The Signal and the Noise: Breaking the Fever of Inflation

Everyone is talking about inflation these days and the debate is consuming the minds of both the pundit and investor classes. Transitory or structural inflation is at the core of the debate. Headline CPI was reported last week at a whopping 5% on a year-over-year basis. [i]

Remember, the Federal Reserve long-term inflation target is 2%.

That report is enough to scare the average investor and even some experienced classic economists. Here’s why I’m not rattled by the noise of the headline at this stage:

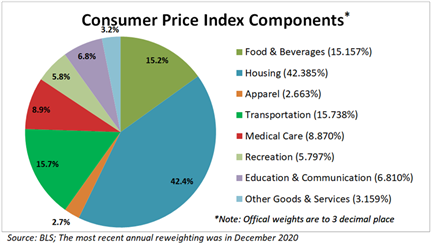

Below are the most recent component weightings of the Consumer Price Index. [i]

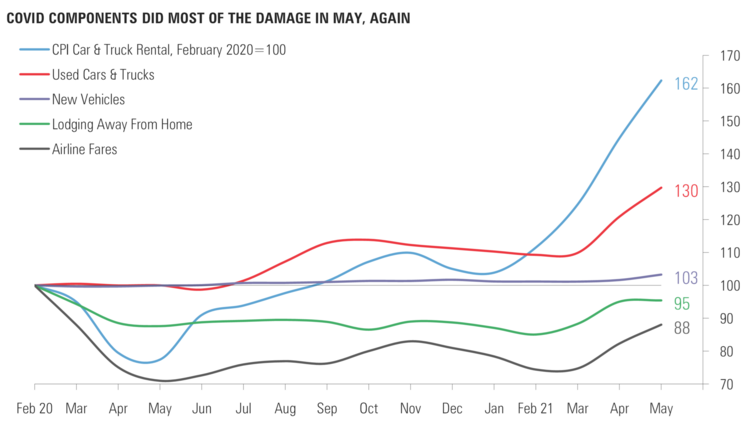

Breaking the components of the Consumer Price Index down further shows us the culprits that are driving inflation right now. [i]

As you can see, the main inflation drivers have been areas that were hit the hardest by the pandemic, namely Transportation—specifically, Used Cars & Trucks and Airline Fares. In total for the month of May, Used Cars & Trucks and Airline Fares made up approximately 300 basis points of the 5% increase in the Consumer Price Index.

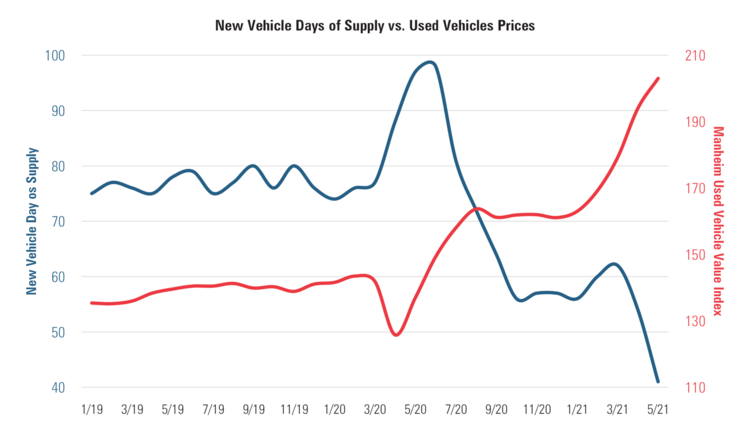

Many buyers have resorted to buying used vehicles due to the massive chip shortage squeezing the supply of new vehicles. This has led to a 48.2% jump in used vehicle prices over the last year.

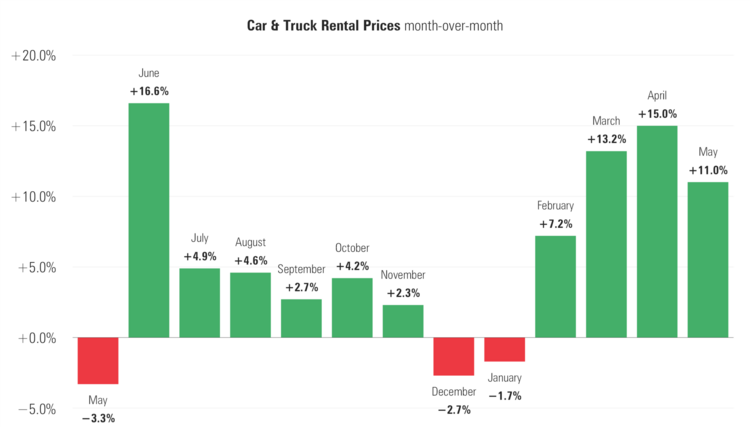

Next is vehicle rental prices: Prices were up 11% in May following a 15% jump in April. [i]

We all know that when the economy was shoved into a medically-induced shut down, all of the car rental establishments unloaded their inventory to survive. With the economy reopening, rental car companies are starting to rebuild their inventories. However, the current chip shortage is driving rental prices temporarily higher until new vehicles can be brought online.

