The Soft Landing Continues

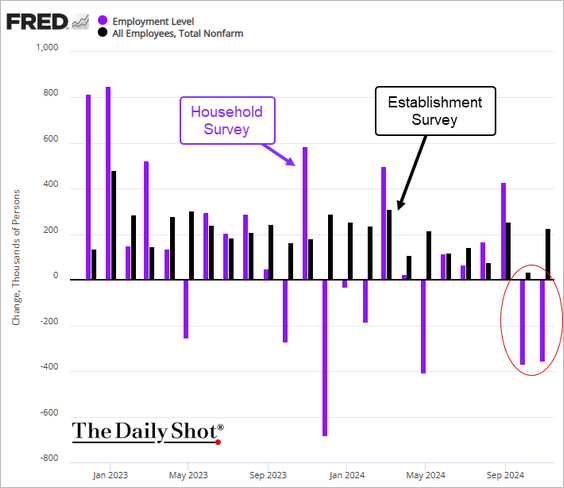

Last week’s jobs report presented new evidence that the U.S. labor market continues its delicate balancing act toward a soft landing. While the jobs report’s headline metric of nonfarm payrolls posted a 277,000 advance in November, another gauge of household employment declined by about 355k people, raising questions as to which is the stronger signal for the labor market. 1

The jobs report, published by the Bureau of Labor Statistics, is composed of two surveys: one of businesses, where the payrolls and wage data come from, and one of households that is used to calculate the unemployment rate. The household survey is a smaller poll with a larger margin of error, a big reason why economists tend to favor the establishment survey instead.

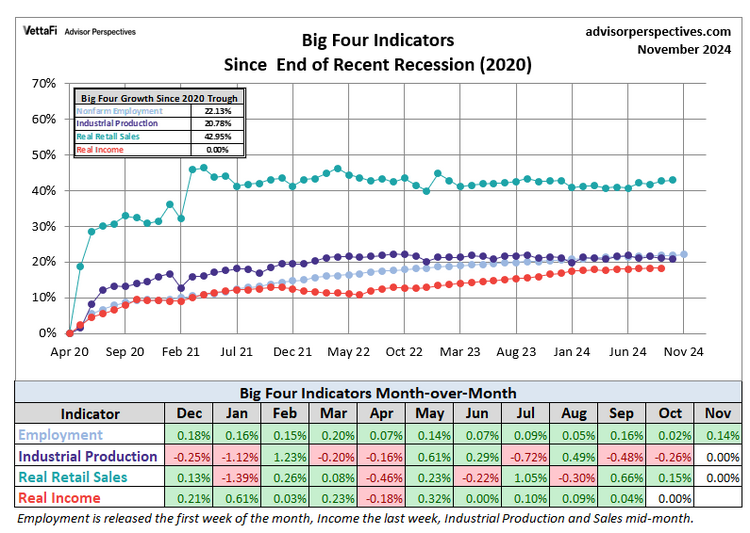

Moreover, other indicators remain strong – such as industrial production, retail sales, and real income – corroborating consistent strength in the payrolls figures. 2

We know the backbone of the economy is the consumer, which drives about 70% of U.S. GDP. Of course, consumers have faced challenges over the past year in elevated inflation readings and higher interest rates, which have pressured both spending and borrowing. Nonetheless, data continues to point to healthy rates of consumption, particularly for services, including leisure, hospitality, travel, and dining.

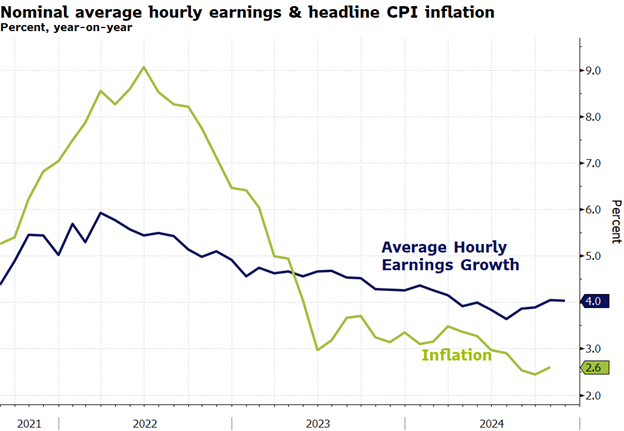

More broadly, we have also seen positive trends in real wage gains across households. Since 2023, wage growth has outpaced the rate of inflation, which has been supportive of consumer confidence and consumption. 3

As we head into year-end, investors have many reasons to cheer. The stock market in the U.S. has been making record highs, and bond markets still offer favorable yields. Overall, the fundamental backdrop for financial markets remains intact, and the U.S. economy appears poised to achieve the elusive “soft landing” (modest slowdown but still growing at or above trend). Despite potential policy uncertainty and market volatility ahead, we continue to believe that pullbacks can offer opportunities for investors, especially because we don’t foresee an economic downturn for now.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://fred.stlouisfed.org/graph/?g=1C4AR

- https://www.advisorperspectives.com/dshort/updates/2024/12/06/the-big-four-recession-indicators

- Bloomberg

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.