The Flip Side

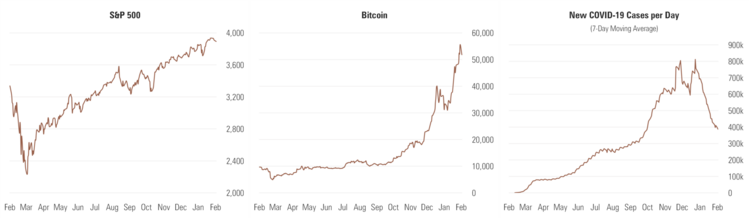

With equity markets hitting all-time highs, bitcoin touching all-time highs, and COVID-19 cases collapsing, the world would seem near perfect for investors. [i] [ii] [iii]

Specifically, retail sales are clearly heating up in January and across several segments. It would appear the Trump stimulus is again hitting the mark precisely. [iv]

Could it be possible the political arm of our country has learned how to use fiscal policy with some precision?

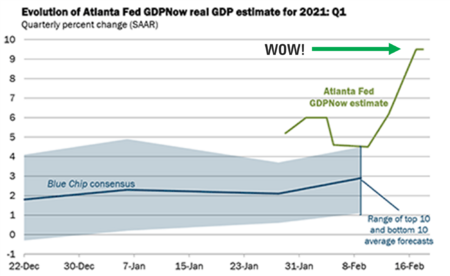

To that point, GDP forecasts are calling for explosive U.S. growth in the coming quarter. [v]

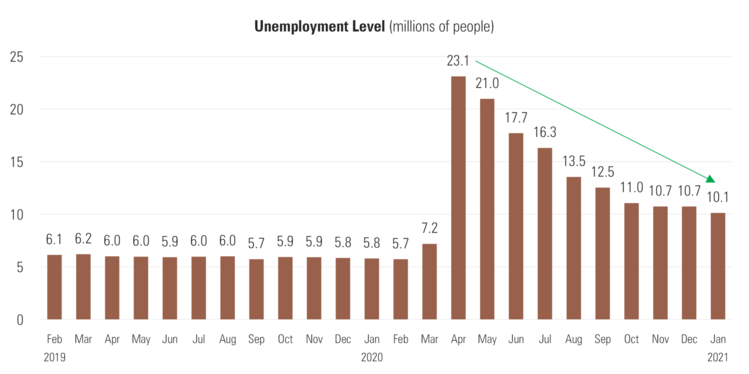

Unfortunately, and like most things economic, we have to take some sour with the sweet. It’s hard to imagine the U.S. economy overheating, especially with so many vulnerable Americans out of work. [vi]

Ten million people out of work is no time to think anything but the fact that more stimulus is needed to lift them too.

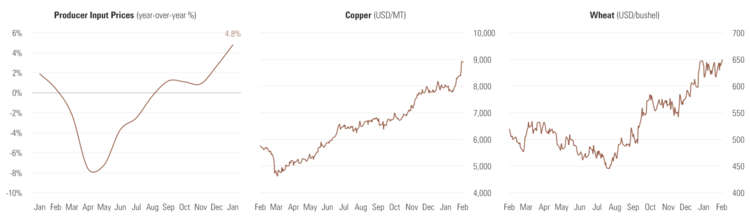

However, there are growing signs of some systemic inflation heading our way. Just look at the cost of goods for producers, or things like copper or grains. [vii] [viii] [ix]

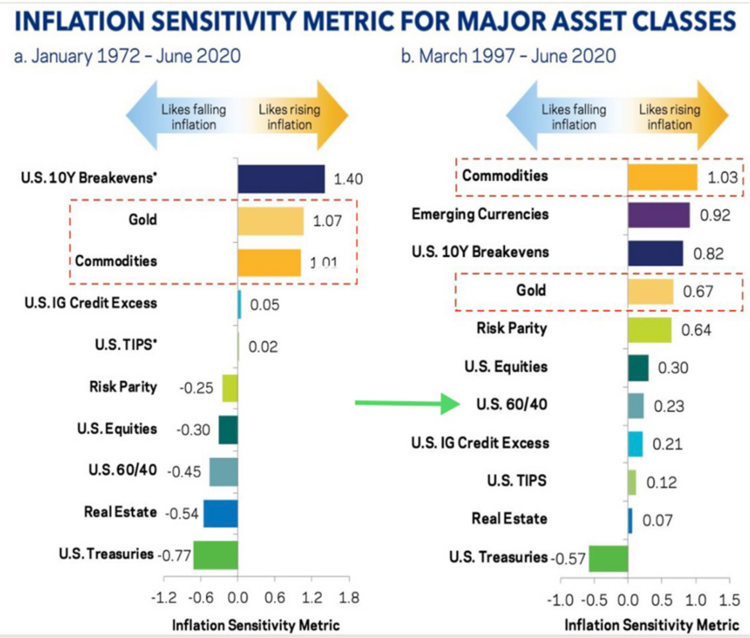

While not catastrophic within reason, rapidly rising inflation is not great for balanced portfolios and equities. Still positively correlated with inflation, there are some headwinds to be expected. [x]

