The Same Tired Paradigm: Inflation, Inflation, Inflation

It may be premature to think about inflation or deflation. However, it is critical that we look around the corner to support what we do today. Remember, as an investor you only own future cashflows, not past ones.

I can’t tell you how many times during the Great Financial Crisis (2008-2009) experts predicted runaway inflation. I’ve even watched billion-dollar portfolios tilt towards trying to profit from inflationary pressures.

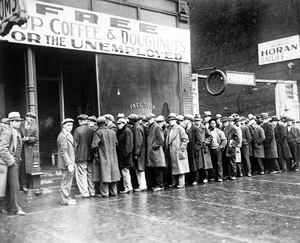

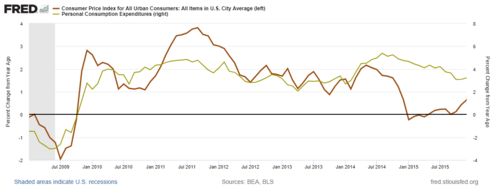

Buying real assets like real estate, commodities, and gold are all traditional hedges against inflation; however, any sign of inflation was nascent at best and almost nonexistent after the Great Financial Crisis. [i] [ii]

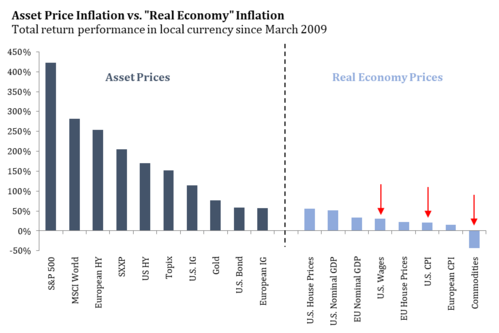

Inflation assets, other than maybe gold, have performed poorly over the last 10 years through April 2019. [iii]

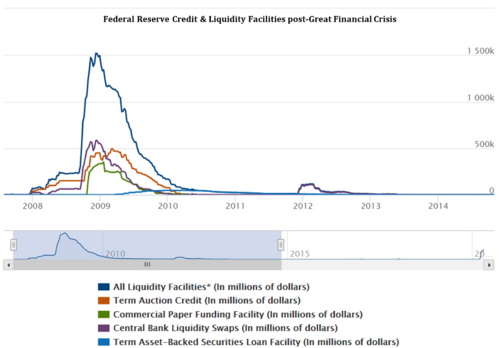

The consensus thinking was the Federal Reserve grew their balance sheet to save the U.S. economy and that extra funding would drive inflation much higher. [iv]

The Fed used various programs to keep credit markets open and functioning, including:

• Discount Window (DW)

• Interest on Excess Reserves (IOER)

• Term Auction Facility (TAF)

• Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF)

• Primary Dealer Credit Facility (PDCF)

• Commercial Paper Funding Facility (CPFF)

• Public Private Investment Program (PPIP)

• Maiden Lane LLC 1, 2, and 3

The Fed saved the economy in 2008 and they will save the economy now without much inflation. When you look at the core of these programs, none put money into the real economy. In fact, they probably created some disincentives to lend and grow mainline businesses and consumers. The programs were stimulative to banks, private equity, and off-balance sheet lenders but, likely more deflationary to wages and home ownership than inflationary.

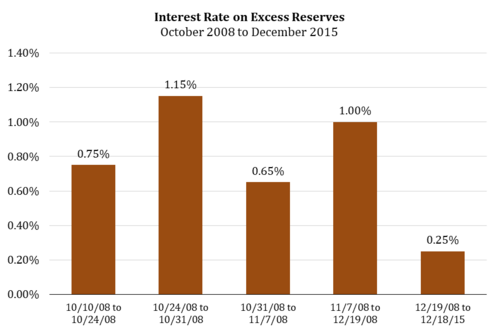

The main tool was Interest on Excess Reserves (IOER rate), which is the rate the Fed would pay banks to keep excess reserves on their books compared to lending those reserves out to businesses and consumers. [v]

Today, the Fed and the U.S. Government are back to doing their job in saving the U.S. economy from COVID-19 and the forced suspension of revenue. [vi]

Using programs like:

• The CARES Act – $2 trillion

• Main Street Lending Program – $2.3 trillion

• Money Market Mutual Fund Liquidity Facility – $51 billion

• Primary Dealer Credit Facility – $38 billion

• Commercial Paper Funding Facility – $249 million

Again, the “old guard” thinking is that all of this stimulus is going to create inflation. But. let’s be clear, most of these programs are not stimulative. It is rescue money—plain and simple. To think of any of this as stimulative is missing the point and is perhaps out of touch with what’s actually happening in the real economy. The CARES Act plugs a big hole in a forced suspension-of-revenue economy. The tools the Fed deployed from the list above are different only in name to the programs in 2008/2009. They will keep credit flowing to banks, private equity, and other securitized lenders.

