The Next Leg of the Cycle

In a recent post, Are We Lost, I explored the headwinds that might impact economic growth in the coming quarter; auto workers strike, government shutdown and student loan payments recommencing. We’ve had the first hit, with the latest labor strike by the United Auto Workers.

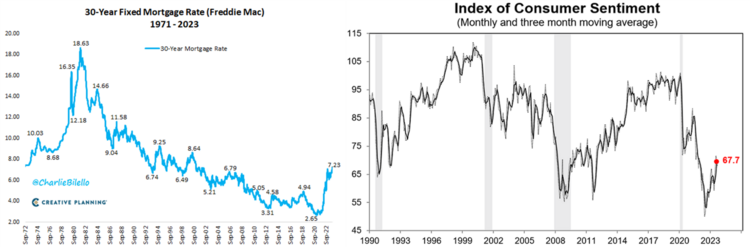

It might feel like we are coming apart at the economic seams with slower economic growth, mortgage rates at generational highs, and consumer confidence eroding according to the University of Michigan Consumer Sentiment Survey. 1 2

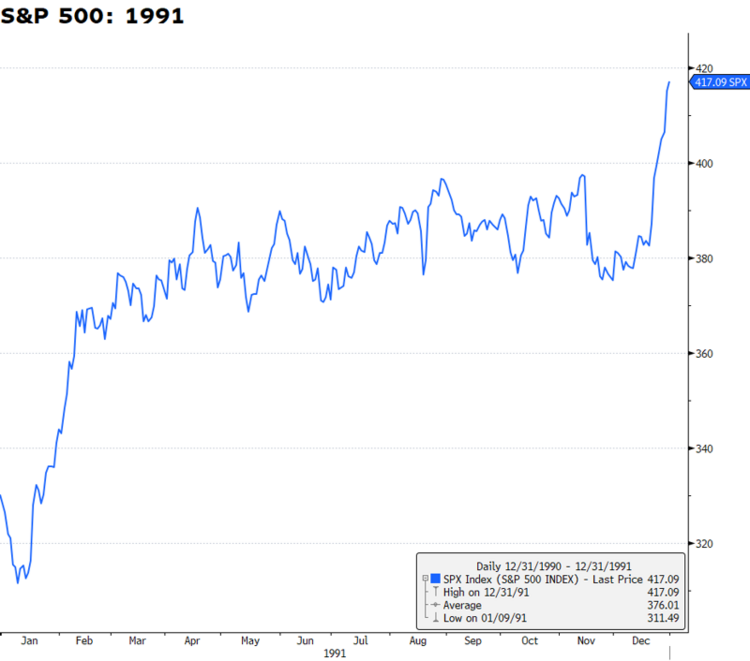

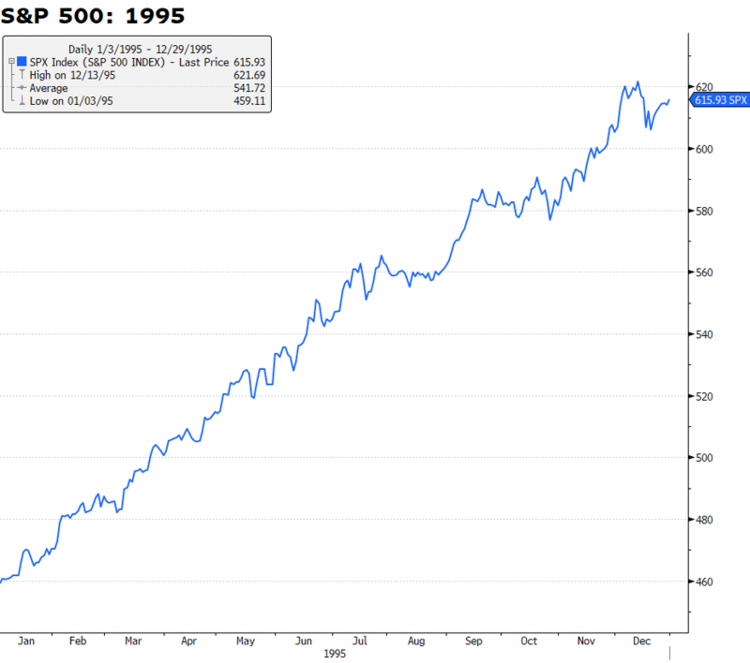

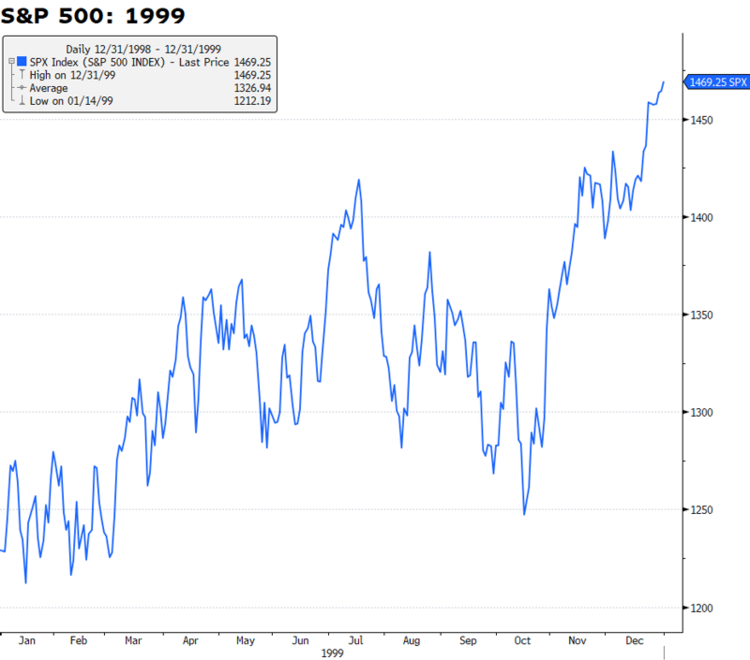

The counterintuitive fact is, in many instances, the softer GDP growth gets, the higher equity markets tend to trade:

