The Fed’s Recession – A Head Scratcher

Did the Federal Reserve, in their last meeting, call for a recession later this year?

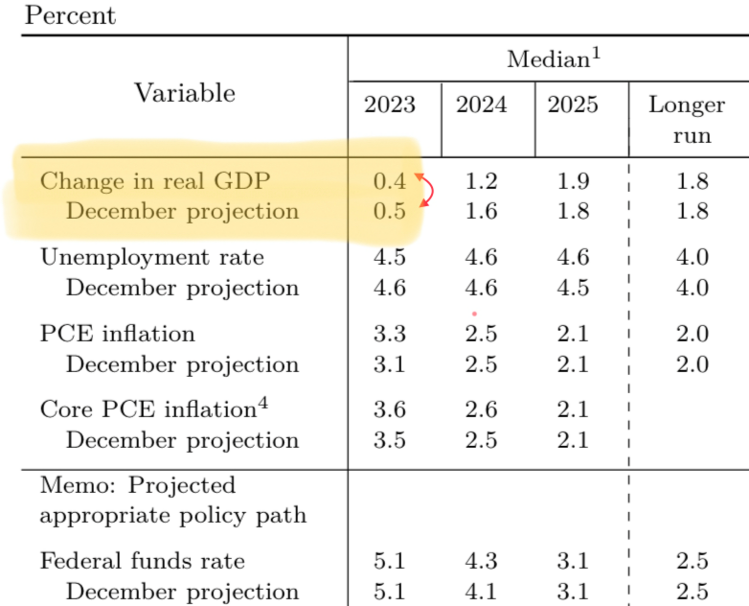

It was no surprise to us that the Fed raised interest rates by 25 basis points last week. That’s the headline. Buried in the details were various Fed Governors’ predictions on inflation, employment, and interest rates. You can see all of that in the table below.

What caught my attention was the consensus view amongst the voting members of the Federal Reserve on overall economic growth (GDP) for this year. They downshifted their very modest expectations from 0.5% to 0.4%. That’s right, just fourth tenths of a percentage point of growth in 2023. 1

It wasn’t surprising in light of rising rates and the mention of capital constraints due to the recent banking debacle in the United States. Here’s Chairman Powell’s comment on a possible credit crunch: 2

“We believe, however, that events in the banking system over the past two weeks are likely to result in tighter credit conditions for households and businesses, which would in turn affect economic outcomes. We will closely monitor incoming data and carefully assess the actual and expected effects of tighter credit conditions on economic activity…”

Wait just a minute!

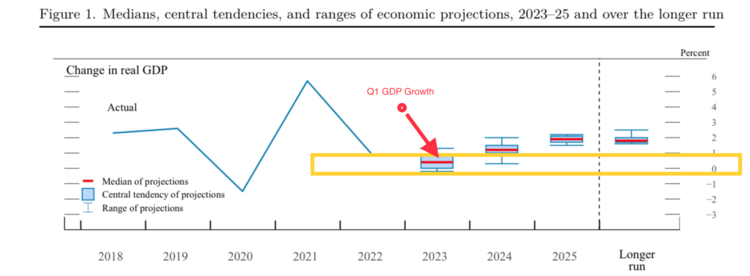

The most recent GDP forecast by the Atlanta Fed is calling for growth to come in at 3.2%. 3

Visually, here’s what the Fed is trying to tell all of us when it comes to economic growth in America. We're going to go from the red dot (my insertion) at 3.2% to the red line at 0.4% (the median of Fed Governors’ projections) this year. 1

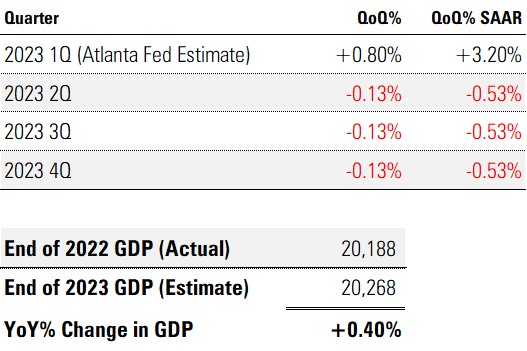

So how does that math work?

One way to express this downshift is an 87% reduction in economic activity from Q1 to full year GDP.

Another way to think about the dramatic slowdown in GDP is for the economy to average -0.53% annualized GDP growth over the next 3 quarters.

Either way it’s multiple consecutive quarters of contraction just to meet the Fed’s central tendency. In my world we call that a recession.

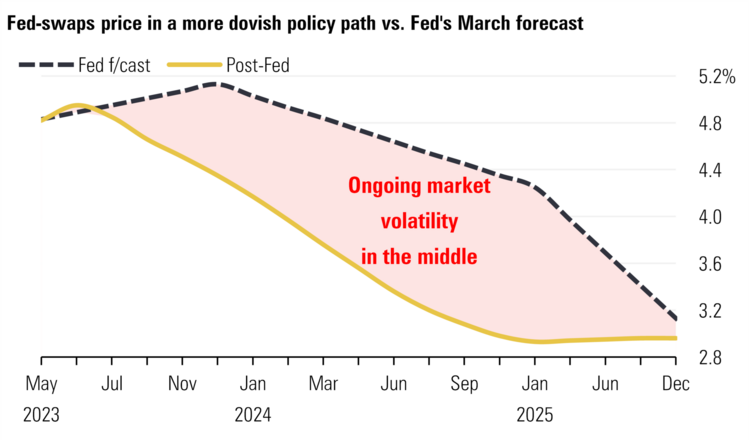

All the while the Fed does not believe they will need to cut rates in 2023. Compare that with the rest of Wall Street and you can see a pretty big difference of opinion. Be on the lookout for next week’s Look Ahead. We will unpack this disparity further. 4

The Fed forecasts a recession and doesn’t call it that along with no rate cuts. Clearly we are in store for some serious volatility until hope meets reality. I’m just not sure who’s more hopeful, Wall Street or the Fed.

This is a head scratcher.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230322.pdf

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20230322.pdf

- https://www.atlantafed.org/cqer/research/gdpnow

- https://www.bloomberg.com/news/articles/2023-03-22/traders-price-in-more-fed-cuts-for-2023-even-as-officials-hike