There Is No Free Lunch: Correlations Abound

There Is No Free Lunch: Correlations Abound

Weekly Market Commentary 6-10-13

Tim Phillips, CEO—Phillips & Company

Since the beginning of the year, the S&P 500 is up 16.2%, the Dow up 17.7% and the NASDAQ up 15.6%.[i]

Over the last several weeks, Wall Street has been having a capital debate with your wealth. On one side, there were those that feared the end of Federal Reserve’s bond buying and intervention in our capital markets. That side was selling. On the other side, there were those that felt the economy was too weak for the Fed to withdraw their stimulative efforts, and hence they were buying.

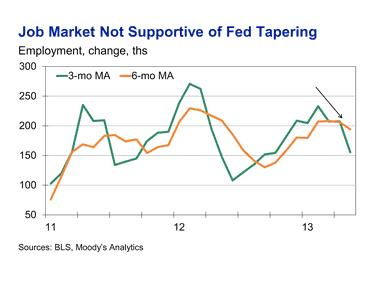

With Friday's jobs report, the latter side won. Last month, the economy added 175,000 jobs, but it’s important to note that 26,000 of those jobs were temporary help jobs. While it is good that those 26,000 people are now working, it is clearly a sign that employers do not have enough confidence yet to offer non-temporary positions.[ii]

On average, the US economy has added about 155,000 jobs per month for the last 3 months. This is about the average when the Fed began their buying programs. The economy needed help then as it does now.[iii]

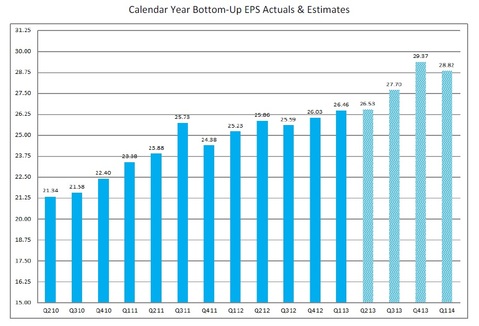

What is worse is that corporate earnings growth is expected to be down substantially. Growth in Q2 2013 earnings over Q2 2012 is expected to be 2.59%, compared to 8.29% growth from Q2 2012 over Q2 2011—almost two-thirds less. Also, at the end of March, analysts expected 4.5% earnings growth from Q1 to Q2 2013 on S&P 500 companies—but now, that estimate has been revised down to 1.3%.[iv]

Source: FactSet Earnings Insight—June 7, 2013

Finally you can see continued weakness in commodity prices. These tend to be predictive of future growth; if commodities are strong, it could be a sign that businesses and manufacturing are expanding, and hence need more raw materials like aluminum, copper, and so forth. The reverse is also true if the economy is shrinking. You can see from the chart below that commodity prices have been pulling back:

Source: Bloomberg LP

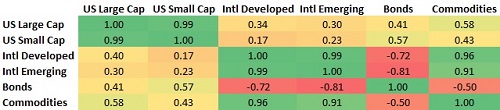

So, it seems bad news in our economy is good news for the market. On Friday, when we received the modest news about jobs, the markets rallied over 200 points. Bad news in the economy keeps the Fed pushing their agenda, and our capital markets moved up. Before the jobs report, we saw many asset classes correlate: stocks, bonds, commodities—and this isn’t normal. Usually, US stocks and bonds have a negative correlation, meaning they move in opposite directions, but you can see below that last week (excluding Friday with the report), stocks and bond actually showed positive correlations:

Source: Bloomberg LP

I normally suggest the only free lunch in the long run is diversification. Unfortunately, without our friends at the Fed, it seems like that free lunch is being challenged. Remember, under extreme events, everything correlates, similar to what we experienced over the last few weeks.

Stay focused for the long run. My expectation is for significant volatility in the short run, challenging most portfolios and investors.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] Bloomberg LP

[ii] “Employment Situation Summary” US Bureau of Labor Statistics, June 7, 2013

[iii] “May Employment: Not Too Hot, Not Too Cold”, Moody’s Analytics, June 7, 2013

[iv] “FactSet Earnings Insight”, June 7, 2013