- 1991: GDP growth was 2.1%, but the S&P 500 returned 26.3%. This was due to several factors, including strong corporate earnings growth and low interest rates.

- 1995: GDP growth was 2.4%, but the S&P 500 returned 37.6%. This was due to a few factors, including strong corporate earnings growth and investor optimism about the future of the internet.

- 1999: GDP growth was 4.1%, but the S&P 500 returned 21.0%, primarily due to strong corporate earnings growth and investor euphoria about the dot-com bubble.

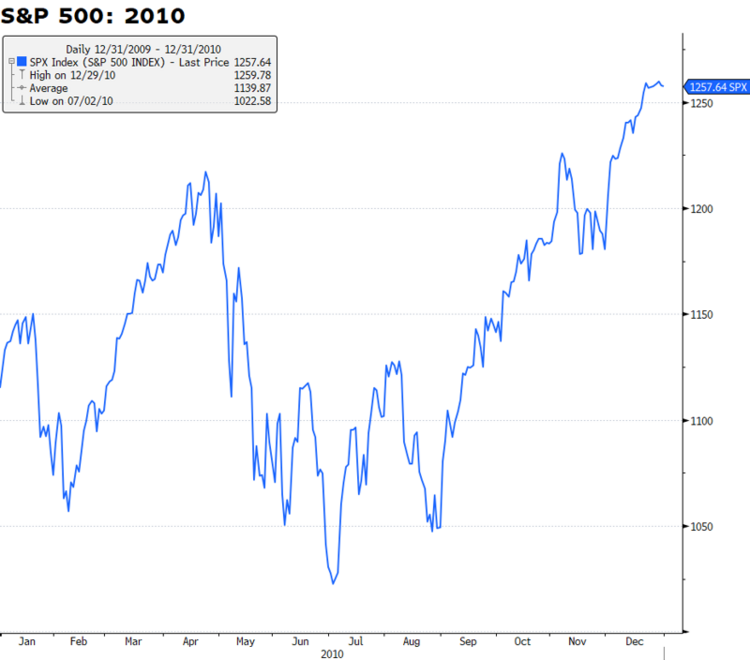

- 2010: GDP growth was 2.5%, but the S&P 500 returned 15.06%. This was due to a number of factors, including strong corporate earnings growth and investor optimism about the economic recovery from the Great Recession.

