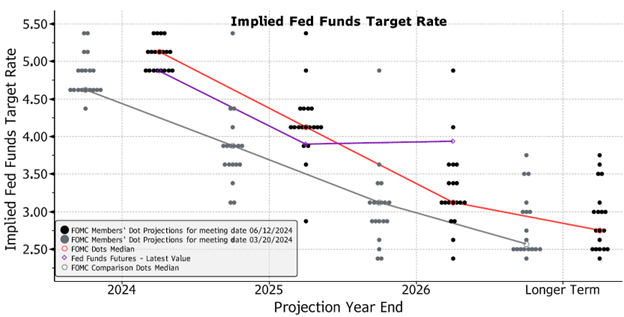

Pay particular attention to the “however, and.” What is he talking about? Either there have been modest improvements or not. Overlay these statements with the changes in the “Dot Plot” – a super technical term for what the voting members believe the direction of rates is headed – and you get the feeling there is some intentional ambiguity. Comparing the black dots (current expectations) to the gray dots (March expectations) in the chart below you can see a different rate cut trend. 3

Let’s pivot to the most recent inflation readings. Inflation at the core level (ex-food and energy) is reading zero. 4

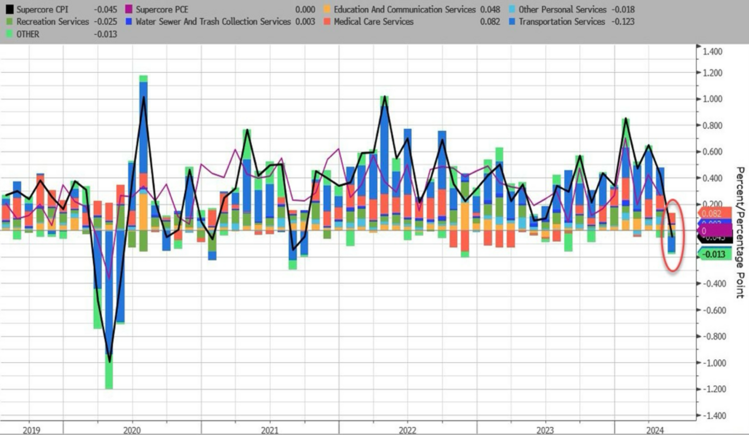

When you take out the flawed housing measurements (“Supercore”), the economy is actually deflating. 3

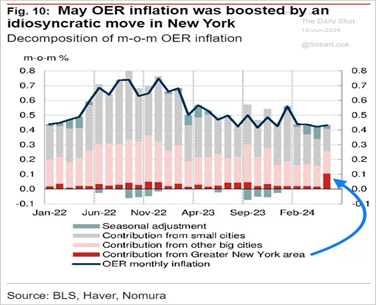

Again, it’s my view the methods the federal government uses to measure housing are flawed and you can read about that in our recent post. When you ask a homeowner in a survey what they would rent their place for, you are going to get a lot of bias in that data, especially if you ask New Yorkers. Those folks, understandably, had a very high opinion of their housing stock in May. Let’s see what happens to the one-month spike in NY rent in the month of June? 5

There is no doubt some segments of the economy should be feeling the pain of higher interest rates:

- Lower-income cohorts

- Homebuilders

- Capital goods manufacturers

However, let’s ground ourselves in some very basic data.

