The Trick Is Not Minding

The economy is definitely slowing. Last week’s blog reviewed the weakness in the labor market. Recent data suggests some consumer weakness is gathering steam.

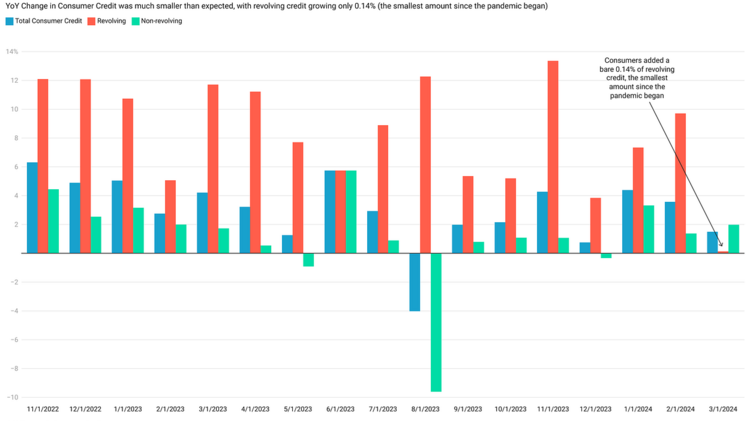

Consumer credit expanded well below expectations in March and revolving credit (credit card debt) expanded at the slowest pace since the pandemic. 1

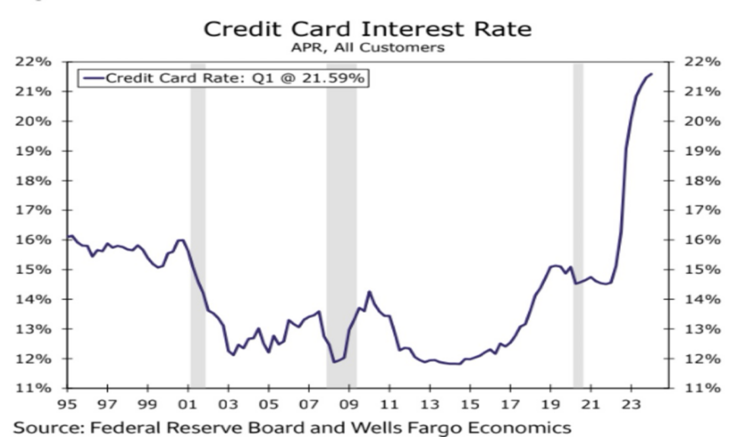

I am convinced this is no coincidence. We know credit card interest rates are near all-time highs and that will certainly keep folks from purchasing. 2

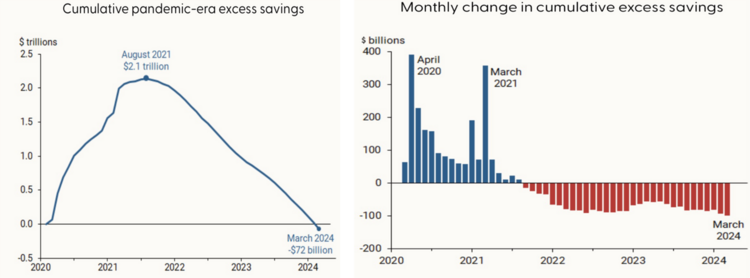

As consumers face record-high credit card interest rates, they have also run out of extra pandemic savings. The Federal Reserve Bank of San Francisco says that pandemic-related savings just dropped below the "zero line". It took since mid-2021 to use up all the fiscal stimulus and we finally crossed zero. 1

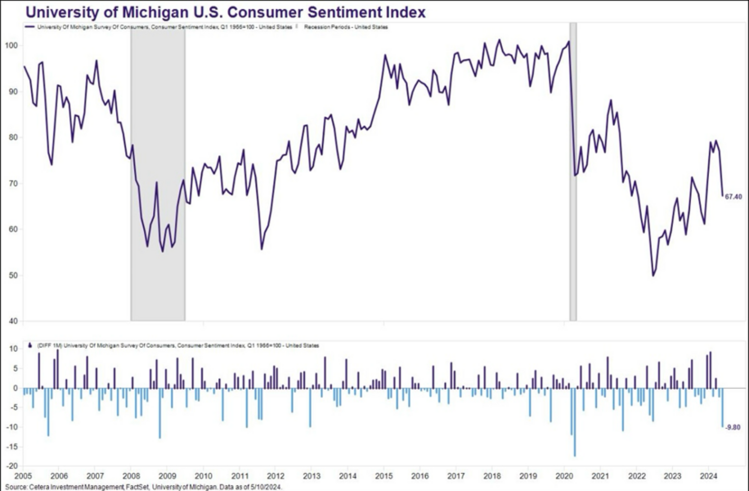

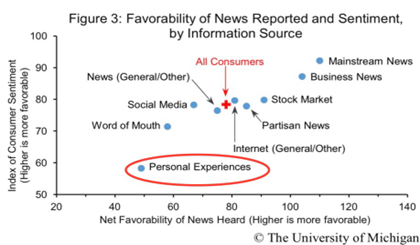

As one might expect, the same consumer is not feeling very optimistic about what the future holds. The University of Michigan Consumer Sentiment Index fell sharply in March. 3

When you actually look at what drives the survey results, personal experience with the economy is the biggest driver of the consumer’s negative sentiment – it’s not what they are reading but what they are experiencing. 3

