The World Didn't Come to an End!

In recent weeks we have seen some extraordinary data published by the federal government. It seems like our budget deficit (the amount of money the government has to borrow to meet its spending) has been shrinking at an astonishing pace.

Contrary to what economists predicted as doom if the US Government cut deficit spending, the US economy has grown. In fact, if a politician ran on the platform of higher taxes, lower spending and more growth, that would be the accurate outcome. Of course, that wouldn't be a winning message for the American voter.

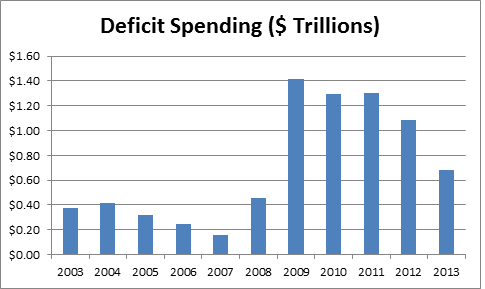

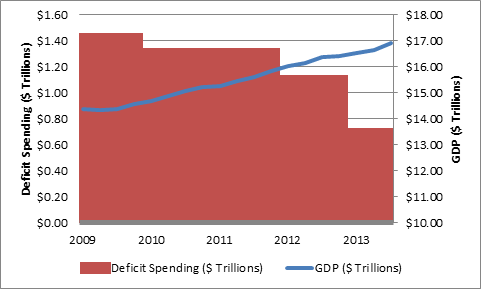

Take a look at the massive buildup and then reduction in deficit spending. [i]

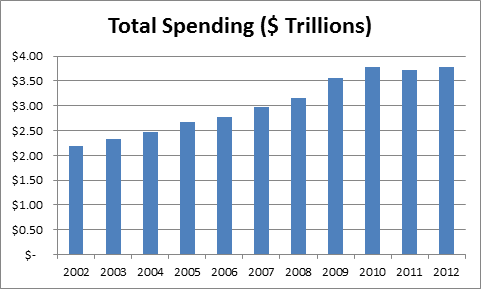

Now take a look at a chart on total federal spending. [ii]

You can see from these two charts we increased our total spending by 19.79% and increased our deficit spending by a colossal 779.1% from 2007 to 2009 in order to accommodate the financial crisis and reduction in consumer spending.

One of the biggest concerns by many of the economic elites was any reduction in deficit spending would lead to a contraction in GDP. They come by this fear honestly. Keynes one of the foremost thinkers on fiscal policy preached this lesson from the 1920's in his book The General Theory of Employment, Interest, and Money.

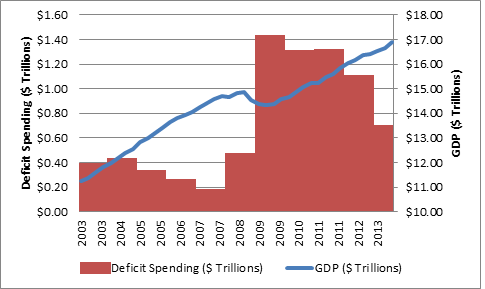

In our current case, there is no doubt deficit spending (Keynes) was right to some extent. [iii]

However, what's telling about our current expansion is much of it is happening with declining federal deficits. Realize for every 169 billion dollar cut to federal spending, we technically lose 1% of GDP growth.

But, look at the same chart when focused in on the years since the financial crisis. You can see that GDP was growing, despite a drop in deficit spending.

Even more astonishing is we have had higher taxes at the same period of time.

- Expiration of the Bush tax cuts, causing the top tax bracket to rise from 35% to 39.6%

- 3.8% surtax on investment income and long-term capital gains for taxpayers with income above $250,000

- Increase in the estate tax from 35% to 40%

- 2.3% excise tax on medical device manufacturers and importers

Investors could become hopeful the nasty fiscal debates of the past are just that: in the past. Is it possible our economy is becoming less dependent on deficit spending? Will the upcoming debt ceiling debate be a non-event?

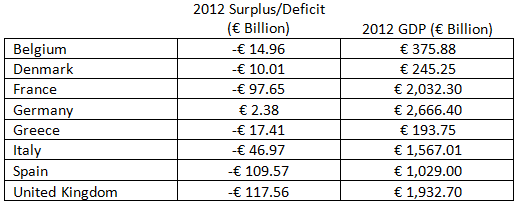

Could Europe be next to grow despite less deficit spending? [iv]

It's certainly possible and all of this would be positive for investors.

The world did not collapse when facing less federal deficits and higher taxes. While no collapse occurred, certainly we have not seen stellar growth either and I expect Q1 2014 to be a bit more challenging for economic growth.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] “Federal Surplus or Deficit [-] (FYFSD)”, Federal Reserve Economic Data

[ii] “Federal Government: Current Expenditures (FGEXPND)”, Federal Reserve Economic Data

[iii] “Federal Surplus or Deficit [-] (FYFSD)”, “Gross Domestic Product (GDP)”, Federal Reserve Economic Data

[iv] “General government deficit/surplus”, “GDP and main components – current prices”, Eurostat