The Trump Economy’s Tightrope: Booming Tech, Limping Labor

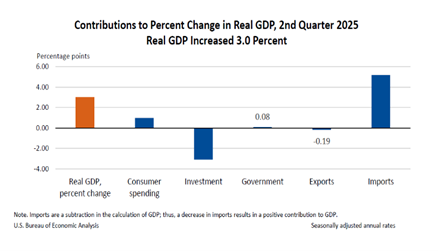

As expected, last week’s data dump told us a great deal about the Trump economy. On the one hand, the U.S. economy grew at a solid 3% pace in Q2. Most of that growth was driven by a significant adjustment to trade, which added considerable momentum. Notably, the consumer’s contribution was smaller.

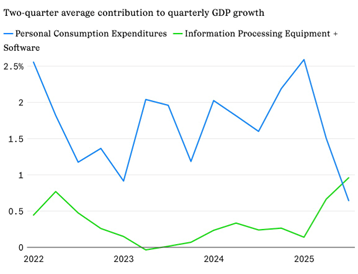

While overall planned investment was negative, the subset of information processing equipment and software has become a larger contributor than personal consumption on a two-quarter average.

While overall planned investment was negative, the subset of information processing equipment and software has become a larger contributor than personal consumption on a two-quarter average.

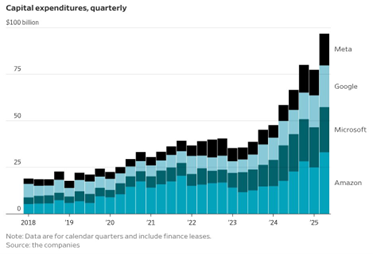

It’s not hard to deduce that the explosive growth in AI spending by the major tech companies is the reason.

It’s not hard to deduce that the explosive growth in AI spending by the major tech companies is the reason.

The combined Q2 2025 capital expenditures of Amazon, Microsoft, Google, and Meta—about $95 billion—amount to roughly 1.36% of quarterly nominal U.S. GDP. I don’t expect this level of spending to be sustainable, but it’s a nice cushion as the consumer appears to be softening.

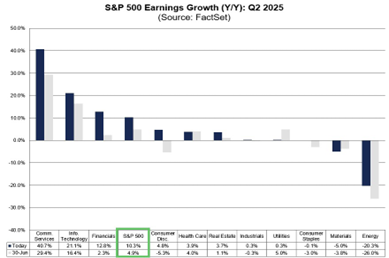

Earnings growth was another strong signal for the Trump economy. Q2 earnings per share growth is far exceeding expectations, with 66% of companies having reported so far. According to FactSet, companies are significantly surpassing the 4.9% growth estimate, coming in at an average of 10.3%.

If you refer back to our Q3 2025 Look Ahead (link here), you’ll see that this upside surprise was something we anticipated as a driver of the early Q3 equity rally.

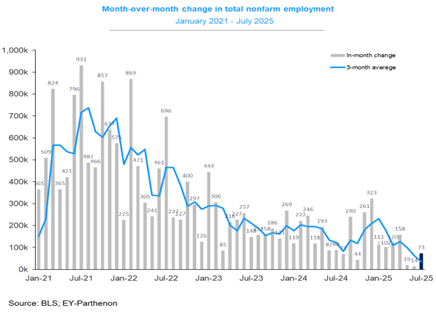

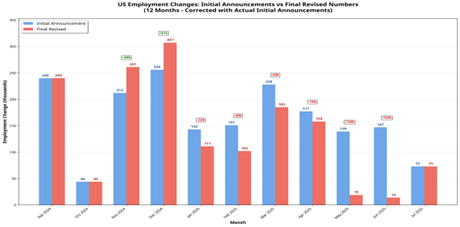

That’s the good news. The bad news? The economy only added 73,000 jobs in July—and even worse are the revisions for May and June.

These revisions are driven by the fact that the government’s initial job surveys are incomplete; once more responses come in, the numbers are adjusted. For May and June, those revisions reveal an economy on the edge. Job growth was revised down to just 19,000 in May and 14,000 in June—numbers that demand serious attention.

These revisions are driven by the fact that the government’s initial job surveys are incomplete; once more responses come in, the numbers are adjusted. For May and June, those revisions reveal an economy on the edge. Job growth was revised down to just 19,000 in May and 14,000 in June—numbers that demand serious attention.

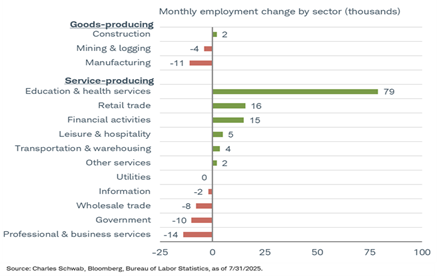

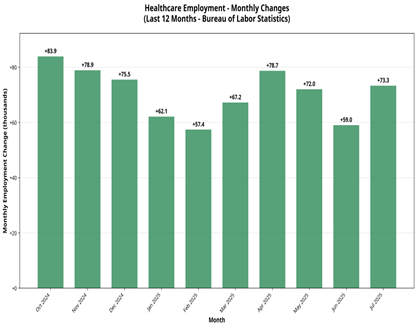

When you look at what sector is still adding jobs, it appears the U.S. economy is almost entirely dependent on one: health care. In July, health services alone added 79,000 jobs—and this trend extends back several months.

Would the U.S. economy be stuck in stall speed without health care spending and employment?

Let’s not find out. The Fed should reconvene and cut interest rates now. Why should the U.S. consumer and worker suffer from a prearranged calendar that delays consideration of rate cuts until September?

The Trump economy is on a bit of a tightrope.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.