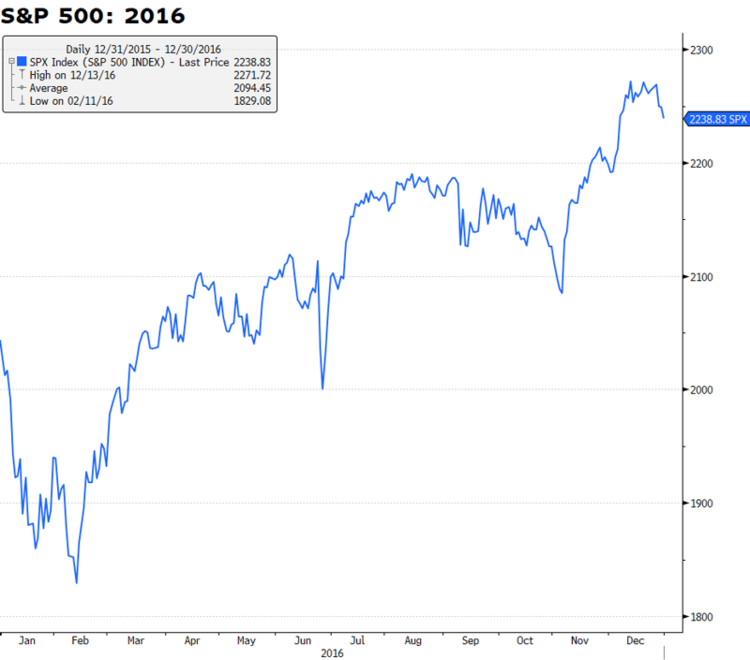

- 2016: GDP growth was 1.6%, but the S&P 500 returned 11.95%. This was due to a number of factors, including strong corporate earnings growth and investor optimism about the pro-growth policies of the Trump administration.

Themes: Earnings growth, lower interest rates, and investor enthusiasm about innovation – kind of like Artificial Intelligence.

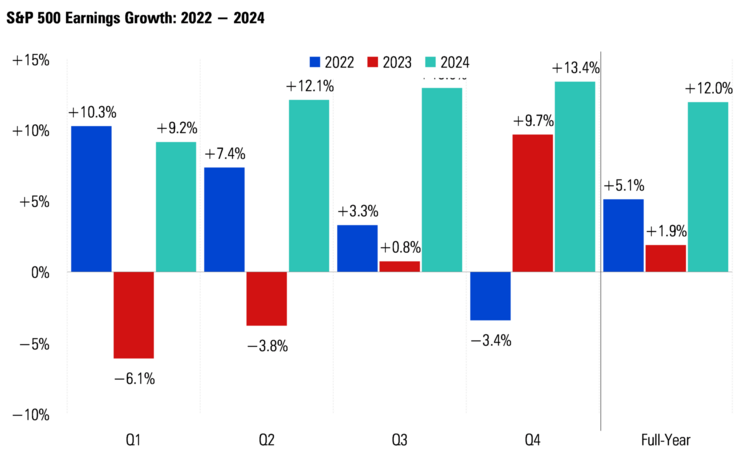

As for earnings growth, we are in a soft patch, but that should be in our rear-view mirror. The simple truth is investors buy into earnings growth rates which are reported on a quarter-over-quarter and year-over-year basis. It’s not hard to see the hurdle rate for 2022 earnings growth was harder to beat for calendar year 2023. Yet, 2024 by comparison will get the benefit of the weak earnings growth seen in 2023. 3

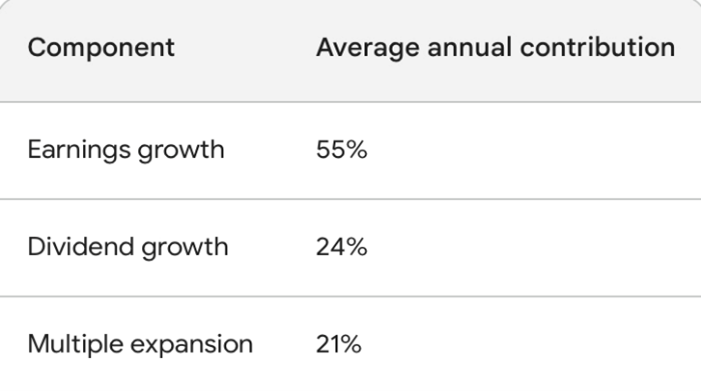

If you look at the past 100 years of equity returns, earnings growth is the largest contributor, with dividend growth second, and then multiple expansion.