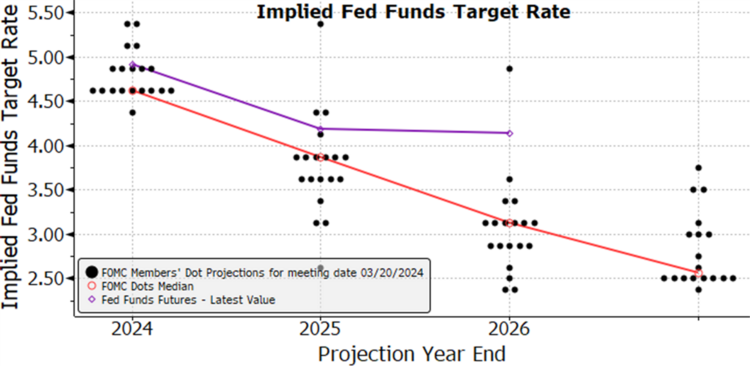

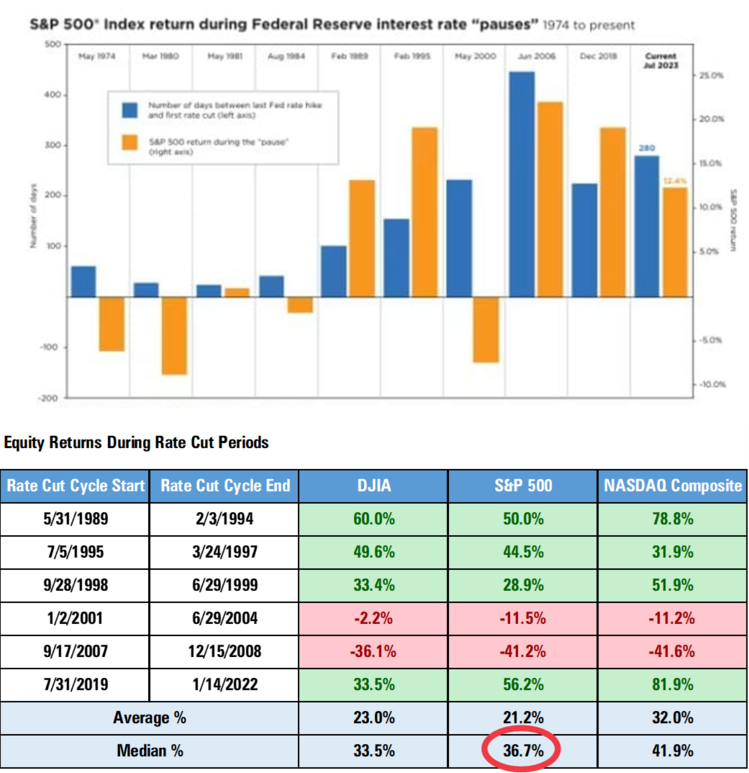

The Fed should cut rates and soon. That might be a very nice upside surprise to Wall Street. Current expectations for a rate cut this year are very low compared to where we started the year at. 4

So, what happens if the Fed botches this window of time and waits to cut until much later in the year?

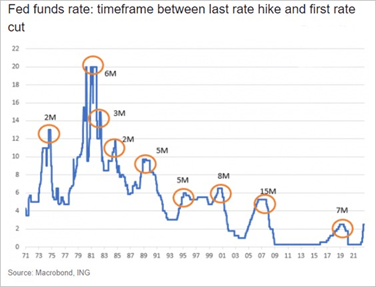

The consumer might tip over, unemployment rises, and the Fed then cuts quickly. After all, that's their historic pattern. You can see rate cuts happen in a pretty severe fashion. Not the smooth, systematic way the Fed or Wall Street are expecting. Based on the rapid rate cut pattern the Fed usually botches the soft-landing job. 4

Before you think about trying to time the markets consider two things:

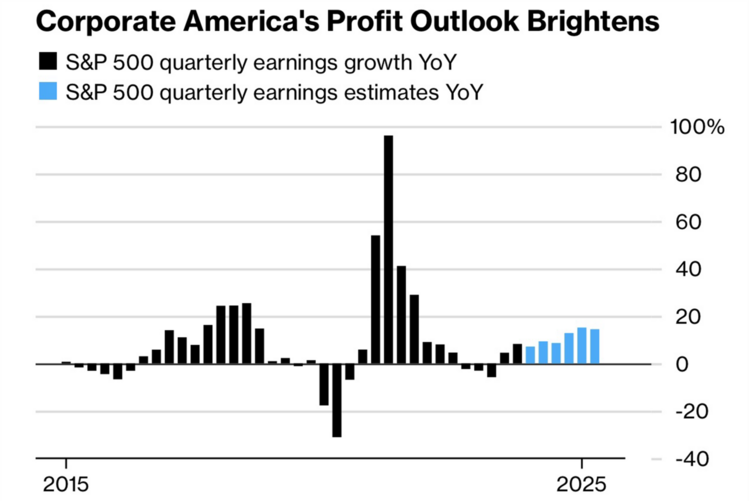

- One, earnings growth looks to be positive in the coming quarters 5

- Equities perform well during rate pauses in anticipation of rate cuts 1 4

The averages are in our favor, yet you have to put them in your favor.

How do you achieve that? You have to accept that equity investing can be painful. You have to tolerate the discomfort. It’s a valuable lesson that we all recognize in our personal lives. Things that produce great results usually require work, sacrifice, risk, uncertainty, and pain.

“The Trick Is Not Minding It Hurts” - Lawrence of Arabia. See our video with world-famous author Morgan Housel here.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: