The Teeter-Totter

The Federal Reserve will raise interest rates by another 50 to 75 basis points this week and creep a little closer to combating inflation without tipping the economy into a recession. Similar to walking on a teeter-totter; at some point, you pass the balance point, and it tips over suddenly. That’s what the Fed is attempting to do with the economy.

Here's the challenge.

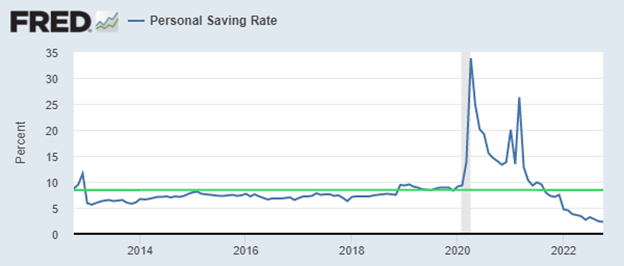

While the current savings rate – measured as a percent of disposable personal income – is well below trend, the consumer still has plenty of firepower beyond saving their current income. 1

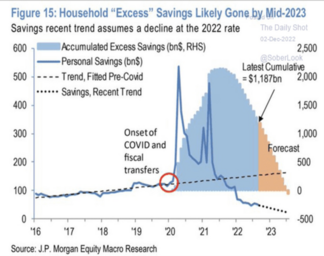

Currently, the U.S. consumer is still sitting on about $1.18 trillion in excess savings that should continue to generate positive economic growth in Q4 and bleed into Q1 2023, according to JP Morgan's recent analysis. $1.18 trillion in consumption is equivalent to 4.5% of GDP. 2

This fact alone will continue to challenge the Federal Reserve on what the appropriately restrictive interest rate level should be to crimp the consumer.

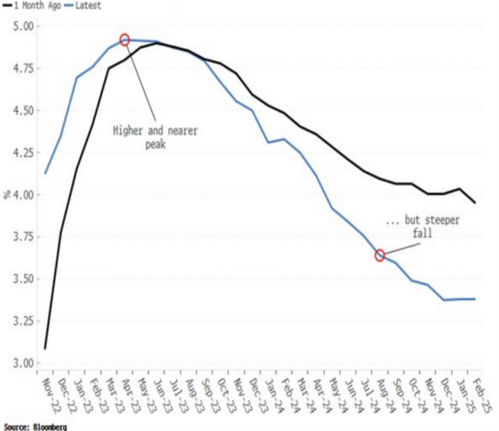

Economists, surveyed by Bloomberg, are perhaps underestimating how high the Fed will need to go to temper a consumer with so much firepower. Currently, the expectation is for the Fed Funds rate to peak at nearly 5%. After this week’s rate increase, we will be around the 4.25%-4.5% level. 3

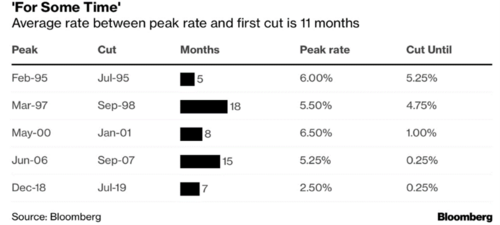

Those same economists also expect the Fed to cut rates much sooner than historic averages. Currently, a rate cut is expected sometime next summer. However, the average rate cut does not occur for about 11 months. 4

That 11 months is the average across various economic conditions, but none are similar to the sticky inflation we are currently facing.

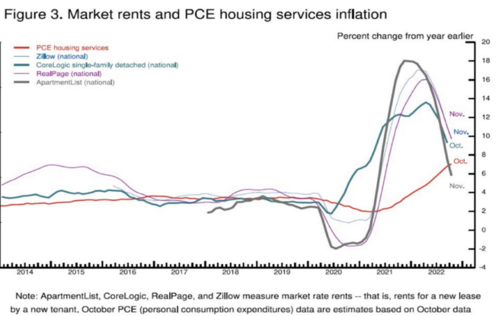

As the Fed creeps along that teeter-totter, they have some other headwinds and tailwinds to the inflation narrative. Rents, the largest component of the inflation index, are moderating. 5

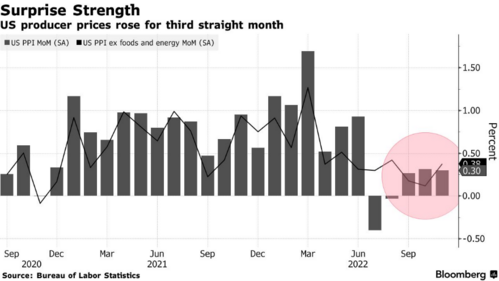

However, wages continue to hover at persistently high levels and producer prices paid for inputs spiked in November. 6

This makes for a very delicate interest rate walk.

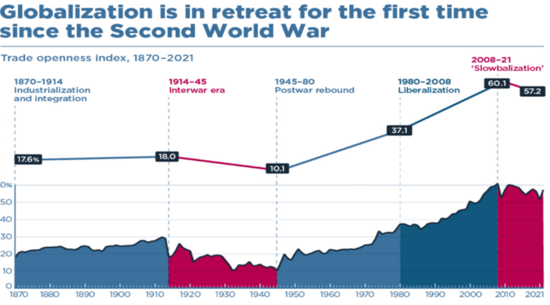

One very interesting trend that needs serious monitoring is the deglobalization trend, which construes creating more self-sufficiency outside of normal global trade. It’s far too early to tell how extensively “made in America” will penetrate our economy, however anything significant can create considerable inflationary pressures, pushing the Fed further than what’s clearly baked into interest rate expectations. 7

Let’s face facts, no one really knows how far the Fed will go on its quest to combat inflation because we don’t know the depths of the challenges on both supply and demand. The only thing we need to be guarded about as investors is the Fed’s creeping up the teeter-totter, hoping they don’t tip it over.

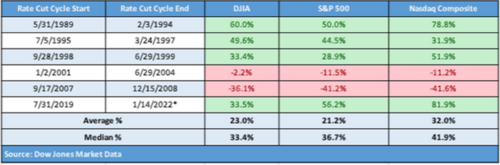

The good news is when the Fed begins to cut rates markets tend to have positive reactions. 8

Balancing on the teeter-totter comes with some challenges. In our view, for the Fed to succeed in this delicate walk they will need to keep rates a little higher than anticipated for a little longer than historic precedent suggests.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://fred.stlouisfed.org/graph/?g=XAN5

- https://dailyshotbrief.com/

- Bloomberg

- https://www.bloomberg.com/news/articles/2022-12-11/fed-message-that-rates-will-spend-some-time-on-hold-clashes-with-rate-cut-bets

- https://www.cato.org/blog/why-fed-further-inverting-yield-curve-4

- https://www.bloomberg.com/news/articles/2022-12-09/us-producer-prices-increased-by-more-than-forecast-in-november

- https://www.piie.com/research/piie-charts/globalization-retreat-first-time-second-world-war

- https://www.marketwatch.com/story/get-ready-for-the-climb-heres-what-history-says-about-stock-market-returns-during-fed-rate-hike-cycles-11642248640