The Gift That Might Keep Giving

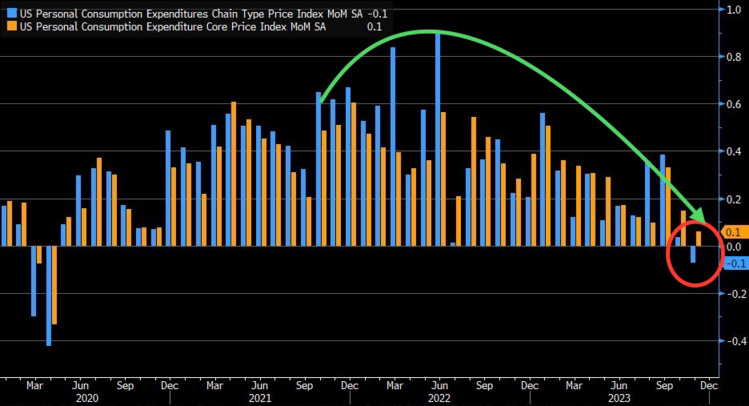

Just before the Christmas holiday consumer prices, as reported by the Federal Reserve's favorite measure Core PCE, came in deflationary for the first time since April 2020. That’s right…prices actually dropped in November (ex-food and energy). 1

On a year-over-year basis, inflation is rapidly moving back toward the Fed’s 2% target. 2

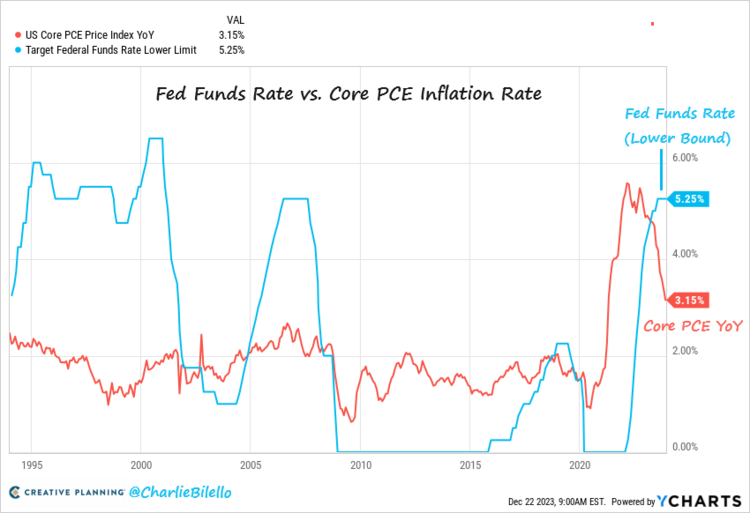

When you blend the month-over-month deflationary print with the year-over-year moderation, the Fed’s interest rate policy is now considered extremely restrictive. Perhaps as much as 2%. Put another way, the Fed’s current policy might be over 60% restrictive.

Fed rate cuts are well deserved if this disinflationary trend continues. The gift to equity investors might be in the form of a rotation. Money market fund assets have enjoyed nice zero risk returns of late. That party might be over and a rotation of those assets into equities might be a nice gift for 2024.

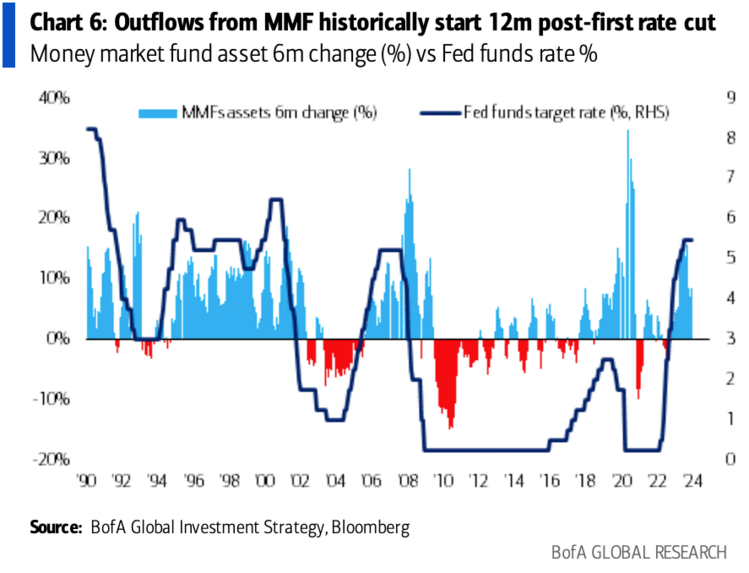

According to Bank of America, outflows from money market funds start about 12 months after the first rate cut. 3

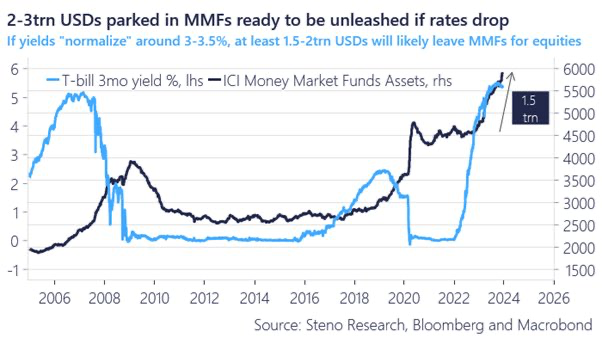

When that trend starts, we could see as much as $1.5 to $2 trillion dollars leave money markets for equities. 4

That’s a staggering 5% of the market cap of the S&P 500. That’s a pretty good gift for 2024.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: