The Goldilocks Economy

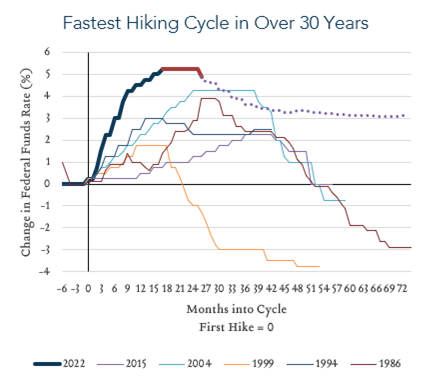

The Federal Reserve raised interest rates for the eighth time in the last twelve months. Going from 0% to 5.5% is now the fastest and highest rates have been in 22 years. We should be at, or near, the very end of the Fed’s rush to raise rates in an effort to combat inflation. 1

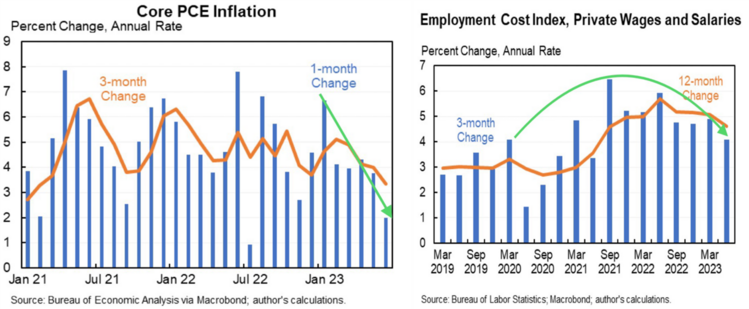

The most recent reading on inflation (Core PCE) shows ongoing moderation, also known as transitory. Further, the employment cost index continues to show wages moderating. In fact, wage growth rates have now returned to pre-pandemic levels. 2

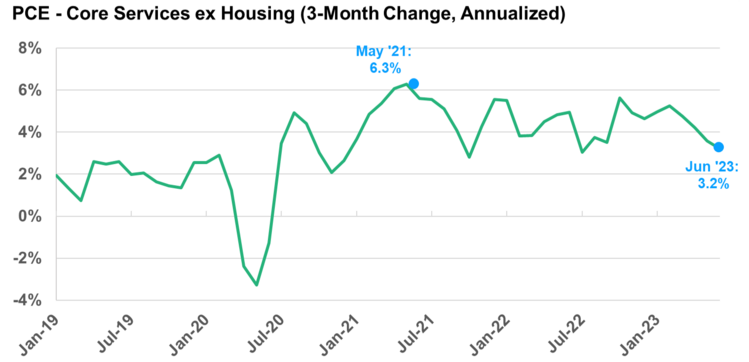

Even the Fed’s favorite inflation index, Core Services ex-Housing, has returned to pre-pandemic growth rates. The Fed likes this measure as it gives them a look at wage inflation mostly driven by the service industry. 3

While we see moderation on the inflation front, there continues to be no significant, widespread deterioration in the U.S. economy. While there are certainly pockets of weakness, the macroeconomic picture looks very robust.

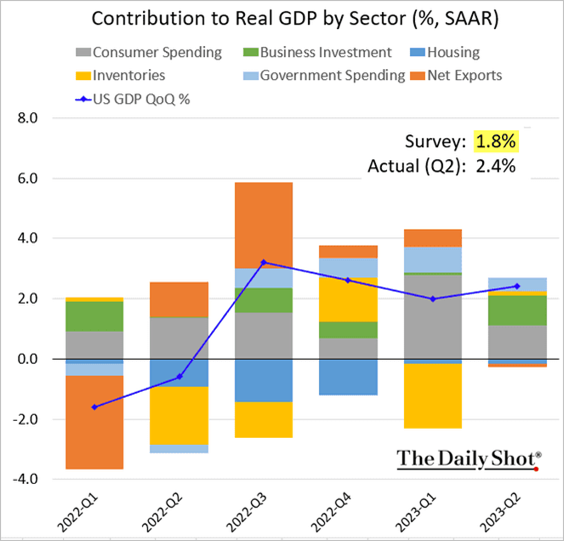

Q2 GDP grew at a rate of 2.4% compared to estimates of 1.8%. The consumer added nearly 46% of the GDP growth, with business investment making up 41%. Not surprisingly, the consumer and business are spending and investing. 4

