The Time Has Come

We’ve had an eventful few weeks of economic data that has led to a significant shift in interest rate policy, with the Federal Reserve Chair announcing a decisive move to lower rates.

Here is a summary of what he said in his recent speech. 1

- On Interest Rates: “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data.”

- On Economic Weakness: While inflation has moderated, the economy faces significant headwinds that could affect growth and employment.

- On Consumer Spending: Consumer resilience has been notable, but cracks are appearing, especially in discretionary spending areas.

- On the Labor Market: Labor market conditions are still tight, but signs of easing are beginning to emerge, which could alleviate some inflationary pressures.

- On Future Outlook: “Our policy stance will remain flexible and responsive to changes in economic conditions, ensuring we balance risks to both inflation and employment.”

Although the exact timing and pace of rate cuts weren’t specified, Wall Street analysts anticipate they will begin in September. In fact, market expectations are for a full 1% of rate cuts between September and the end of the year. 2

In my opinion, rate cuts can’t come soon enough. The economy is weakening, and the job market is not as good as the headlines suggest.

Let’s follow this simple line of thinking: 3

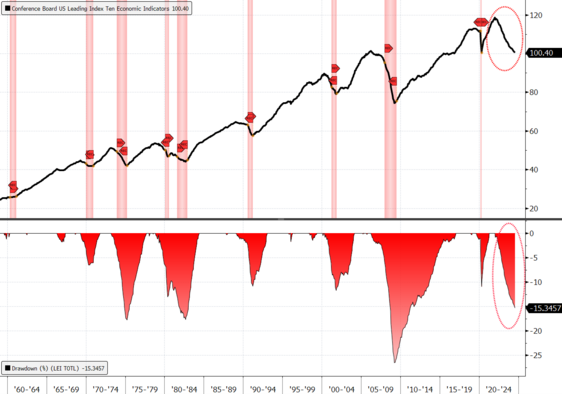

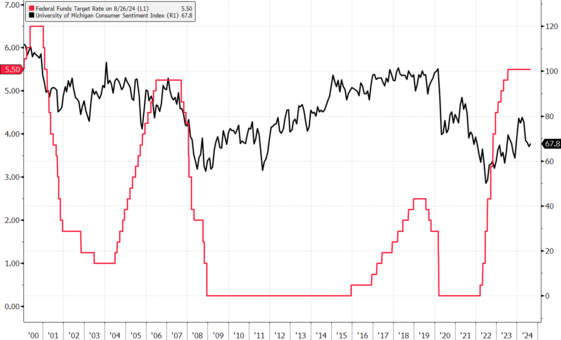

Consumer sentiment has been declining and the rate of change in the Conference Board’s sentiment survey is at an extreme. 4

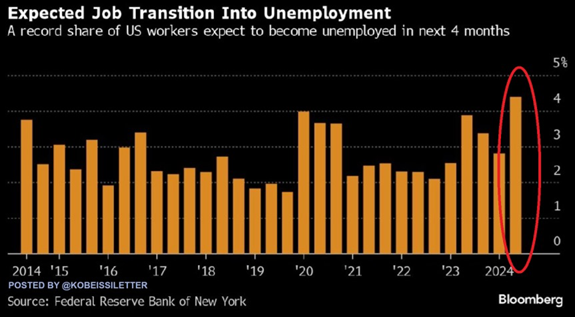

That drop in sentiment has spilled over into the labor market, with a whopping 4% of U.S. workers expecting to be unemployed in the next four months. While 4% might not seem like a lot compared to our current unemployment rate of 4.3%, it’s the highest reading in 10 years. 5

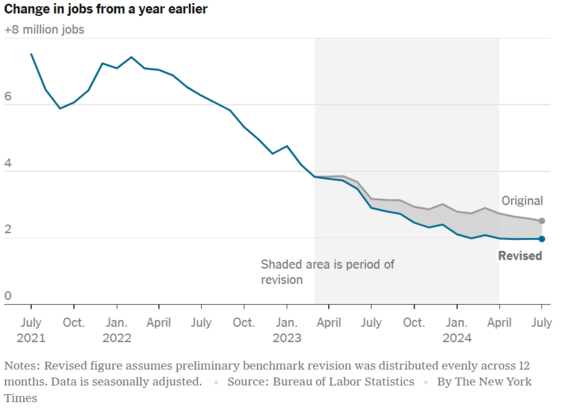

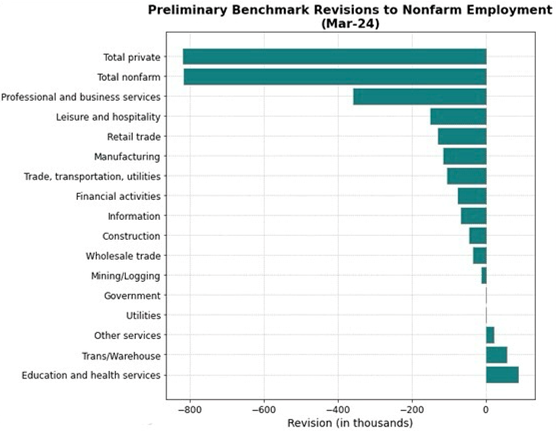

A recent look back on past employment survey data showed a significant error in the calculation of the actual jobs picture. The revision was dramatic and pronounced. We had 800k fewer jobs in the last year than initially reported. 6

Unsurprisingly, the big business of government and health care were the segments that didn’t have any negative revisions. Anything private sector was much weaker than initially reported. 7

It’s not just the survey data that reflects a softening in the consumer and labor market; CEO’s of the top consumer companies are also feeling the pinch:

- Walmart (Doug McMillon, CEO): “Customers are putting fewer items in their baskets but shopping more frequently,” highlighting the difficulty in selling big-ticket items like electronics due to economic pressure.

- Amazon (Andy Jassy, CEO): “Inflation has been slowing, but prices for basics like food and lodging are still high, forcing consumers to prioritize and make trade-off spending decisions,” which indicates a shift in consumer priorities away from discretionary items.

- Home Depot (Richard McPhail, CFO): “Customers are still putting off bigger projects – especially the large-scale jobs that may require a loan – because of higher borrowing costs,” reflecting a slowdown in consumer spending on home improvement projects.

- Airbnb (Brian Chesky, CEO): “We are seeing shorter booking lead times globally and some signs of slowing demand from U.S. guests.”

- Marriott International (Tony Capuano, CEO): Capuano remarked that while overall demand has remained stable, there is “softening in leisure travel, particularly in certain U.S. markets,” which has led the company to adjust its forecasts for the remainder of the year.

So now we need to wait out a softening consumer while rates are being cut. There is some correlation to better consumer sentiment with lower interest rates, albeit with a lag of perhaps six months. 4

The time has come to protect the consumer and directly support corporate earnings. The key question now is how long it will take for consumers to regain the confidence to go out and spend again.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.federalreserve.gov/newsevents/speech/powell20240823a.htm

- https://x.com/LanceRoberts/status/1826922313079504915

- https://fastercapital.com/content/Consumer-Spending--Real-Interest-Rates-and-Consumer-Behavior-Patterns.html

- Bloomberg

- https://www.bloomberg.com/news/articles/2024-08-19/expectation-of-losing-one-s-job-at-record-high-in-ny-fed-survey

- https://www.nytimes.com/2024/08/21/business/economy/us-jobs-economy.html

- https://www.bls.gov/web/empsit/cesprelbmk.htm

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.