The (Perfect?) Landing

The Federal Reserve is going to be meeting this week and will likely confirm their pause in raising rates. So far, the Fed has orchestrated a perfect economic soft landing, if you want to give them credit for that.

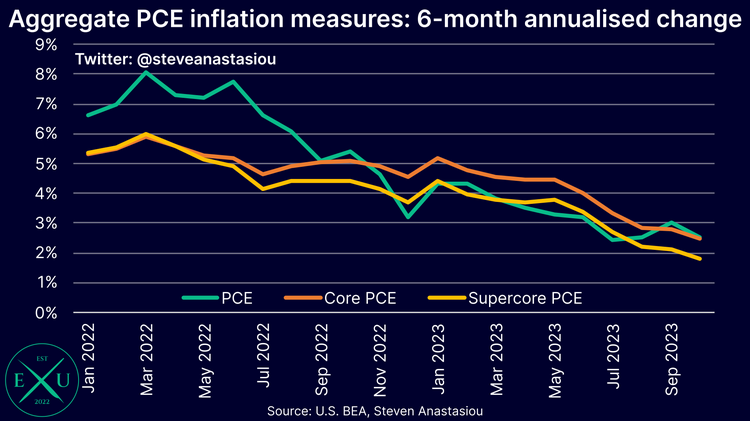

The latest consumer price report (PCE) solidified the continuing moderation trend in prices. Inflation is moving rapidly toward the Fed’s 2% target. Considering inflation was peaking at 8% just about 18 months ago, the consumer has slowed considerably. 1

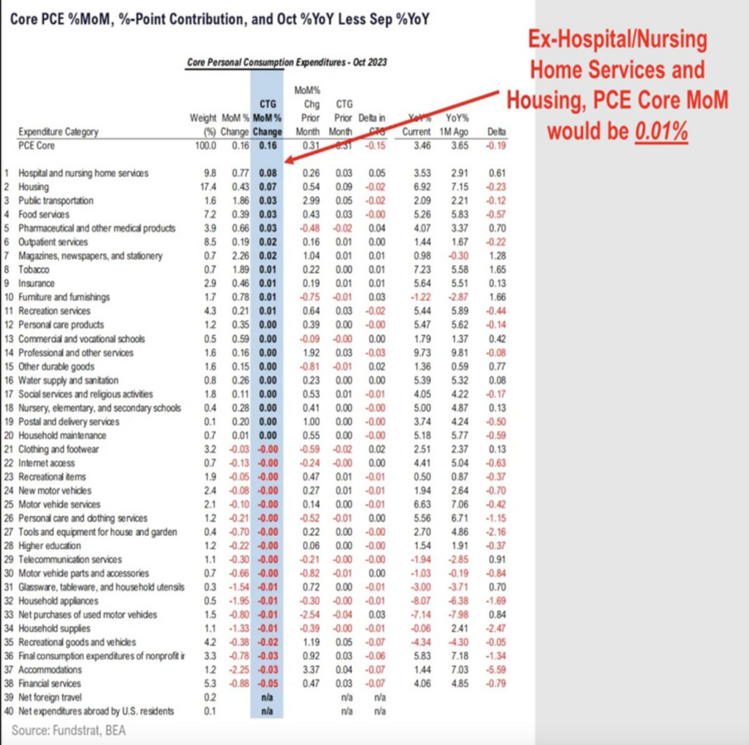

In fact, when looking at many of the component parts of inflation, just two sectors are driving most of the gains – housing and hospitals. If you remove those two segments, you get inflation at 0.01% on a month-over-month basis. Take a look at how many sectors are not inflating or are in deflationary mode. 1

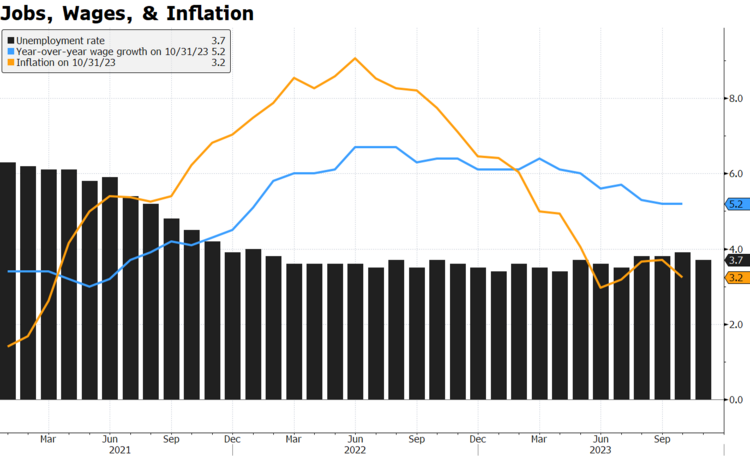

When it comes to inflation, jobs and wages tend to drive much of the cost of goods and services. 2