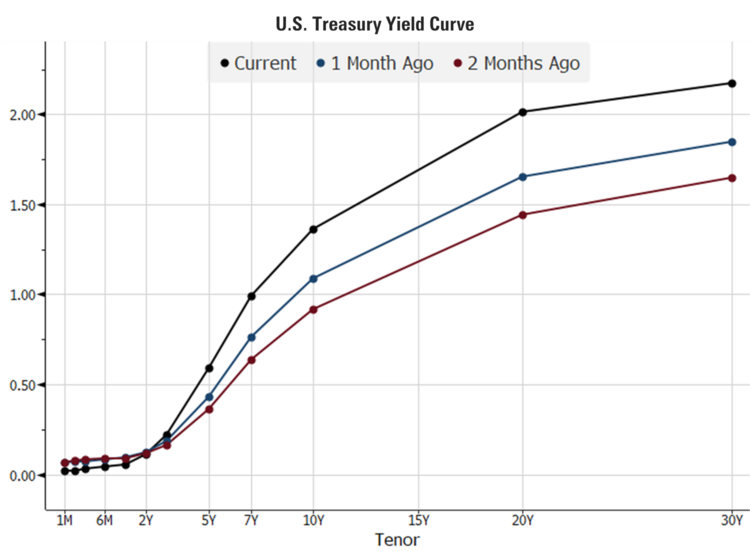

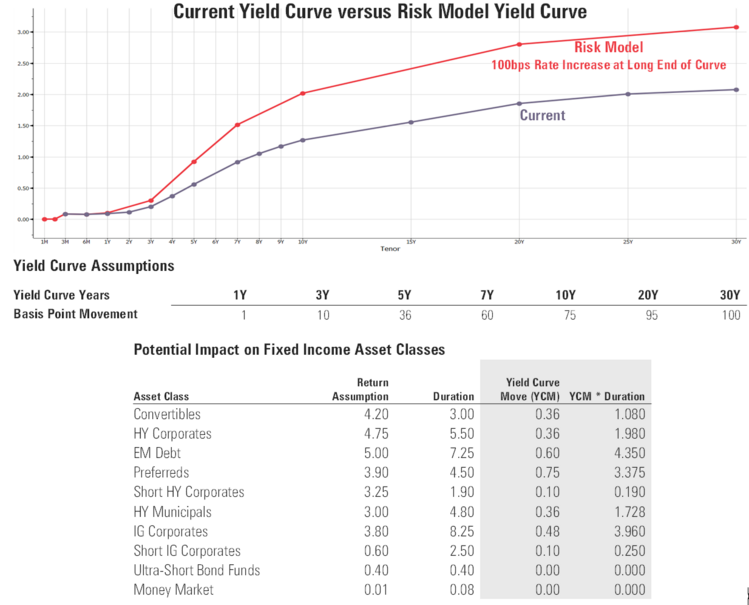

The bigger challenge is with fixed income investments like U.S. Treasuries. As inflation rises, it makes future fixed cash flows worth less, therefore creating a sell-off in most fixed income asset classes. In fact, we are seeing some of that sell-off occurring right now. [xi]

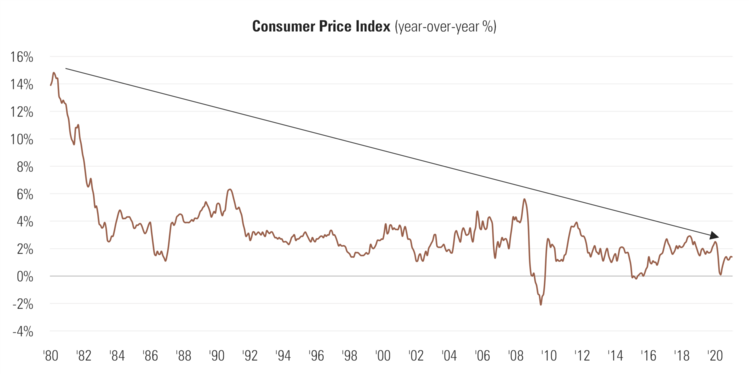

Let’s level-set on where inflation is today and what expectations are for the future. Inflation has been in a historic downtrend for the last 40 years. [xii]

