The Recession That Never Came…Yet!

The Wall Street consensus call for a recession appears to have faded. Various investment banks have been changing their calls as of late:

- Goldman Sachs: “The probability of a U.S. recession in the coming year has declined, as recent economic data signal that bringing inflation down to an acceptable level will not require a downturn” July 17, 2023

- Bank of America: “Recent incoming data has made us reassess our prior view that a mild recession in 2024 is the most likely outcome for the U.S. economy.” August 2, 2023

- JPMorgan: “The likelihood of a contraction has diminished in recent months and now expects US GDP to grow at a healthy 2.5% annualized pace in the current quarter, followed by 1.5% in the fourth quarter.” August 4, 2023

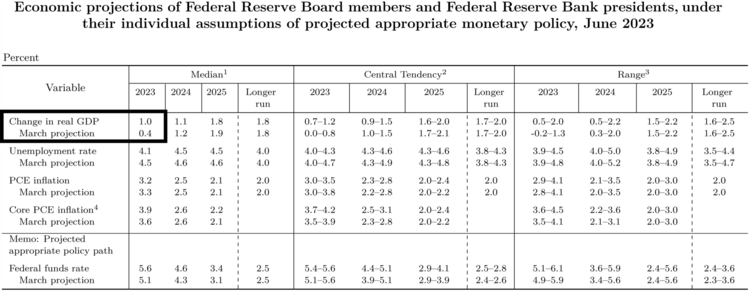

In fact, the Federal Reserve changed their stance on growth with their forward guidance. 1

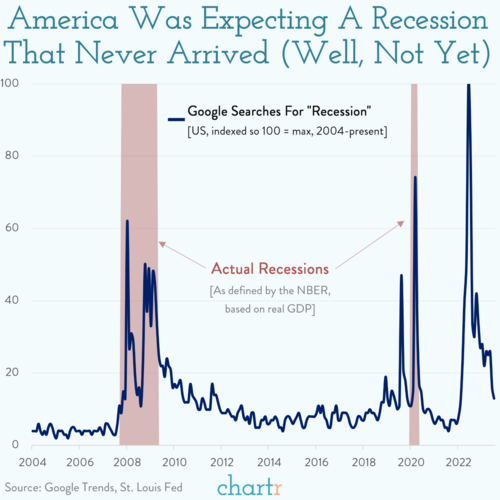

It appears the U.S. Consumer has also shifted their sentiment when it comes to recession. 2

Unfortunately, if you followed these sage predictors, you were probably longer in duration in fixed income for a year and likely also owned Health Care and Consumer Staples stocks. You might have even missed the recent tech rally. (To be transparent, we unwound our longer duration in 2022 and our Health Care and Staples early in 2023)

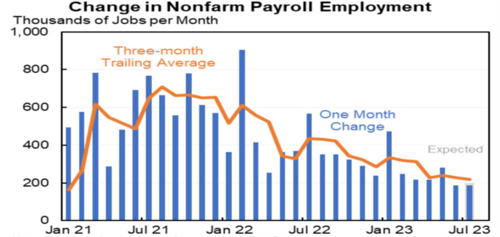

The fact is the U.S. economy is showing moderating strength. The recent jobs report suggested the U.S. economy added 187,000 jobs in July, which should help the Fed pause their rate increase cycle. 3

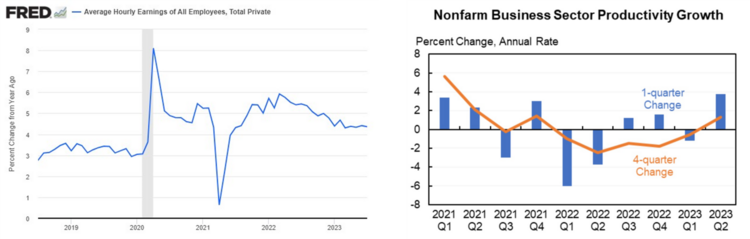

Wage growth continues to hover around the 4.5% level while the U.S. worker is adding tremendous productivity to their efforts.

