The Uneasy Expansion: Inside the Anxiety Economy

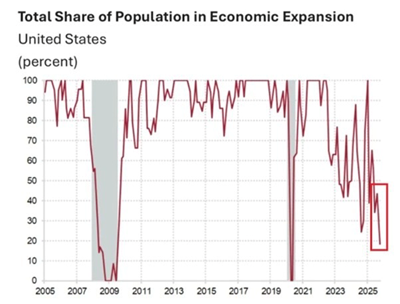

You can feel it in the data — the economy isn’t evenly expanding.

The latest Federal Reserve regional surveys show that only about 20% of the U.S. population lives in areas considered “in expansion.”

That’s near the lowest level outside a recession.

Most of America, economically speaking, is just holding on.

Is this a Patchwork Economy at a tipping point? The chart above might suggest that most of America is collapsing but in reality, we are more neutral than negative.

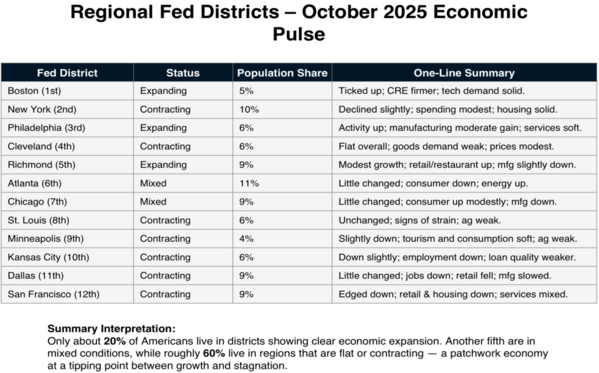

The Federal Reserve’s October 2025 Beige Book paints a picture of divergence. Only three districts — Boston, Philadelphia, and Richmond — are clearly expanding. The rest are stagnating or contracting, and notably, population-heavy regions like New York, Dallas, and San Francisco are among the weakest.

Only 20% of Americans live in expanding regions, another 20% in “mixed” conditions, and roughly 60% in flat or contracting areas.

The economy, in other words, is bending — not yet breaking — but it’s leaning on fewer pillars than headline numbers suggest.

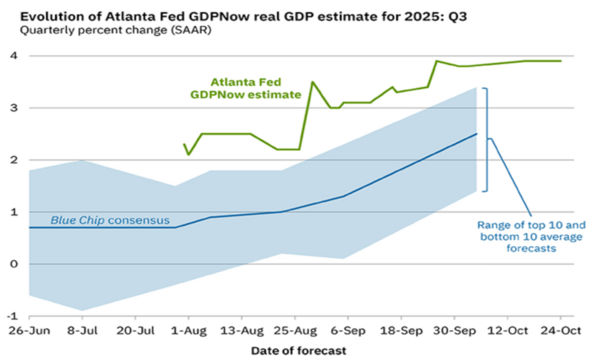

Yet the national numbers look fine — for now.

On the surface, growth still looks healthy. The Atlanta Fed’s GDPNow model estimates nearly 4% real GDP growth for the third quarter — well above consensus forecasts.

That’s the headline everyone sees. But peel back the layers and you find something very different: a narrow expansion driven by regions and sectors most tied to equity markets and capital spending, not broad consumer demand.

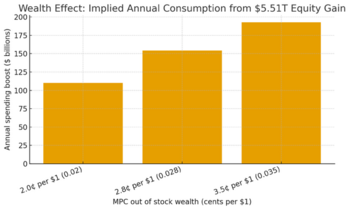

Think of it as an economy being carried — not lifted — by a few heavy lifters where wealth becomes the primary engine. The stock market’s $5.5 trillion gain this year isn’t just a number — it’s a tailwind for spending.

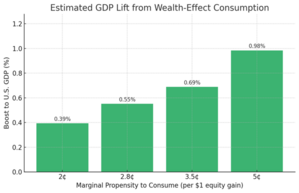

Economists call it the wealth effect: for every $1 increase in equity wealth, households tend to spend between 2¢ and 5¢. At the high end, that translates to nearly a 1% GDP boost from equity-driven consumption — a meaningful offset to sluggish regional activity.

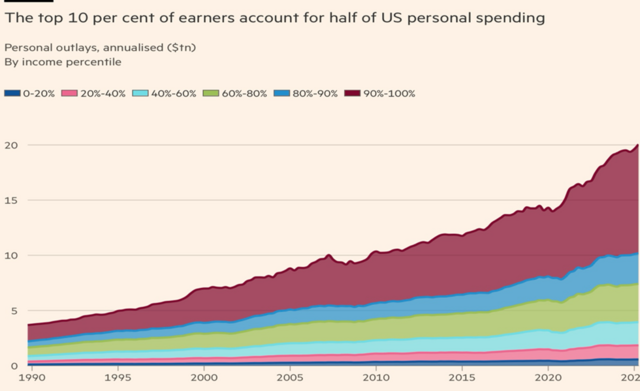

So, who’s doing the spending? Half of all U.S. consumption now comes from the top 10% of earners. They are also the ones who own most of the equities.

When markets rise, consumption rises — but mainly for those already invested. This isn’t moral commentary; it’s economic math.

Ownership — of assets, not just income — has become the dividing line between those benefiting from growth and those experiencing the slowdown. For a consumption driven economy the wealth effect can carry the economic day.

This leads us to ask if the wealth effect is on the precipice of turning? Despite the uneven economic backdrop, valuations remain anchored by earnings growth.

The S&P 500 PEG ratio (the price to earning growth) sits near 1.3× — suggesting that markets aren’t pricing in euphoria, they’re pricing in resilience. Corporate profits continue to justify valuations, especially as companies wring more productivity out of tighter labor and capital conditions.

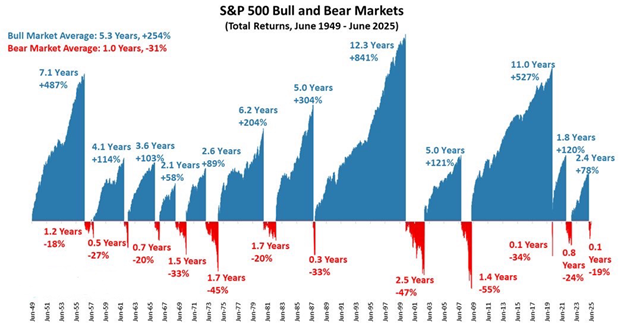

I’ve been doing a lot of valuation rationalization of late which can be risky, as I am not a firm believer in forecasts. I do believe history still favors the patient.

Since 1949, the average bull market has lasted 5.3 years and delivered +254% returns, while bear markets have averaged 1 year and –31% declines. The long-term advantage goes not to the traders but to the investors who can resist regret aversion — that gut impulse to sell after losses or sit out after rallies.

Here’s a story worth remembering: During Peter Lynch’s run at Fidelity Magellan in the 1980s, the fund returned nearly 29% a year. The average investor, however, earned far less — because they jumped in after gains and bolted after dips. They let regret, not reason, set the rules. The market rewards the patient, not the perfect.

The U.S. economy is still growing, but where it’s growing matters. With only one-fifth of the population in expanding regions, this recovery is narrow, not broad. Yet thanks to rising equity wealth and resilient earnings, growth continues to push forward.

It’s a bifurcated economy, but not a broken one. And as history shows, even uneven expansions can fuel long bull markets for those who stay invested. Because the lesson remains simple: The market doesn’t reward anxiety. It rewards ownership.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.