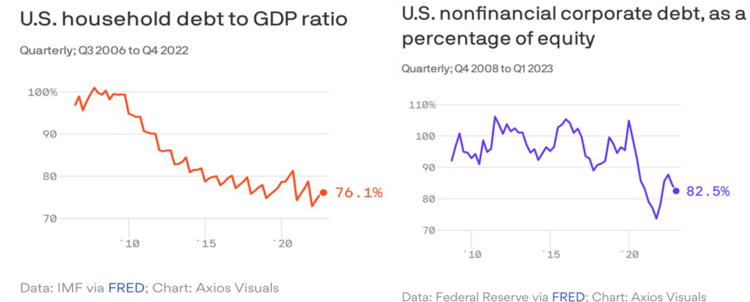

This is being driven partly by the fact that both the consumer and corporate debt service levels have moderated – in other words, a lot less money is going toward interest payments. 4

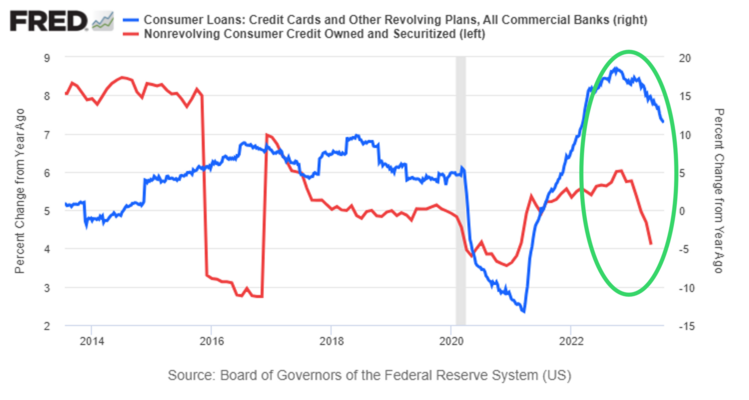

This confirms moderation in the year-over-year growth in revolving and non-revolving debt levels. It is clear the consumer is being modestly cautious when it comes to adding high interest debt to their balance sheet compared to this time last year. 5

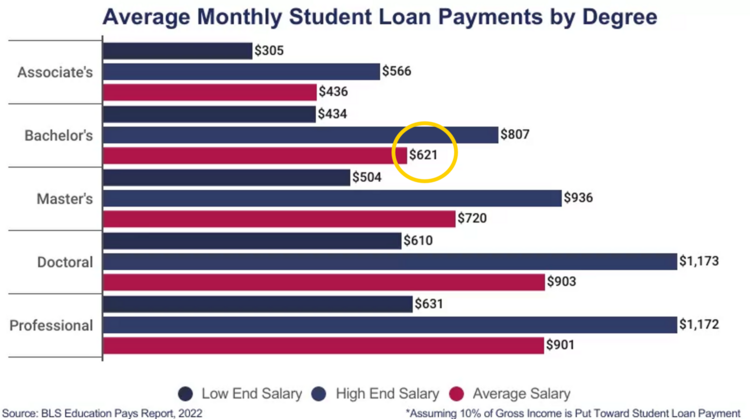

The expectations for Q3 GDP look to be continued growth in the overall economy. However, the one fly in the growth ointment might be the return of student loan payments. Those are set to largely resume at the end of September. While that drag won’t impact Q3, it’s surely going to impact Q4. The average monthly loan payment for a bachelor's degree is $621/month. That’s a lot of money coming out of the pockets of a very large consumer set. 6

The Goldilocks economy is poised to continue at least through this quarter and the rest of the year. However, the economy is probably still too hot for the Fed to consider any rate cuts this year. We might have to live with the current interest rate picture well into next year. We all know how the story of Goldilocks ends; the bears return home, and she runs away.

What we are doing:

- Cautiously moving fixed income duration closer to benchmark based upon the yield curve

- Holding growth and core to capture a better earnings picture in Q3

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://greenleaftrust.com/news/fed-raises-0-25-as-expected-keeps-options-open/

- https://www.bea.gov/news/2023/personal-income-and-outlays-june-2023

- https://twitter.com/sonusvarghese/status/1684948193744715776

- https://thedailyshot.com

- https://fred.stlouisfed.org/graph/?g=17sVP

- https://educationdata.org/average-student-loan-payment