The Quiet Period

Now that we have mostly concluded earnings season (over 85% of S&P 500 companies have reported earnings), we enter a quiet period of data and investors shift their focus back to macro events.[i] Before I address the "quiet period", let's quickly review a summary of Q4 earnings.

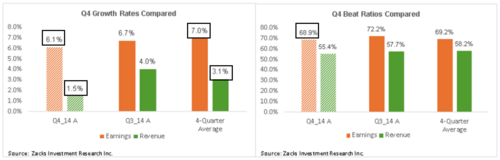

As you can see we exceeded on both earnings per share and revenue, albeit much lower expectations than historical growth averages (7.0% for EPS and 3.1% for revenue).[ii]

It's not surprising these "quiet" periods of time often meet with more volatility than we see during earnings season. It appears earnings provide investors an anchor to windward.[iii]

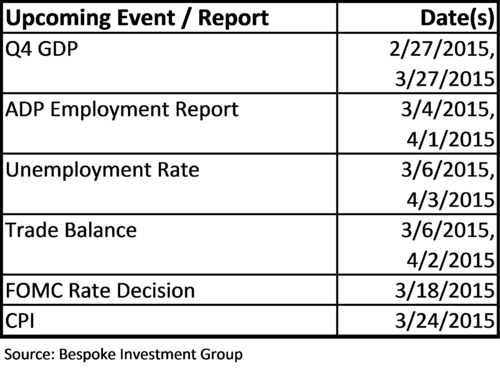

So what macro events and data are likely going to consume our attention before we start Q1 earnings season on April 13th?[iv]

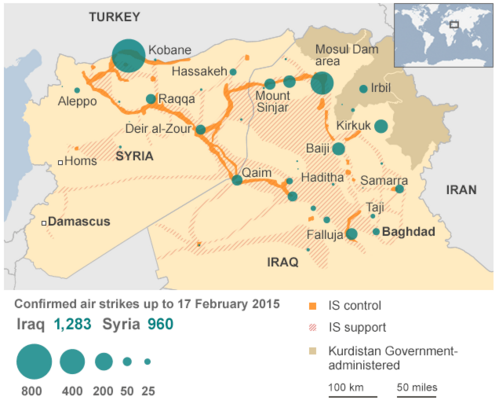

Geopolitically we know we can expect more bad news from ISIS and Middle East volatility. While that region only represents about 3% of global GDP, the horrific terrorism campaign haunts us more than the economics.[v,vi]

We can also expect continuing troubling news from Russia and Ukraine. It's always been clear to us that Russia wants a much bigger geographic buffer from Europe than simply the old border of Ukraine. In a prior posting, we examined the issue much more closely. A country like Ukraine that would become a NATO and EU member cannot sit only 354 miles from Moscow.[vii] It's their version of the Cuban Missile Crisis without the missiles.

The current map shows an effective buffer being built by Russia.[viii] Let's hope that's all they want and not a resurrection of the former Soviet Union as many pundits suspect.

Of course any news on declining oil prices, strengthening dollar, jobs and inflation will adjust investors’ perspective on interest rates.[ix]

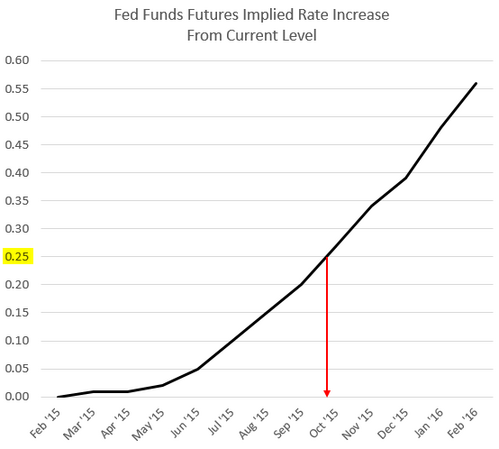

Right now investors are not expecting the Fed to raise rates until October of this year.[x]

So while we enter a normally volatile cycle in the markets, don't let the variance spook you. Remember your portfolio is likely built on the averages, but the variances can always be painful.

Enjoy the "quiet" period.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] Mian, S. (Feb 19, 2015). Zacks Earning Trends. Zacks Research. p 2.

[ii] Ibid.

[iii] Google Finance. (Feb 23, 2015). VIX Chart.

[iv] Yahoo Finance. Earnings Calendar.

[v] Knoema.com (Feb 23, 2015). GDP in US Dollars. Data from IMF World Economic Outlook, Oct 2014, for World GDP and Iraq, Iran, Turkey, Syria, Jordan, and Saudi Arabia).

[vi] BBC.com. (Feb 20, 2015). Battle for Iraq and Syria in maps.

[vii] timeanddate.com. (Feb 23, 2015). Distance from Moscow to Ukraine – Sumy.

[viii] Tharoor, I. (Sep 5, 2014). MAP: Russia’s expanding empire in Ukraine and elsewhere. The Washington Post.

[ix] Bespoke Investment Group. (2015). The Bespoke Market Calendar 2014/2015.

[x] Soberlook.com (Feb, 22, 2015). Market expectations of the first Fed rate hike seem unrealistic.