The Surge Pricing Economy

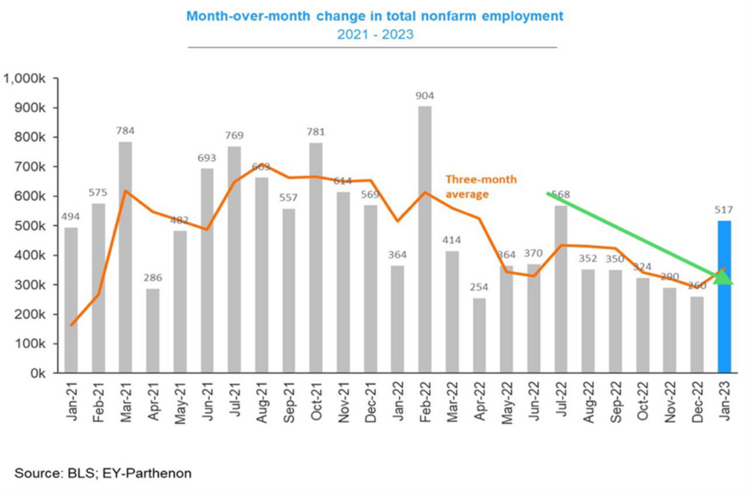

Wow! The U.S. economy added 517k jobs in January. This reversed a cooling trend and surprised everyone. 1

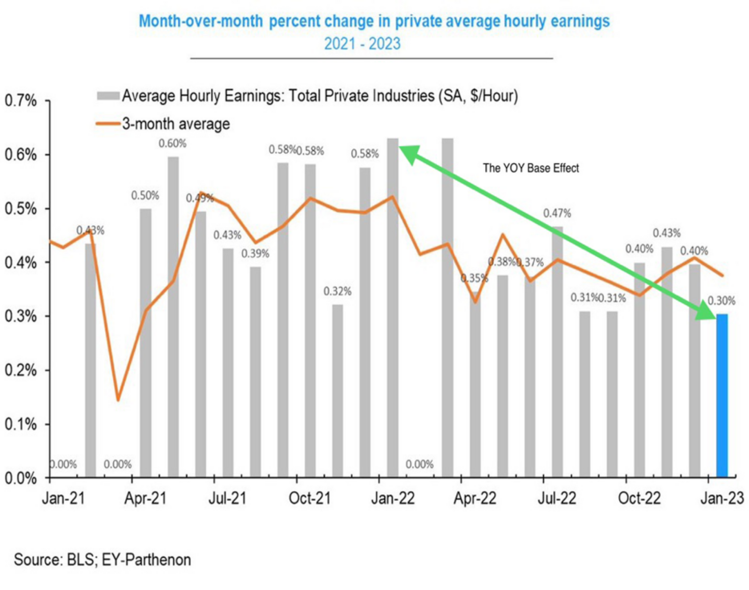

Oddly enough, wage growth continued to moderate in January in conjunction with the rapid expansion in employment. 2

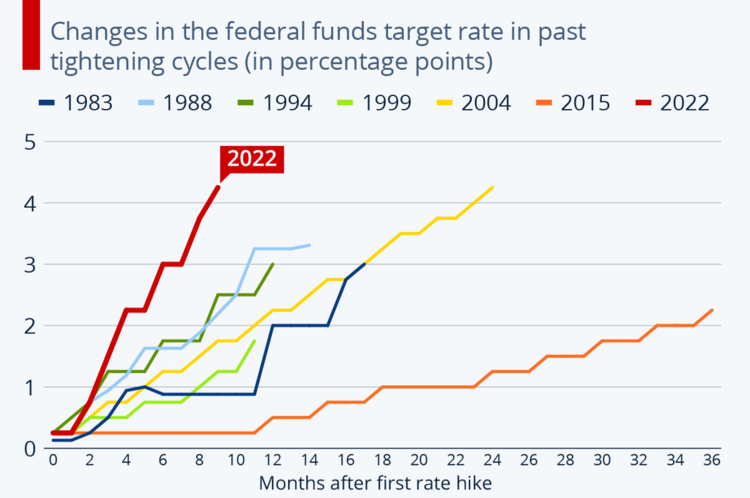

The Fed has been on a warpath to cool the U.S. economy over the last year by raising rates at one of the fastest paces on record, all in the name of crushing inflation. 3

The Fed formula is very simple: raise interest rates, crush consumer demand, create weakness in the labor market, and cool wage growth.

So, what’s going on here? More jobs and cooler wages! Is it possible the old lens the Fed looks through when trying to conquer inflation is outdated?

A recent paper by Fed Governor Neil Kashkari (link) might shed some light on what’s really happening. He labels it “surge inflation”, similar to surge pricing when you take Uber at the wrong time. When there is little supply of drivers, prices surge to attract more drivers off the couch and onto the roads. When demand is met, prices quickly normalize. No need to crush all the drivers or put people out of business.