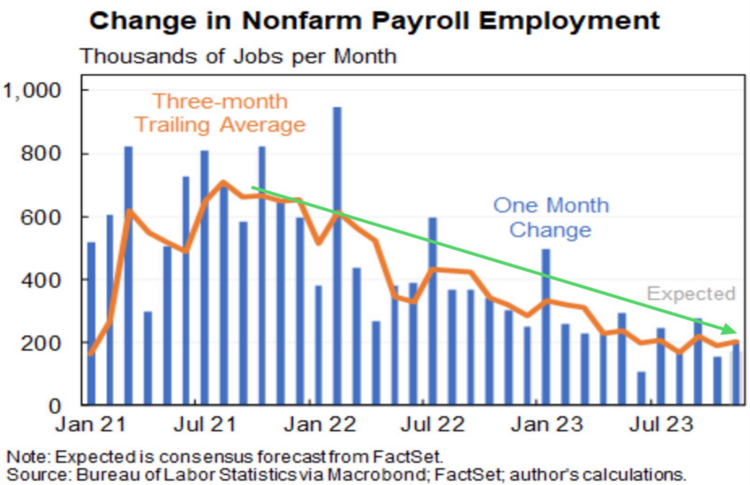

To that end, the jobs picture has been moderating. The U.S. economy added just under 200k jobs in November. This is a continuation of the softening in the jobs market. I try and look at the rolling averages, as the month-over-month changes can distort the trend. 3

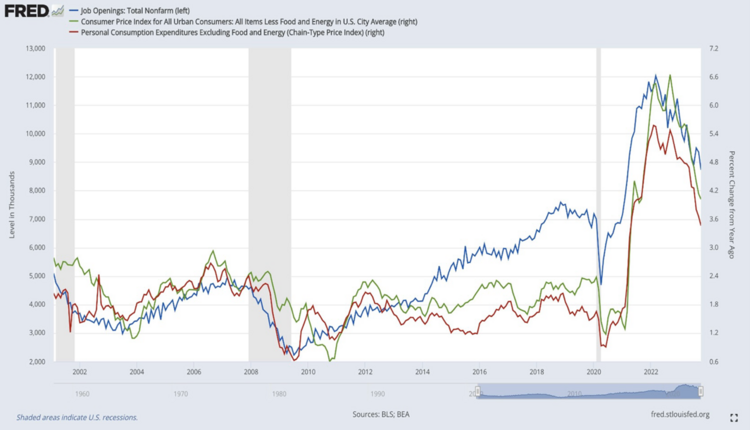

Estimates suggest it takes about 150k jobs a month to keep up with labor force growth and the moderation in jobs growth is getting pretty close to neutral. Job openings declined last month and the correlation between job openings and inflation is high: fewer job openings mean less jobs and lower wages. 4

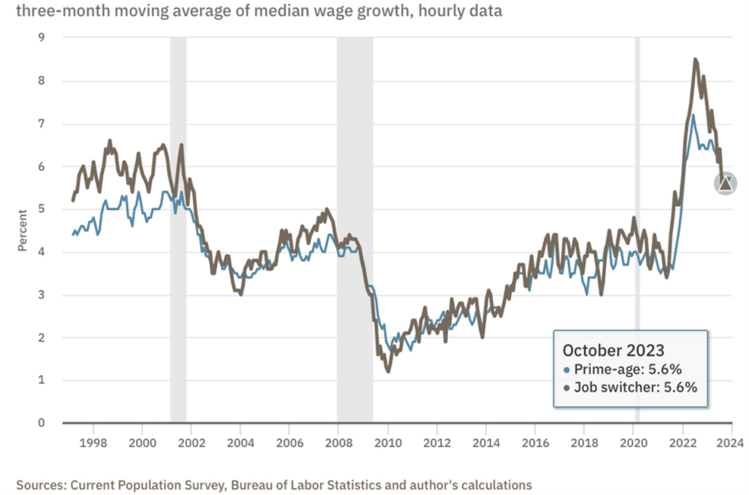

Wage growth is rapidly moderating, with job switchers now getting about the same wage growth as those that remain in jobs. Perhaps that’s why there are fewer job openings as the switchers aren’t getting the big benefit from jumping around. 5