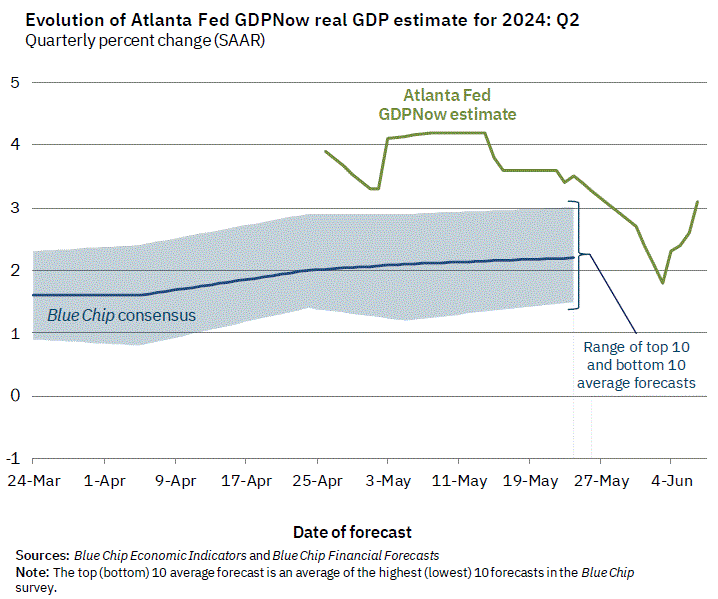

First, the economy is growing at a modest pace in Q2. 6

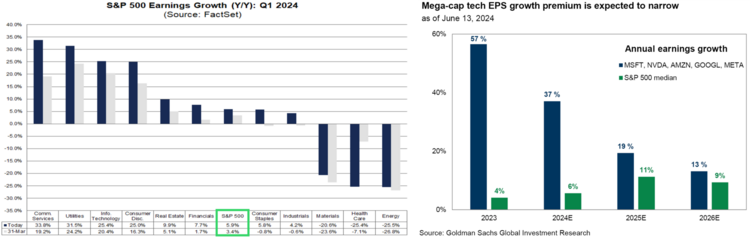

Second, earnings expectations are robust for the S&P 500. 7 8

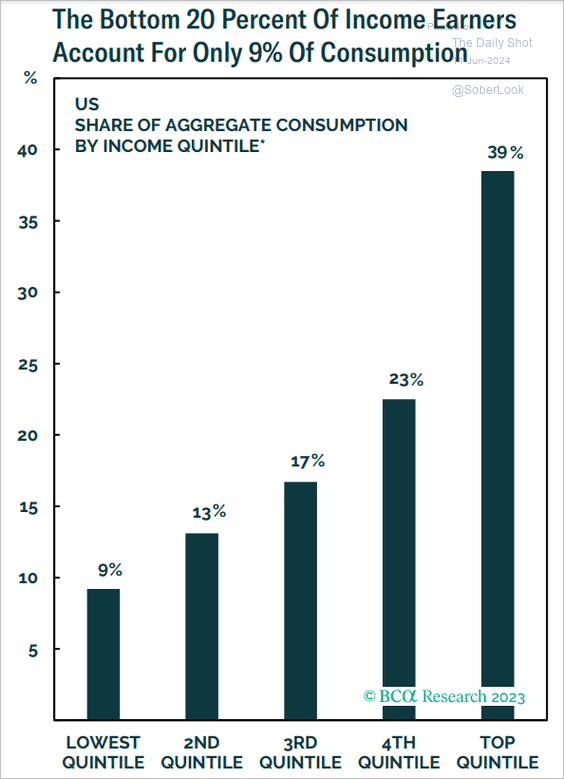

Third, and perhaps most important, is the bulk of U.S. consumption is composed of higher quintile earners. While it’s true lower quintile folks spend all their resources to survive (unfortunately), the bulk of the U.S. consumption economy is driven by the upper half of income brackets. It’s these top three brackets ($50k-$119k and above) that keep 70% of our GDP going strong. 9

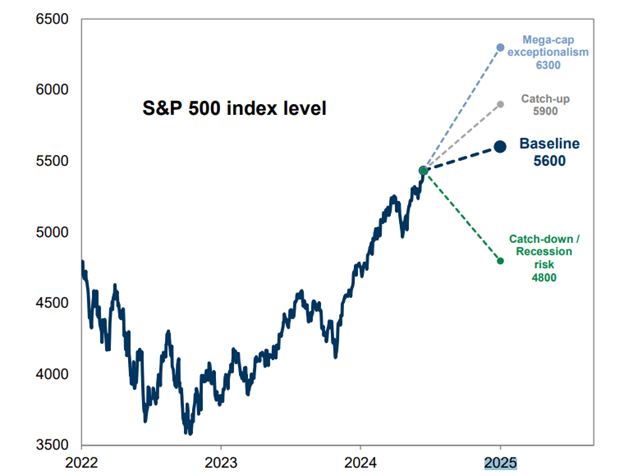

Fourth, and perhaps as a result of the above macro drivers, Goldman Sachs has upped their year-end S&P 500 target. 8

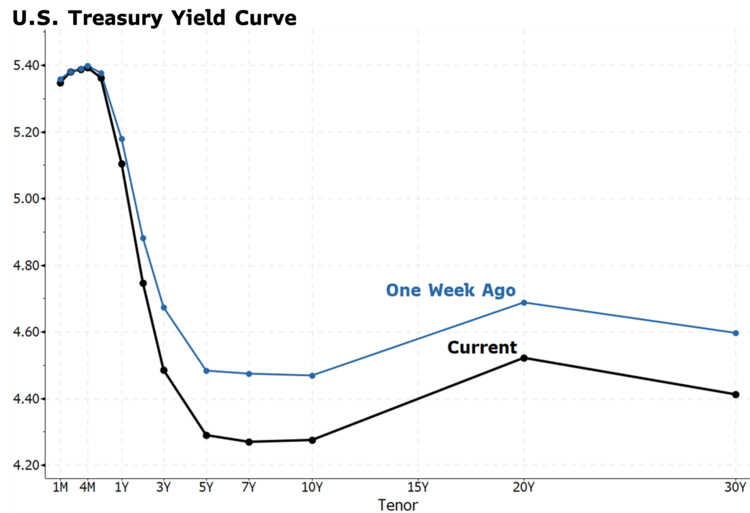

Let me leave you with one more reassuring fact. It looks like the investor class can handicap inflation better than the Fed. Even when the Fed said they would leave rates higher for longer with only one rate cut this year, bond investors drove down yields. 3

While the old adage “Don’t Fight the Fed” is noteworthy, it’s also important to realize the hundreds of PhDs at the Fed are going to get a full dose of someone who will fight them (Trump) if they don't realize the economy is cooling despite their flawed data sets, surveys, and models.

Equity markets know this too.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240612.pdf

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20240612.pdf

- Bloomberg

- https://x.com/GregDaco/status/1800869913298637240

- https://thedailyshot.com/

- https://www.atlantafed.org/cqer/research/gdpnow

- https://insight.factset.com/where-are-analysts-most-optimistic-on-ratings-for-sp-500-companies-heading-into-q3-1

- https://research.gs.com

- https://www.bcaresearch.com/