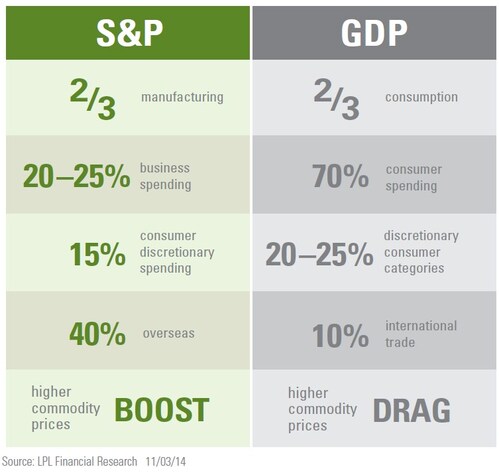

S&P earnings growth drivers and the U.S. economy are not perfectly correlated – that’s how you can get very positive equity returns when the economy is slowing. It’s also a fact that when the economy slows, companies tend to trim workers, cut costs, and increase productivity. It’s also true that the Fed tends to lean toward interest rate cuts. All beneficial to equity investments. 4

S&P earnings growth drivers and the U.S. economy are not perfectly correlated – that’s how you can get very positive equity returns when the economy is slowing. It’s also a fact that when the economy slows, companies tend to trim workers, cut costs, and increase productivity. It’s also true that the Fed tends to lean toward interest rate cuts. All beneficial to equity investments. 4

It’s easy to get lulled into a negative feedback loop about GDP growth and miss out on great equity returns.

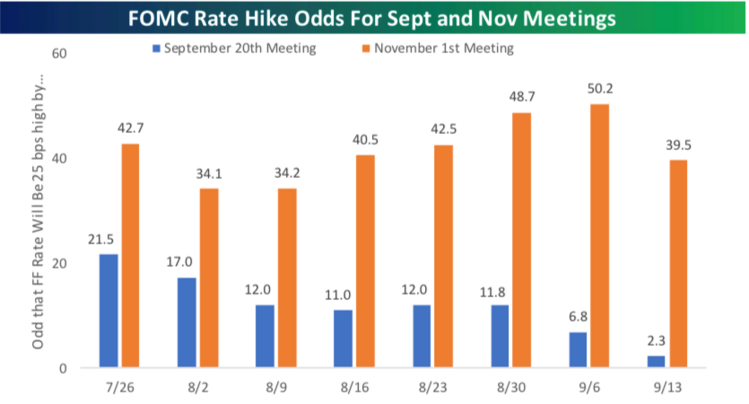

As for lower interest rates, expectations are near a zero percent chance for an additional hike next week and could erode for November hikes as we view more economic data. 5

A pause in hiking rates is generally a catalyst for better equity returns one year later. 5

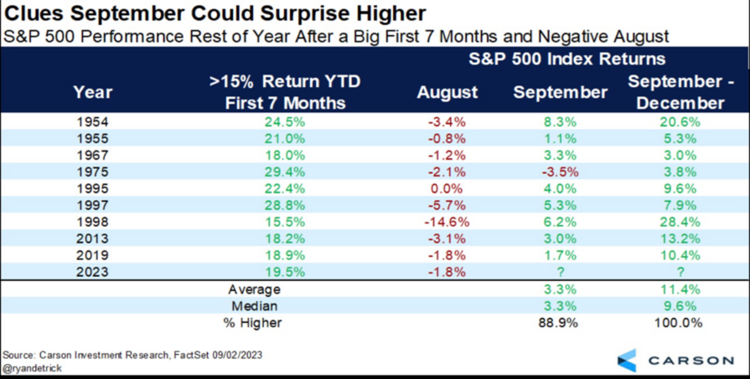

Further, patterns suggest a stronger finish to the year as we emerge from the earnings growth slumber. 6

It’s going to be hard to look past the noise of strikes, government shutdowns, and modest earnings growth expectations, but being positioned for the next leg of the cycle is critical.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: