The Threat of Stagflation

Global supply chain challenges combined with a constrained labor supply have many worrying about stagflation – the combination of economic stagnation and inflation. People are fearing that we’re headed into this type of economy where inflation is rampant yet, the economy is not growing.

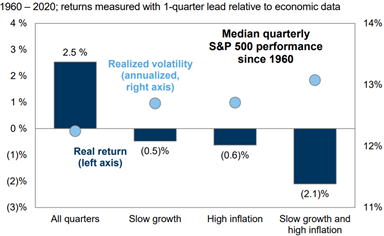

The weak historical performance of equities in stagflationary environments helps explain why some investors are concerned. Per Goldman Sachs, during the last 60 years the S&P 500 has delivered a median total return of +2.5% per quarter but, that quarterly return fell to -2.1% in stagflationary environments—worse than the median returns in environments characterized solely by weak economic growth or high inflation. [i]

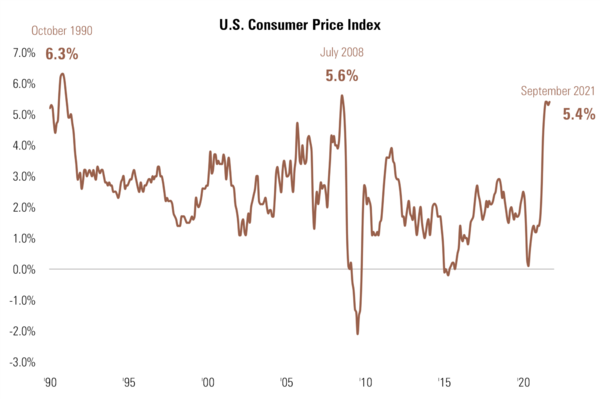

From the inflation side, it is also easy to see why there are concerns. The Consumer Price Index rose 5.4% year-over-year in September, putting it on track to grow at its fastest pace since 2008. [ii]

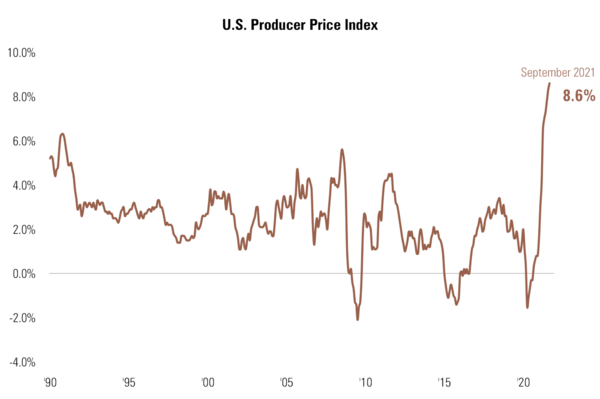

Input costs have increased due to supply chain shortages and delays which has pushed the Producer Price Index up 8.6% year-over-year in September. [iii]

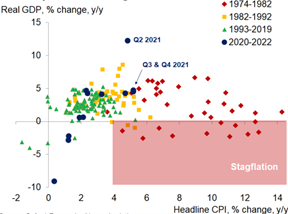

But what is missing in the discussion on stagflation is the “stag” part, i.e., stagnation. In the last bout of stagflation in the 1970s, CPI inflation averaged 11% but, real GDP contracted 3.1%. Today, CPI inflation is running at 5.4% but, real GDP is expanding at about a 4% clip. [iv]

In our view, the current inflation environment could be better described as a moderating expansion with lingering supply-side inflation, in turn creating a tricky inflation environment.

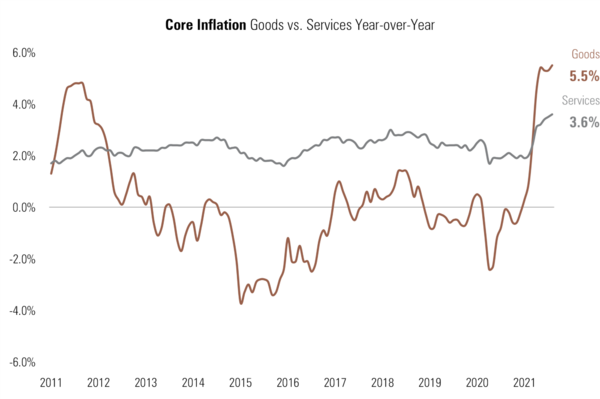

As COVID initially weighed on the economy, the mandated social distancing measures and high fiscal transfers to households supported a surge in Goods spending. With supply chains struggling to keep up, inventories were being depleted and prices for goods rose. As the economy re-opened, there was more demand for services which also bumped up against tight supply conditions, leading to higher Services inflation. [v]

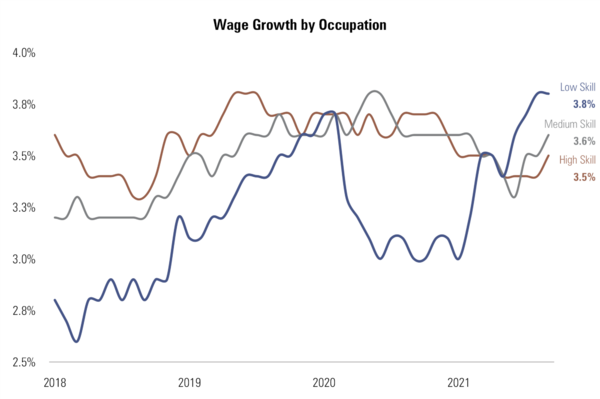

Another risk for the inflation outlook stems from the potential of a self-reinforcing feedback loop between wage growth and consumer price inflation. As we’ve discussed previously, there is ample evidence of strong wage increases at the lower-end of the income spectrum, and small businesses are reporting record wage increases as well as record-high wage expectations. [vi]

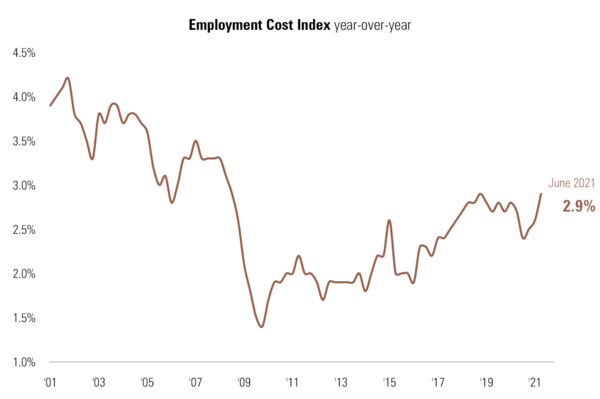

In addition, wage barometers adjusted for compositional shifts in the labor force – like the Employment Cost Index – don’t point to spiraling wage inflation. [vii]

With productivity growth increasing since the pandemic began, unit labor cost growth has fallen to 0.2% year-over-year versus growth of 1.7% from 2015 to 2019. So, businesses should be able to manage higher labor costs without too much pressure on margins and thus the need to pass on higher costs could be low.

In the debate between transitory and runaway inflation, we have said that while we view inflation as largely transitory, the truth lies somewhere in the middle with inflation likely to be sticky but, not oppressive to overall economic growth.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://research.gs.com/

ii. https://www.bls.gov/cpi/

iii. https://www.bls.gov/news.release/pdf/ppi.pdf

iv. https://www.oxfordeconomics.com/

v. https://www.bea.gov/data/personal-consumption-expenditures-price-index

vi. https://www.atlantafed.org/chcs/wage-growth-tracker

vii. https://www.bls.gov/news.release/eci.toc.htm