The Fed’s Quiet Pivot

For two years, the Fed has battled inflation with a restrictive stance. But Chair Powell’s recent Jackson Hole remarks mark a notable shift. He acknowledged the difficult balance of the Fed’s dual mandate, saying:

“In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside…with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

That word—adjusting—was the dovish tell. The Fed may now lean toward cutting rates not because inflation is solved, but because employment is flashing warning signs.

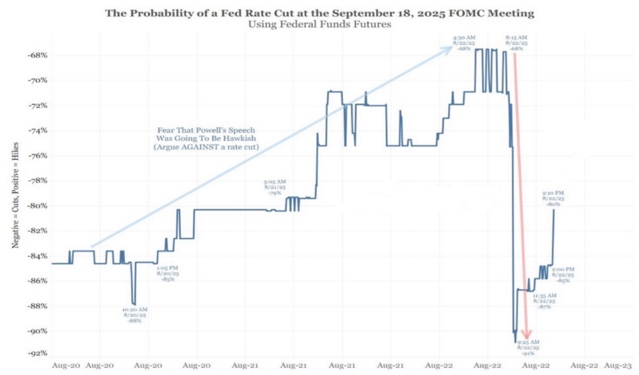

Ahead of Powell’s remarks, traders feared hawkish rhetoric and positioned against cuts. But as soon as Powell opened the door to “adjusting our policy stance,” futures swung aggressively toward a September rate cut, with odds briefly touching 91% before retracing. The market heard the pivot loud and clear.

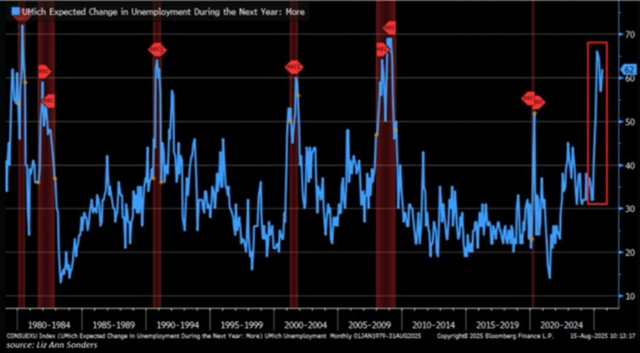

Labor Risks Are Rising

Consumers now expect unemployment to rise sharply, with the University of Michigan survey hitting levels historically tied to recessions. Powell acknowledged this tradeoff directly—keeping policy restrictive for too long risks accelerating job losses.

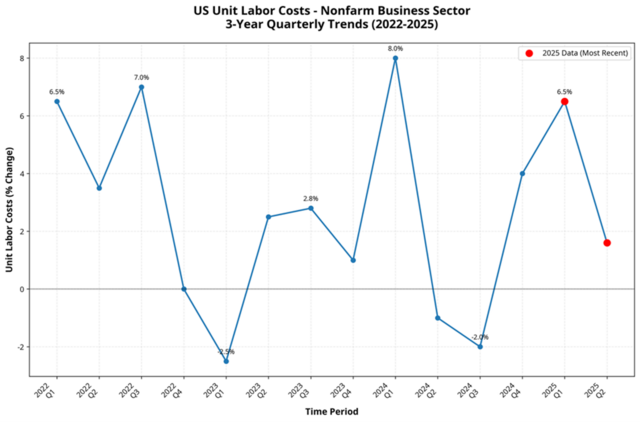

Unit labor costs were running hot—6.5% in Q1—but have now cooled, signaling wage pressure is easing. Powell’s speech admitted the Fed will not ignore weakening labor conditions to chase the last mile of inflation.

Inflation Still Matters, But the Priority Has Shifted

Powell did not declare victory on inflation. He warned that risks “are tilted to the upside.” Yet, with rates now 100 basis points closer to neutral than a year ago, and the economy showing strain, the balance of risks favors easing.

The Fed’s willingness to protect jobs, even at the cost of tolerating above-target inflation, is the pivot. We will know more on Friday when the Fed’s preferred inflation index is released.

Rate cuts reintroduce liquidity, often fueling speculative upside. Powell’s dovish tilt may set the stage for another rally in growth and AI leaders.

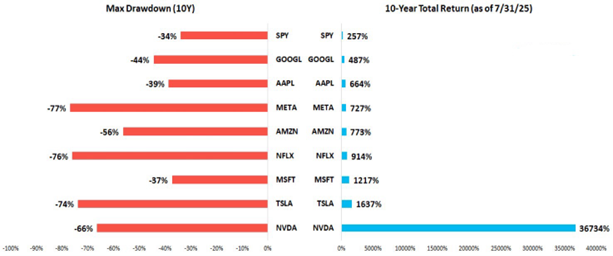

History shows that liquidity shifts drive outsized gains in growth stocks. Over the past decade, Tesla, Microsoft, and Nvidia all suffered brutal drawdowns (-70%+), only to rebound exponentially—Nvidia up 36,734%. Again, later this week the world’s most valuable company, NVDA, will release earnings and guidance that might reaffirm growth can persist.

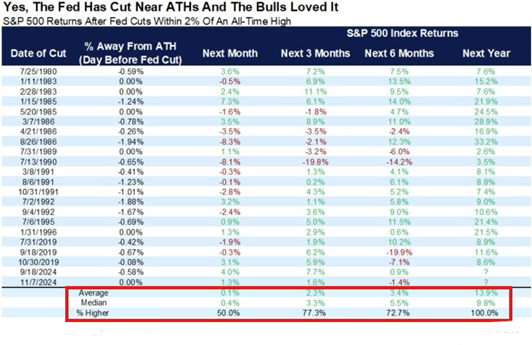

Skeptics argue that cutting rates near market highs leaves little upside. But history disagrees. When the Fed has cut rates with the S&P 500 within 2% of its all-time high, forward returns have been robust:

- Next 3 months: +2.3% median

- Next 6 months: +5.5% median

- Next 1 year: +10.9% median

In fact, stocks finished higher 100% of the time one year later.

In fact, stocks finished higher 100% of the time one year later.

The Fed’s Balancing Act

Powell framed it plainly: “When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate.”

Translation: Inflation isn’t solved, but employment is now the swing vote in monetary policy. The Fed’s credibility on jobs means it will not risk a deep downturn.

Bottom Line

The Fed has quietly pivoted. Powell signaled readiness to cut rates—not as victory over inflation, but as insurance against labor market deterioration.

For investors, this could be a green light for risk-taking, but also a warning: if the labor market weakens faster than expected, cuts may arrive too late to prevent a recession. Remember, big upsides come with big drawdowns. This quiet pivot by the Fed does not come without risks to investors and the American worker.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.