The Markets at War - Again!

Geopolitical events took a turn for the worse over the weekend with the US bombing of Iran nuclear enrichment facilities. It’s hard to say what the ramifications and consequences of another Middle East conflict will be for the United States.

Equity markets will adversely react to any signs this conflict will be prolonged and/or destabilizing in the energy sector.

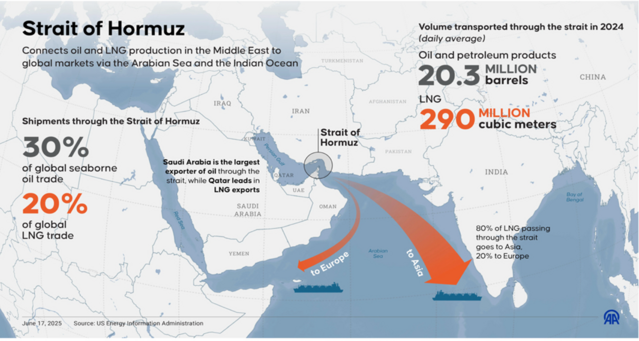

The Strait of Hormuz provides passage for 30% of global oil supplies and, as I wrote in last week’s post, the biggest loser to any energy disruption from Iran will be China.1

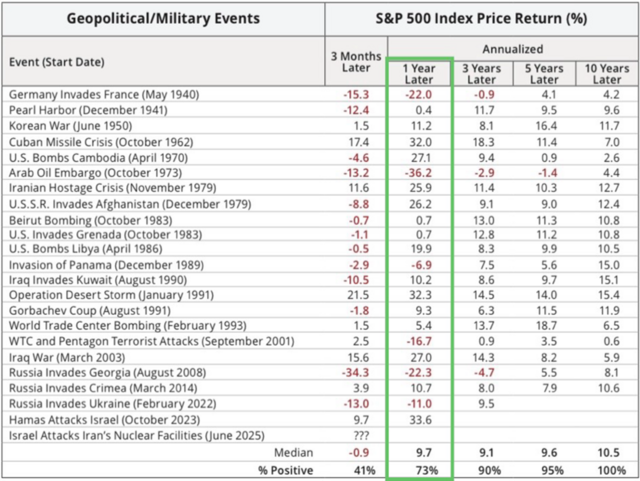

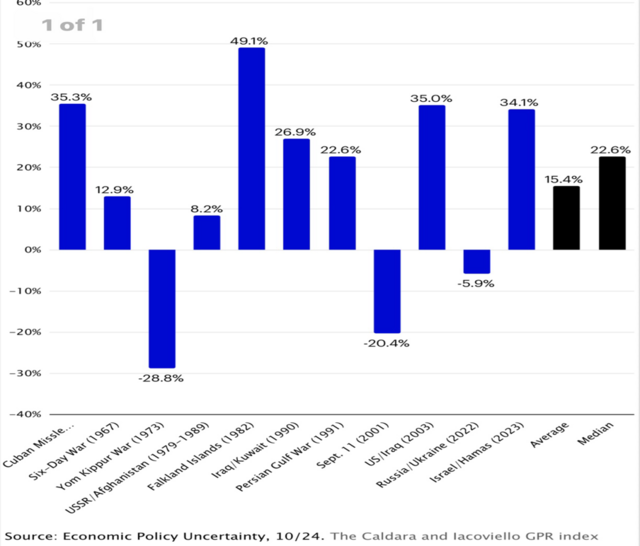

While these events are certainly concerning and unsettling, oddly enough, historically they have little impact on long-term equity returns. In the short term (3 Months Later), equity returns are volatile but on average, flat. In the longer term, 1 year or more, they average 9.5%+ per year.2

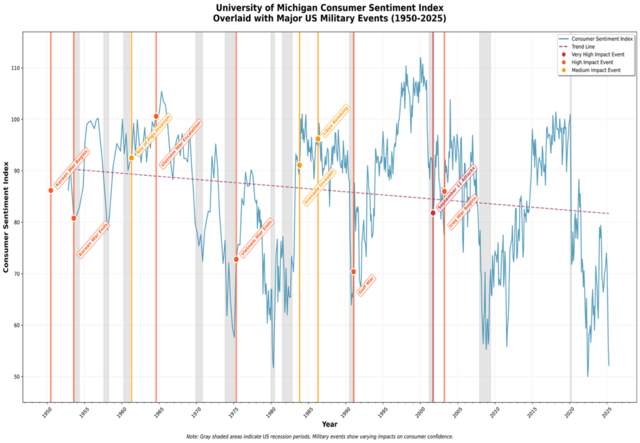

It’s astonishing considering how dire things seem at the time of the event. It’s enough to shake anyone’s confidence. In fact, consumer confidence does erode depending on the duration and impact of these events. However, it appears recessions have a bigger influence on attitudes than military events.3

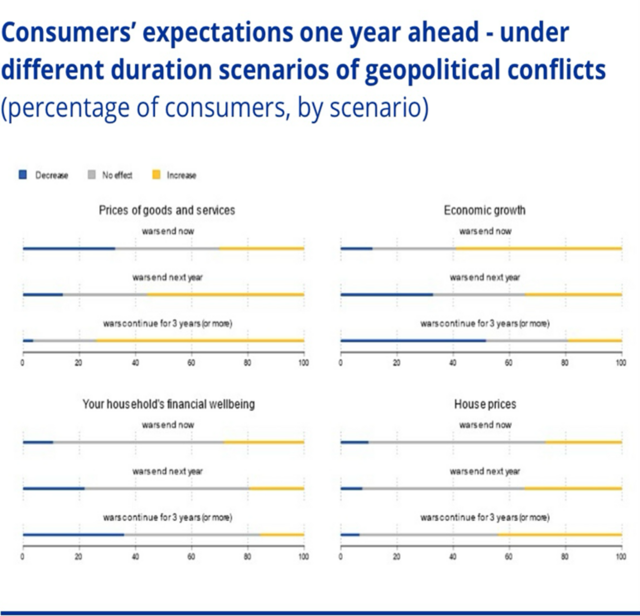

It’s critical for this administration to limit the duration of this recent event to protect consumer attitudes. In various surveys, consumer attitudes deteriorated based on the duration of the event. Everything from expectations on prices, financial wellbeing, and economic growth are all impacted by duration.4

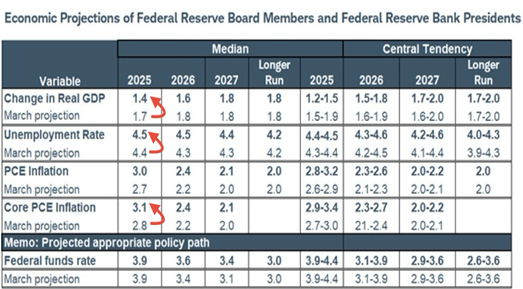

Considering the Federal Reserve is expecting slower growth, higher unemployment, and inflation, there is limited room for the President to maneuver this crisis while overlaying such economic uncertainty with tariffs.5

As investors we should watch the duration and intensity of this event, but let’s also keep an eye on the durable nature of the US consumer and how we’ve handled events in the past.6

The markets may be at war, but time remains our ally.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1.) https://x.com/JournoPranay/status/1936835729432138170

2.) How the S&P 500 has historically reacted to geopolitical shocks

3.) https://x.com/KobeissiLetter/status/1906411587771961400

5.) https://x.com/CEOBriefing/status/1935407689741561919

6.) Military Conflicts Haven’t Derailed Long-Term Stock Growth | Seeking Alpha

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.