Think about it this way: Wage Growth = Inflation + Productivity. If wages are growing by 4.5%, it’s not a problem for the Fed as long as productivity remains high. Currently productivity is nearing 4% when it traditionally languishes around 1%. 4 3

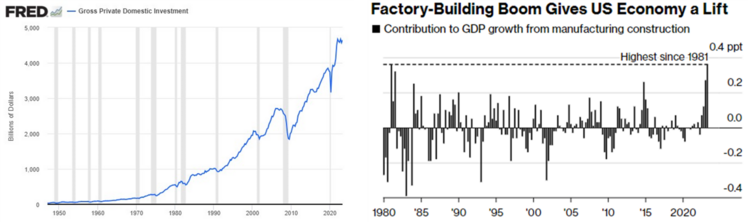

Further, the various fiscal policy measures (CHIPS and Science Act, Inflation Reduction Act, and the Infrastructure Bill) are creating a private investment boom stimulating a building burst for factories across the country. 5 6

It’s no wonder Q3 GDP estimates by the Fed are ticking up to 4%, although we expect that figure to moderate later this quarter. 7

Here’s a riddle:

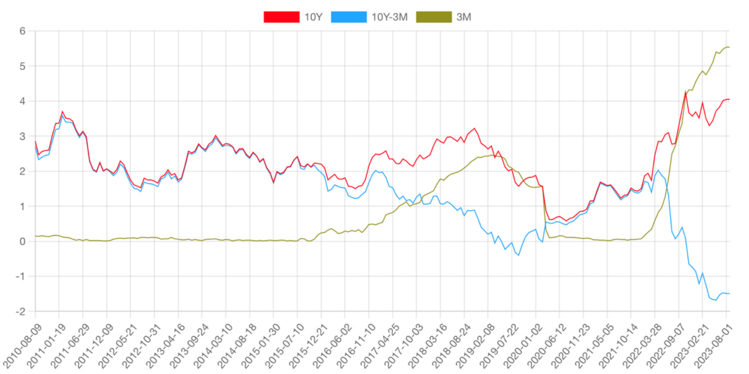

If there is not going to be any recession, we would need the yield curve (the difference between short term interest rates and long-term interest rates) to normalize. Investors should get paid more for taking on longer-term risks. Right now, short term rates (green) are about 150 basis points higher than longer term rates (red). Historically, longer-term rates are between 100-200 basis points higher than short-term rates (blue). We need about 250 basis points of adjustment between the 3 month and 10-year treasury. 8

Will the Fed cut short-term rates by 250 basis points anytime soon? Not likely – the economy, today, is still strong.

Will investors sell their long-term treasuries and buy short-term treasuries? That would do it, but that doesn’t seem logical if there is no recession coming.

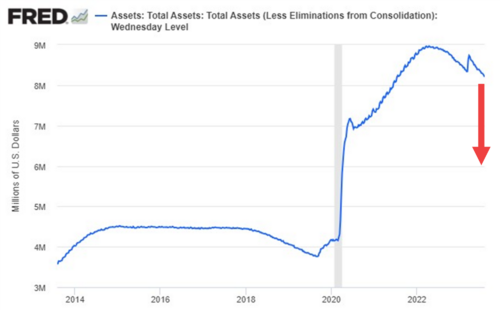

Will the Fed pause their short-term rate-hiking cycle and pound the table on selling off their long-duration treasuries or hyper-accelerate quantitative tightening? It might be the only tool they have to manage the long end of the yield curve. I suspect this might be what we see. 9

Perhaps, the Fed will drag higher short-term rates out much longer than expected, perhaps even years to allow time for the balance sheet to normalize and long-term rates to rise without a recession. Historically, the U.S. economy has grown just fine for a longer period of time with high shorter-term rates. 8

While I haven’t sorted out the riddle yet, it’s prudent to plan for the current restrictive short-term rates environment to continue for much longer than what is currently expected. Cuts to short-term rates mid-next year may be a bit premature.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230614.pdf

- https://read.chartr.co/newsletters/2023/8/6/the-us-economy-a-temperature-check

- https://www.bls.gov/news.release/empsit.nr0.htm

- https://fred.stlouisfed.org/graph/?g=17EkL

- https://fred.stlouisfed.org/graph/?g=17Elj

- https://www.bloomberg.com/news/articles/2023-08-06/bidenomics-boosts-the-us-economy-fanning-soft-landing-hopes-inflation-fears

- https://www.atlantafed.org/cqer/research/gdpnow

- Bloomberg

- https://fred.stlouisfed.org/graph/?g=17Eme