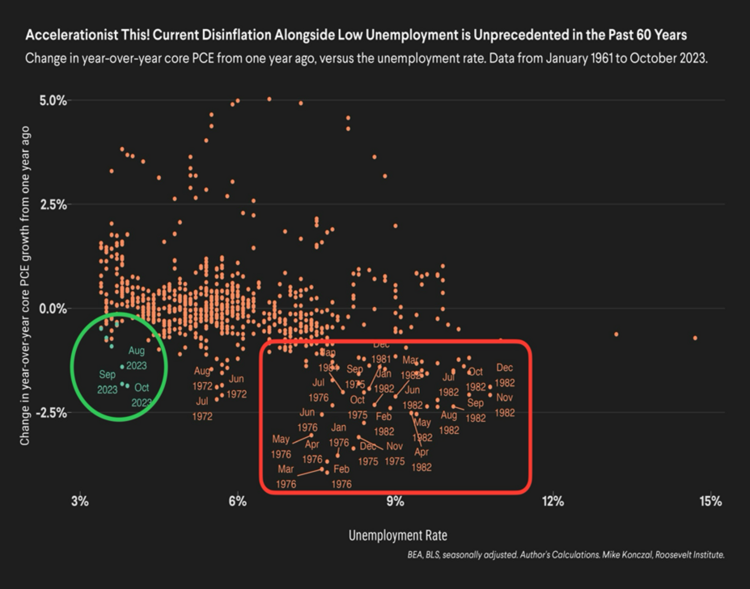

I will admit moderating inflation without more job destruction is not typical. Historically you need some broad-based job losses to get inflation to moderate. Unemployment above 6% is the historical standard, not the current 3.7%. 6

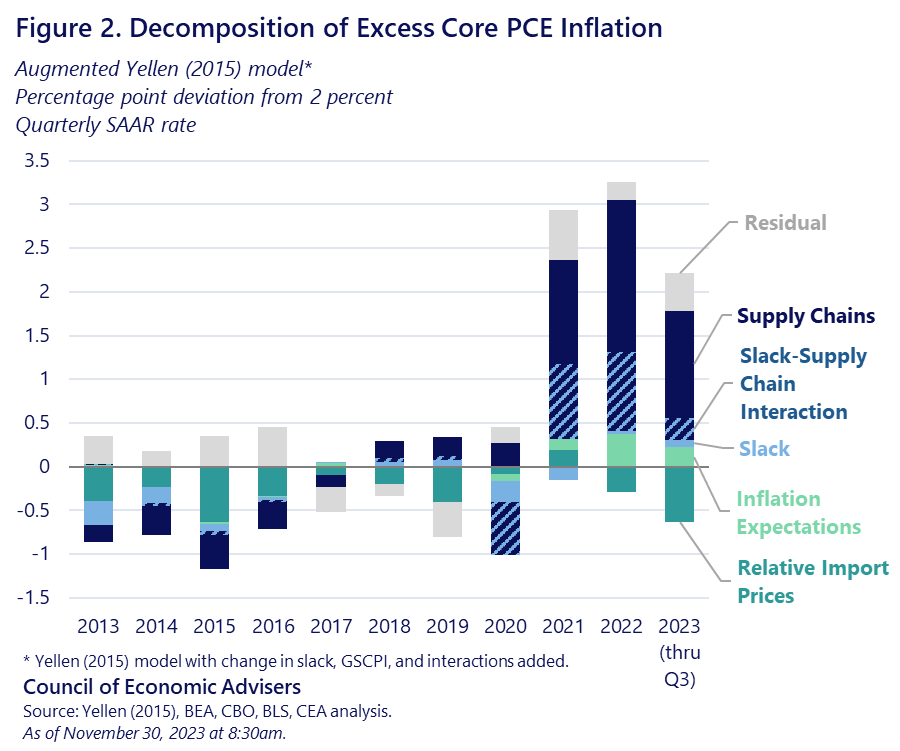

One school of thought is the Fed is not really manufacturing the soft landing and much of the reduction in inflation is from the supply chain easing. According to the Council of Economic Advisors, supply chains along with the slack amounted to about 80% of the disinflation since 2022. 7

