The Holy Grail

This week, as the Fed's interest rate setting committee convenes, they face another opportunity to achieve the elusive 'holy grail' of monetary policy: soft-landing the economy. Balancing between an economy that's neither too hot (inflationary) nor too cold (high unemployment) has long been a challenge.

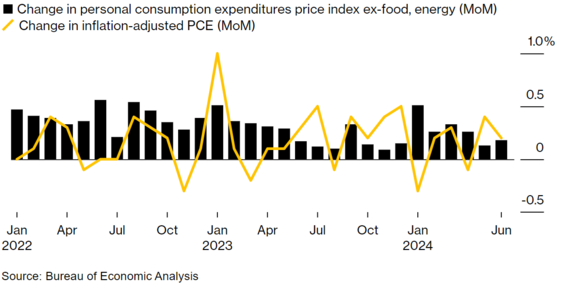

Inflation is finally cooling, consistent with the latest reading on Personal Consumption Expenditures (PCE). 1

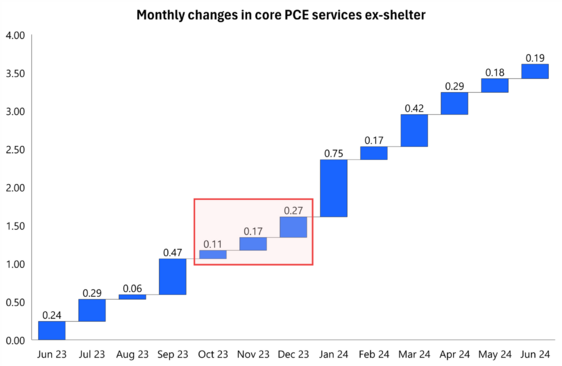

Monthly PCE, excluding shelter (a measure I consider flawed), is also showing a slower pace of increase. It's worth noting that year-over-year comparisons may become more challenging, as the October-December 2023 period saw relatively mild inflation. 2

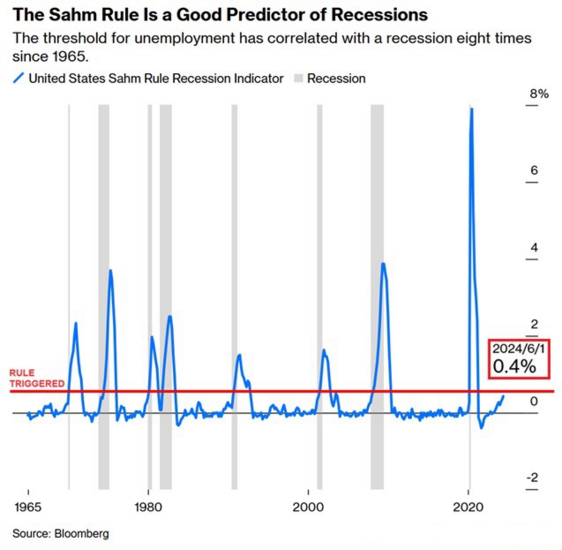

The unemployment rate has risen at a fairly fast pace, according to the BLS. In fact, a 0.4% increase is a historically fast pace. Interestingly, there is an indicator that suggests that a recession typically follows when the unemployment rate climbs 0.5% above its previous low. Currently, this would mean a rise to 4.2% and we will certainly learn more later this week from the July jobs report. 3

Conditions are perfect for the Fed to attempt achieving the holy grail.

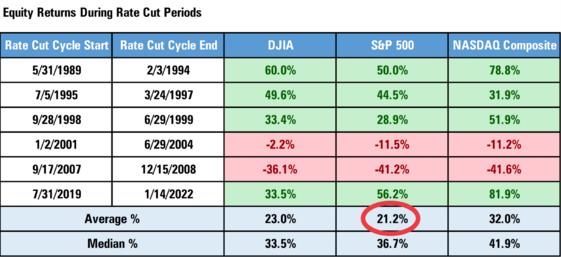

Equity returns tend to be strong on average during the full rate cut cycle. 4

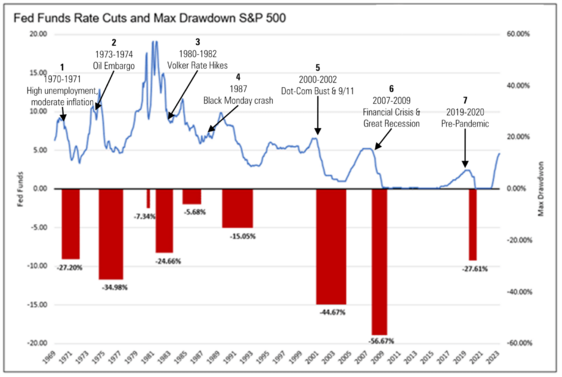

However, when you unpack each of those rate cut cycles you can see various maximum drawdowns. Interestingly, each of these rate cut periods was preceded by distinct macroeconomic factors. 5

- 1970-1971: Unemployment was high, inflation was moderate. The Fed cut rates to fight off a recession.

- 1973-1974: Oil embargo threw us into stagflation. Soft landing? Forget about it!

- 1980-1982: Volcker hiked rates like crazy to crush inflation, but it led to a brutal recession.

- 1987: Black Monday crash. The Fed stepped in to save the day and keep the economy from tanking.

- 2000-2002: Dot-com bust and 9/11 hit hard. The Fed slashed rates, but the economy still struggled.

- 2007-2009: Financial crisis, Great Recession. Massive rate cuts were the only option.

- 2019-2020: Pre-pandemic, the Fed aimed for a soft landing, but COVID-19 had other plans.

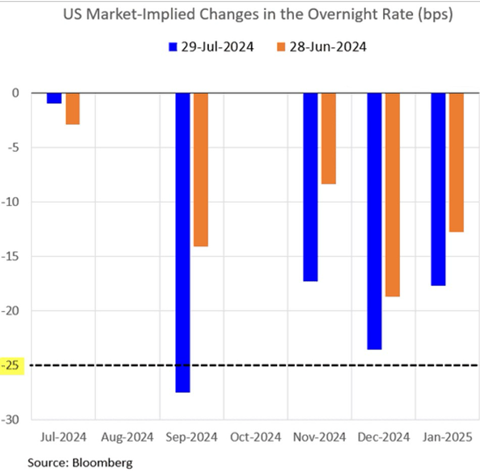

The Fed has never, at least in the last 50 years, had a chance to attempt to achieve the holy grail of monetary policy. Market expectations suggest that the Fed will kick off their attempt in September with a series of rate cuts. 6

The grail quest was elusive for Sir Galahad and his knights. Let's see if it will be the same for Sir Powell and his global economists.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bloomberg.com/news/articles/2024-07-26/fed-s-preferred-inflation-gauge-rose-at-mild-pace-in-june

- https://www.bea.gov/data/personal-consumption-expenditures-price-index-excluding-food-and-energy

- https://x.com/KobeissiLetter/status/1817894572229341256

- https://www.institutionalinvestor.com/article/2bstmh8ejny137jj9sf0g/innovation/a-historical-look-at-equities-during-rising-rate-environments

- https://realinvestmentadvice.com/a-federal-reserve-pivot-is-not-bullish

- Bloomberg