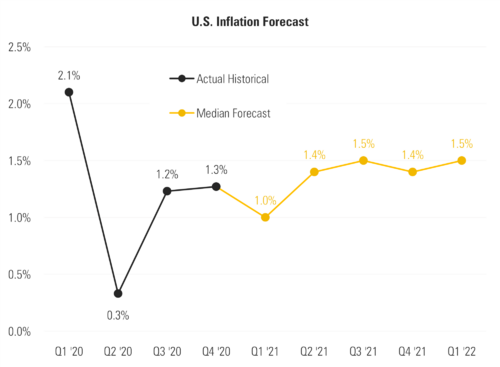

Near term expectations for inflation also appear to be muted. [xiii]

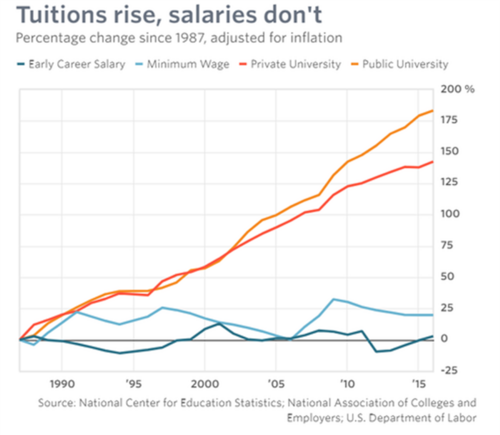

Technology, the internet, cheap foreign imports, cheap energy with fracking, and China have all led to systemically low inflation. One particular inflation point of interest for me is the economic anxiety and low wage inflation for young people graduating from college relative to the inflation in tuition they may have experienced. [xiv]

I do expect an interest rate “tantrum” in the short run that will cause some bruising for investors; however, the general inputs for low inflation have not left the building and for college graduates, I don’t suspect their wages will lift commensurately.

We could see a steepening of the yield curve and some associated pain within fixed income.

You can see some potential strain within fixed income in the table above.

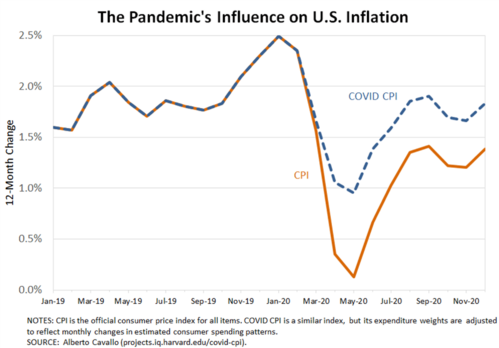

Over the past 10 years, inflation has averaged just 1.6%. To move inflation back to the Fed’s stated long-term target of 2%, we would need to see the next 10 years average 2.5% to achieve the 2% target rate.

Finally, and this might be the most insightful point made by the St. Louis Fed, inflation right now can be deceiving. You can see how COVID magnified inflation in certain sectors and, under normalized circumstances, might be lower than what’s actually occurring. For example, the cost for goods like groceries are elevated because there is simply more demand due to COVID and the same supply. [xv]

It might be a rough few months as we deal with the expected uncertainty surrounding inflation and interest rates. It’s just the flip side of the coin that accompanies growth.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/quote/SPX:IND

ii. https://www.coindesk.com/price/bitcoin

iii. https://coronavirus.jhu.edu/map.html

iv. https://thedailyshot.com/

v. https://www.frbatlanta.org/cqer/research/gdpnow

vi. https://fred.stlouisfed.org/series/UNEMPLOY

vii. https://fred.stlouisfed.org/series/WPUIP2311001

viii. https://www.cmegroup.com/trading/metals/base/copper.html

ix. https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/kc-wheat.html

x. https://www.linkedin.com/in/christian-gerlach-liquid-real-returns/

xi. https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

xii. https://fred.stlouisfed.org/series/CPIAUCSL

xiii. https://www.bloomberg.com/quote/CPI%20YOY:IND

xiv. https://graphics.wsj.com/marketwatch/college-debt-now-and-then/

xv. http://econintersect.com/pages/contributors/contributor.php?post=202102130520