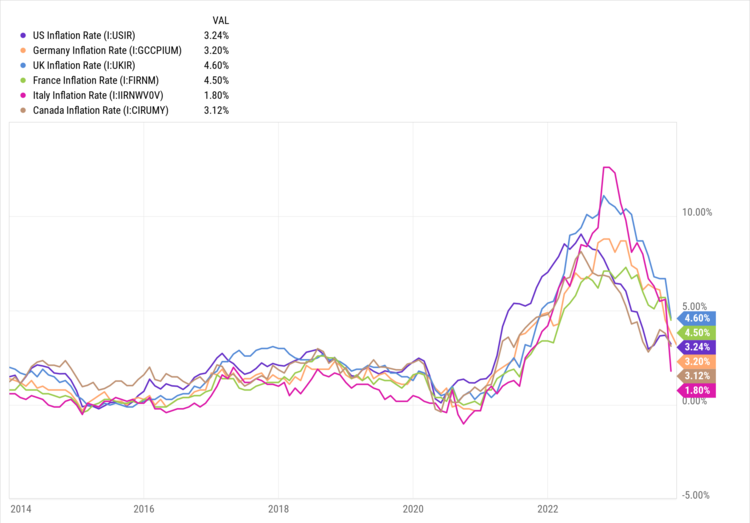

Further proof the Fed might not be in charge is moderating inflation across the globe, with each Central Bank exercising different monetary policies. 8

I also know this is the debate investors and economists are dealing with right now. So much of capital allocation is dependent on where you think the cost of capital will be in the long run.

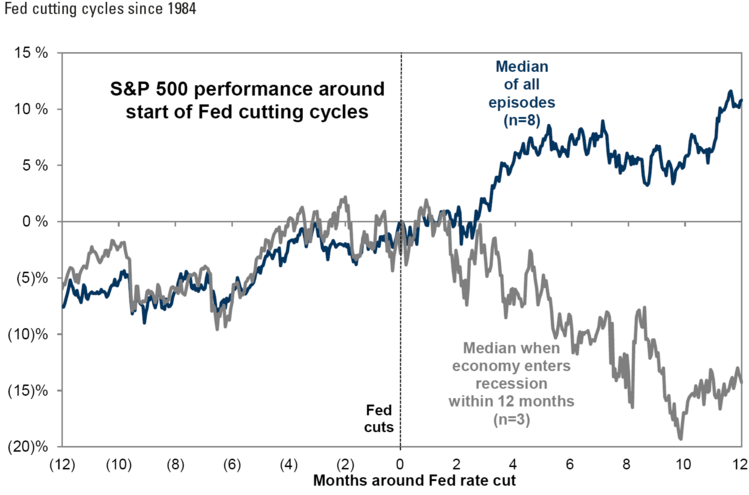

Whatever camp you're in, the fact remains that jobs, wages, and inflation are moderating. If the Fed (or whatever economic forces) can deliver a perfect landing, it will impact future capital allocation and equity prices. A recession or moderating economic growth can inform the S&P 500 in the coming months. 9

In all episodes (8) the S&P 500 has averaged about a 10% gain when the Fed starts cutting. Unless it’s a recession (3 episodes). In those cases, the S&P fell about -15%, with a trough of down -20%.

Investors should continue to focus on their liquidity needs to prepare for any eventuality, emotionally decouple from the short run volatility of equity investing and add duration to their bond holdings.

The perfect economic landing will always be in doubt because demand will always be subject to the fluctuating animal spirits of the U.S. consumer.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.economicsuncoveredresearch.com/p/pce-data-reinforces-why-fed-should-shift-stance

- Bloomberg

- https://thedailyshot.com

- https://fred.stlouisfed.org/graph/?g=1czs8

- https://www.atlantafed.org/chcs/wage-growth-tracker

- https://twitter.com/mtkonczal/status/1730221086304850207

- https://www.whitehouse.gov/cea/written-materials/2023/11/30/disinflation-explanation-supply-demand-and-their-interaction

- https://tinyurl.com/5933t69v

- https://research.gs.com