Another common refrain is that the Fed is printing money and that will create inflation. That is simply an uninformed view of how the Fed functions. The fact is only the Treasury Department, by authorization of Congress, can print money.

To that end, the U.S. Government added trillions in deficit spending to the existing debt structure and did that under incredibly low rates. Recent treasury auctions have had debt issued across durations from one month to thirty years at rates as low as 0.115% for the 1-month T-Bill to 1.231% on 30-Year Treasury Bonds.

That is certainly not inflationary.

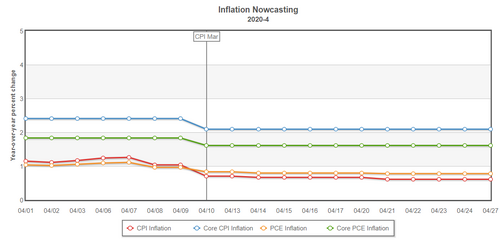

In fact, inflation expectations are nonexistent—especially CPI and PCE that include food and energy prices. [vii]

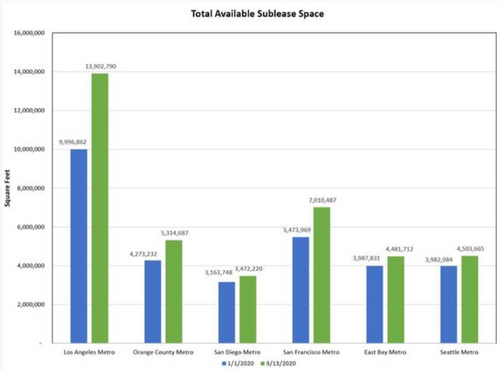

When taking a quick look at commercial real estate from January through mid-March, we can see subleased space has jumped in some metro areas—in turn giving an advantage to renters and not landlords. No inflation here. [viii]

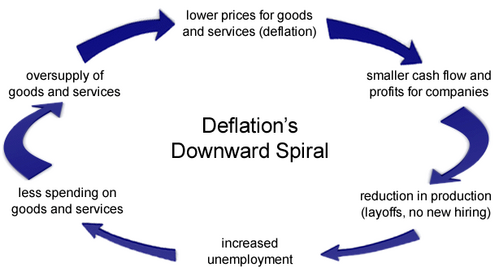

The cycle is straightforward. There is nothing good that comes from a deflationary downward spiral. [ix]

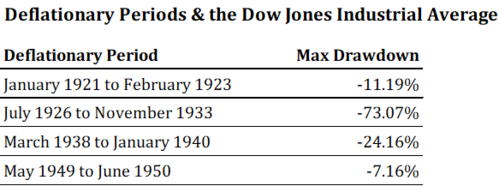

We have had very few deflationary cycles in our history but, they have all been met with equity market drawdowns. [x]

Defending against deflation will be the near-term challenge and the shape of the economic recovery will be the corollary to that challenge. Both go hand in hand. A quick recovery will likely not lead to inflation but, should defend against deflation and stagflation.

As an investor you should have hedges in place for inflation and deflation. In my view, fixed income, utilities, and consistent dividend payers are all good hedges to tilt toward. Let’s take a wait and see approach to inflation before we jump; especially if real estate is your hedge.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/series/CPIAUCSL

ii. https://fred.stlouisfed.org/series/PCE

iii. https://www.bloomberg.com/quote/SPX:IND

iv. https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

v. https://fred.stlouisfed.org/series/IOER

vi. https://www.federalreserve.gov/covid-19.htm

vii. https://www.clevelandfed.org/en/our-research/indicators-and-data/inflation-nowcasting.aspx

viii. https://www.bisnow.com/national/news/commercial-real-estate/west-coast-sublease-inventory-rises-hinting-at-looming-recession-103547

ix. https://learnbonds.com/news/deflation/

x. https://www.bloomberg.com/quote/INDU:IND