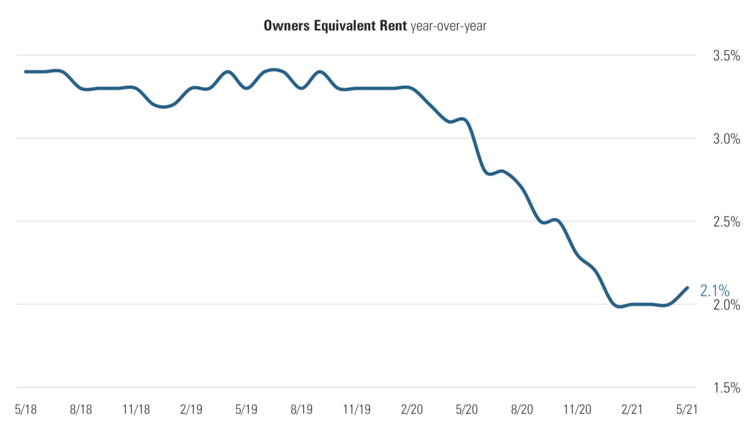

Let’s pivot to housing, which is a major component of CPI. The main subset is known as “owner equivalent rent.” Owner equivalent rent does not measure the traditional price of homes but rather the price of equivalent rents for those homes. You can see from the data below those rents have been moderating. [i]

When the moratorium on evictions expires in many states soon, we could see more supply of rentals and some deflationary pressure on rents. [iii]

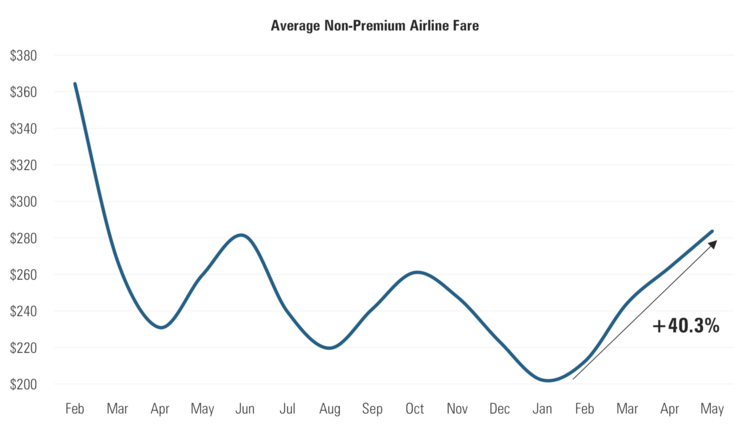

Finally, airline ticket prices spiked, mostly driven by a massive lack of labor supply of labor. [vii]

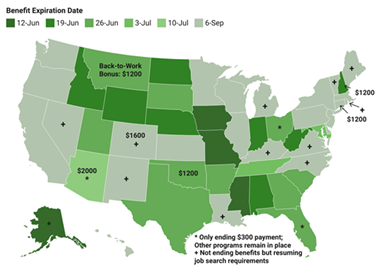

With more states cutting off additional unemployment benefits and pushing people back to work, we should see increases in the number of flights and a normalization of airline ticket prices. [iv]

In fact, in four states (Alaska, Iowa, Mississippi, Missouri) additional pandemic benefits ended this past weekend.

Ending these benefits early will pull pressure off wage increases and reduce the risk of an excessive wage-price spiral. Right now, with extra benefits the “get off the couch” wage is $19.35/hour.

By removing the $300 per week in additional federal unemployment benefits, the “get off the couch” wage drops to $11.85/hour. [v]

Right now, much of the inflation we are seeing is cost-push inflation which is generally transitory. It’s mostly driven by supply shocks (generally in oil but, post-pandemic it could be anything) which should normalize over the next year.

So, what’s my proof that we are in a transitory cost-push inflation environment? Look at the 10-year treasury. The yield on the 10-year has dropped as investors are grabbing yield while they can before a potential softening of inflation is seen. [vi]

Although there is a lot of noise, and inflation is on a delicate balance between cost-push and demand-pull, it should break its fever and normalize in the coming 12 months.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bls.gov/news.release/cpi.nr0.htm

ii. https://www.coxautoinc.com/economic_insights_category/data-point/

iii. https://www.nolo.com/evictions-ban

iv. https://research.gs.com/

v. https://fileunemployment.org/dataview/

vi. https://www.cmegroup.com/trading/interest-rates/us-treasury/10-year-us-treasury-note.html

vii. https://www2.arccorp.com/articles-trends/sales-statistics/