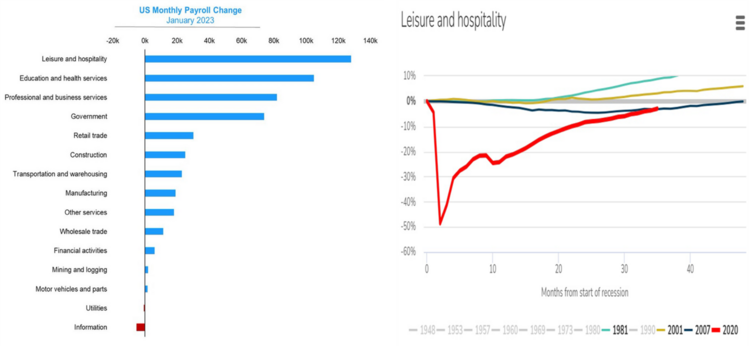

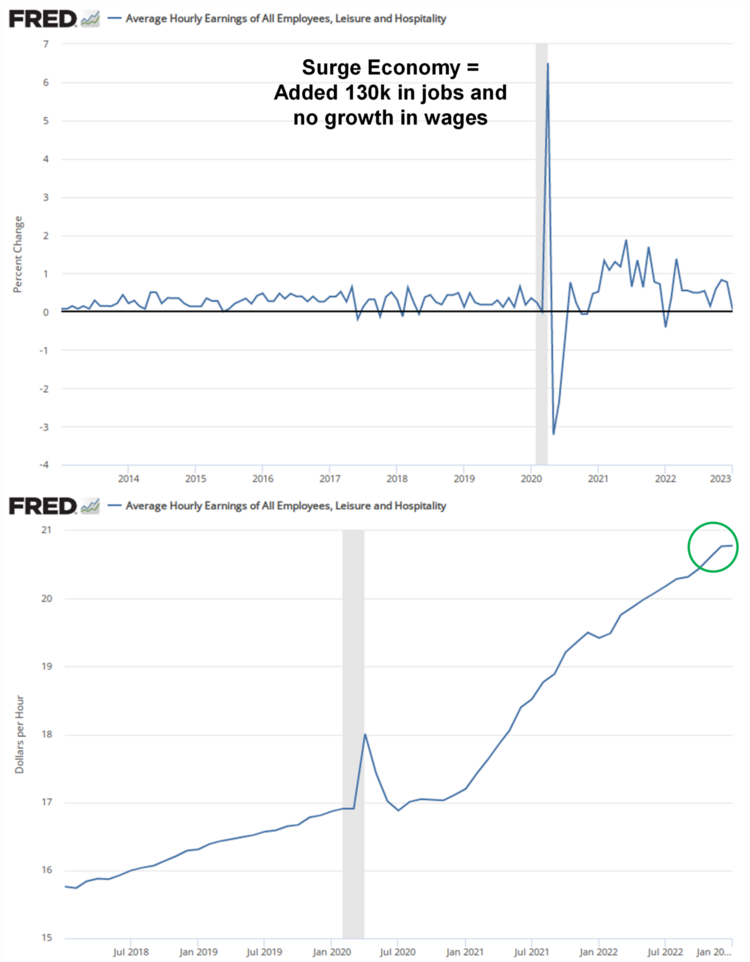

So, let’s see if we have some surge employment to meet demand. Leisure and hospitality contributed the most to the recent jobs report, representing over 25% of the bump. We’ve all experienced the long waits to get your car from a hotel valet or to place a food order. With the surge in employment, we should see a reduction in the rate of change for wages in this sector as the employment trend returns to normal. 4

Sure enough, with 130k jobs added in leisure and hospitality the rate of change in wages was near zero. Over the past year the average hourly pay for leisure and hospitality workers jumped by 30%; enough to pull workers off the sidelines. That surge in wages is now over as more workers were added and wage gains moderated.

It’s a very odd playbook and defies classic economics for sure. 5

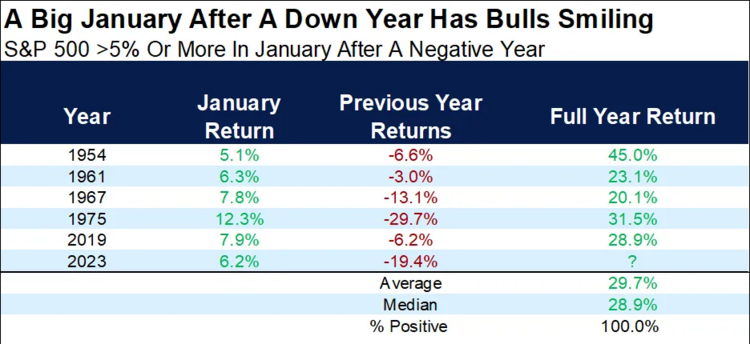

Is it possible for the Fed to learn new tricks? A surge pricing economy might just require some new thinking. If the Fed can grasp this, perhaps a soft landing is still in the cards. If history is any guide, then we can all benefit from a great equity rebound in 2023 following a terrible 2022. 6

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bls.gov/news.release/empsit.nr0.htm

- https://www.bls.gov/news.release/empsit.t19.htm

- https://www.statista.com/chart/28437/interest-rate-hikes-in-past-tightening-cycles/

- https://www.bls.gov/web/empsit/ceshighlights.pdf

- https://fred.stlouisfed.org/graph/?g=ZJgG

- https://www.carsongroup.com/insights/blog/so-goes-january-goes-the-year/