They Are Growing Angry Yet, They Shop

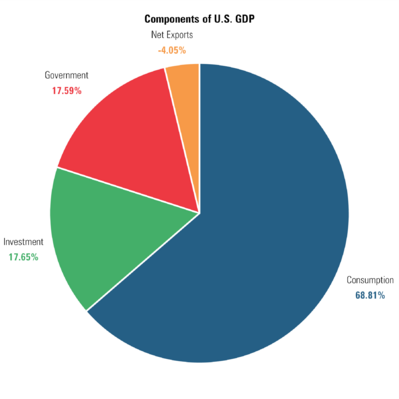

One of my key performance indicators for corporate earnings and U.S. GDP growth is the consumer. However, you do the math: without U.S. consumer spending, we would fast approach a growth cliff. Consumption is about 70% of the U.S. economy. Only on the margins can the government or fixed investment make up some ground when the consumer slips…but, only on the margin. [1]

To that end, there is visible and growing discontent with the American consumer these days. Survey after survey show various levels of dissatisfaction.

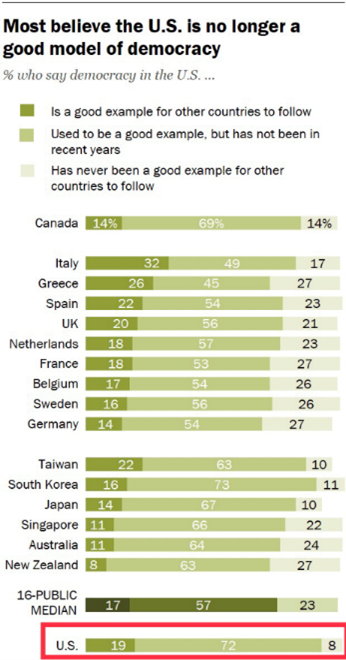

First, at a very high level, from Pew Research, 72% of Americans believe American Democracy use to be a good model but, has not been in recent years. [2]

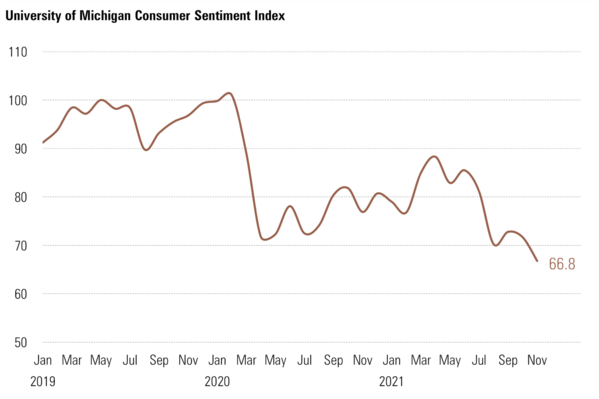

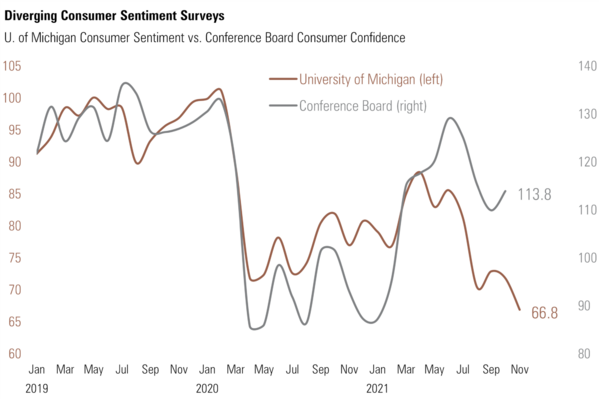

Next, consumer confidence as reported by the University of Michigan Survey on Consumer Confidence took a precipitous dip last month. [3]

Further, in that same survey, and according to Moody’s Analytics, “About 58% of respondents expect the country to have bad times within the next 12 months. It was as low as 41% as recently as July, and though it is still below the peak of about two-thirds in April 2020, it is as high as it was this spring.”

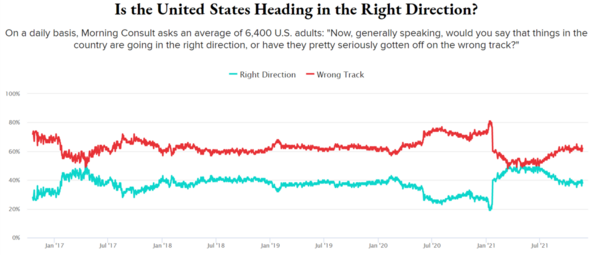

In an ongoing survey by Morning Consult, a leading business intelligence and survey research firm, respondents have recently turned sour on the direction of the United States. [4]

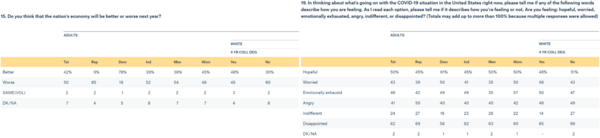

More telling is this recent survey by Quinnipiac that captures the mood of Americans: [5]

Those surveyed see an economy that will be worse a year from now with well over half describing the current COVID situation as disappointing, exhausting, and worrisome. None of this good for confidence.

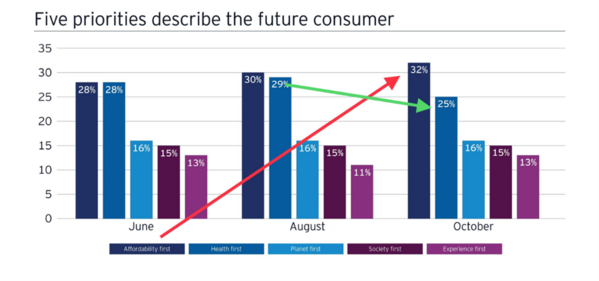

Again, a recent survey by leading accounting firm Ernst & Young suggests the consumer is growing more keenly focused on affordability (aka prices) with health matters becoming less of a concern. [6]

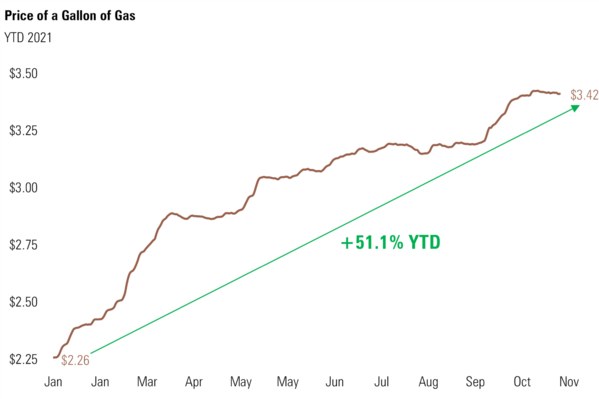

Speaking of prices, gasoline pricing has been on a tear as of late. [7]

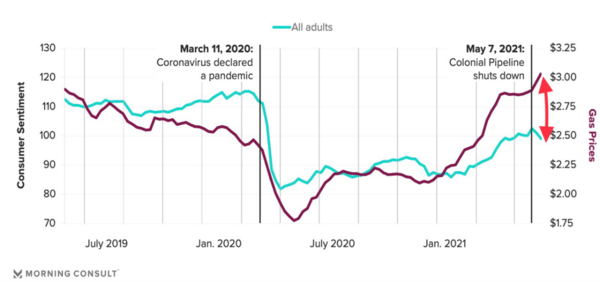

Another data point clearly connects higher prices to lower consumer confidence. While the pandemic created a temporary connection to lower confidence (purple) and lower prices (blue), that trend has normalized and higher gas prices will erode consumer confidence over time. [8]

Back to the main question, how is the consumer? Based upon these popular surveys, one might think the consumer is downright pessimistic, angry, and might conserve resources and pull back on spending.

Not So Fast!!!

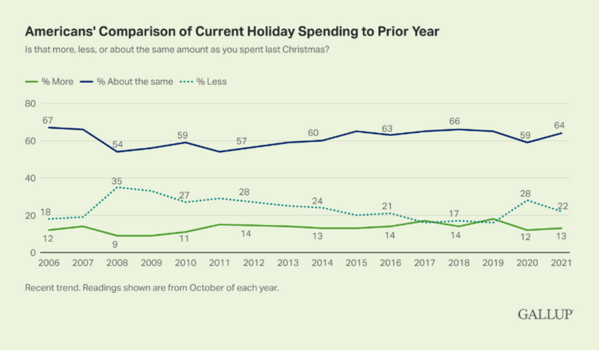

Gallup’s long running survey on Christmas shopping suggests the consumer continues to look past their pessimistic mood and plans to spend at levels similar to last year’s holiday season. [9]

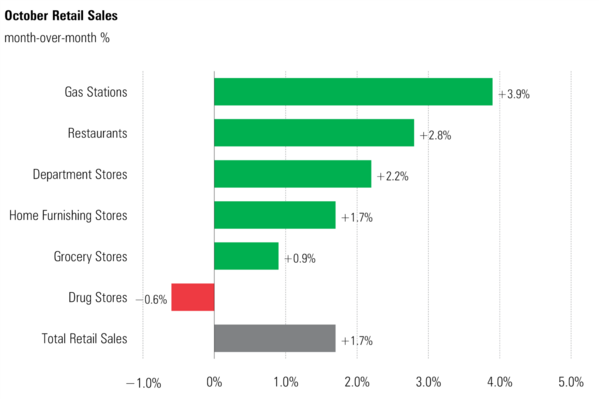

Current retail sales data, as reported on November 16th, suggests the consumer is still looking past their grumpiness and continues to shop. Retail sales were up 1.7% in October, with every sector except one reporting positive gains. [10]

Further, the Conference Board Consumer Confidence Index actually rose in October, contrary to the University of Michigan survey. [3] [11]

The difference is in the nuance but, perhaps the nuance is everything. The Conference Board weights much more to jobs while University of Michigan tilts toward inflation.

It would appear the consumer is putting much more weight on jobs vs. inflation when it comes to actual spending.

The simple formula I use to grasp the larger earnings picture is:

Despite the downbeat in some survey data, the consumer continues to shop and expects to do more in the coming months.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1. https://www.bea.gov/data/gdp/gross-domestic-product

2. https://www.pewresearch.org/

3. https://data.sca.isr.umich.edu/

4. https://morningconsult.com/news/

5. https://poll.qu.edu/poll-release?releaseid=3826

6. https://www.ey.com/en_us/consumer-products-retail/us-future-consumer-index-edition-5-an-online-holiday-sets-the-stage-for-retails-future

7. https://gasprices.aaa.com/todays-state-averages/

8. https://morningconsult.com/2021/06/02/consumer-confidence-gas-prices-data/

9. https://news.gallup.com/poll/356897/early-holiday-spending-plans-look-similar-2020.aspx

10. https://www.census.gov/retail/marts/www/marts_current.pdf

11. https://www.conference-board.org/us