Things Change, Especially Bottlenecks

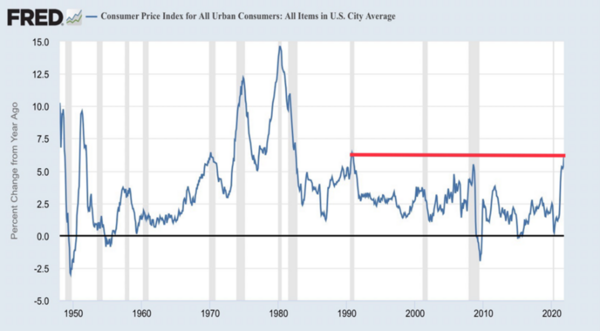

I have been getting a lot of curious reactions to my view that inflation is transitory as I’m sure the Federal Reserve is as well. After all, last week inflation was reported at a 30-year high of 6.2% on a year-over-year basis. [i]

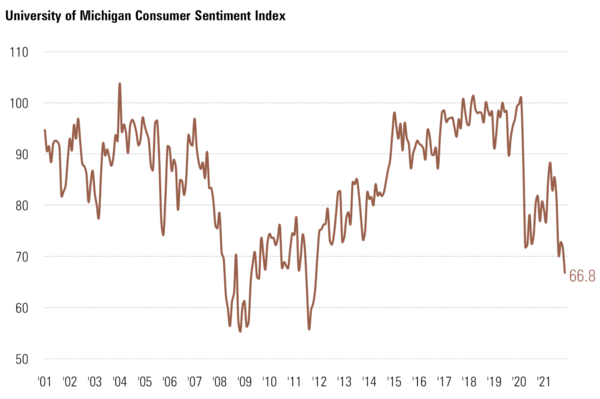

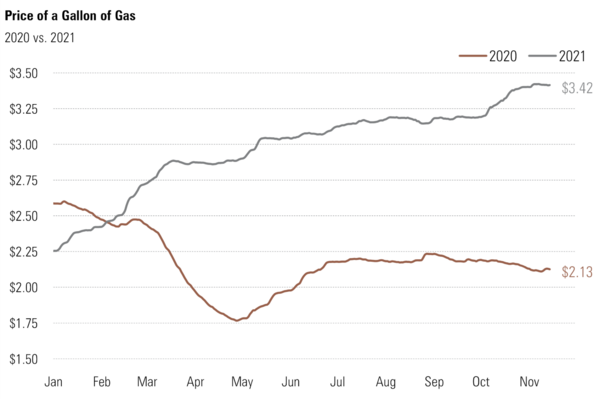

Inflation is such a significant concern; consumer confidence is starting to erode. The University of Michigan Consumer Sentiment Index dropped rapidly—likely due to high prices at the gas pump, turmoil in Washington DC, supply chain disruptions impacting consumer purchases, and ongoing Covid concerns. [ii]

Most people I talk to have capitulated on transitory inflation and can hardly hear past what they see on a daily basis. Inflation right now is real, present, and threatening, for sure.

Yet, if we look at just a few key facts, I think you might see why we believe inflation will be transitory.

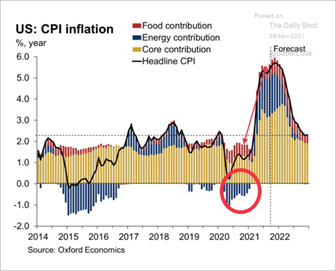

First, inflation is measured on a rate of change basis. Meaning, we generally measure inflation today by comparing it to the same month last year. A 6.2% increase in CPI in October 2021 is compared to October 2020. [iii]

It’s easy to see from the chart above there was little inflation during the pandemic. In fact, everything was inflating well below the Fed’s target rate of 2% and energy was actually deflating (blue bars). Roll forward to this year and it’s easy to see everything is inflating at very high rates of change coming off a low base from last year, especially energy. [iv]

A better way to look at post-pandemic inflation might be to compare the rate of change from 2019. Let’s get rid of the pandemic distortions and take a look. When you look at the inflation rate in October 2019 compared to October 2021 and average that over 2 years, inflation looks much tamer—at just 4%.

In any case, we have several more months to go before shedding the low-base effect.

Second, if you roll this logic forward to October 2022 inflation on a year-over-year comparison to October 2021’s reading of 6.1% might look downright tame. If relative prices adjust to existing levels and stay there, you might even get an inflation reading of 0%. While prices will have adjusted higher, they would reach an equilibrium that would give a much more muted reading on a rate of change basis – between 0-2%.

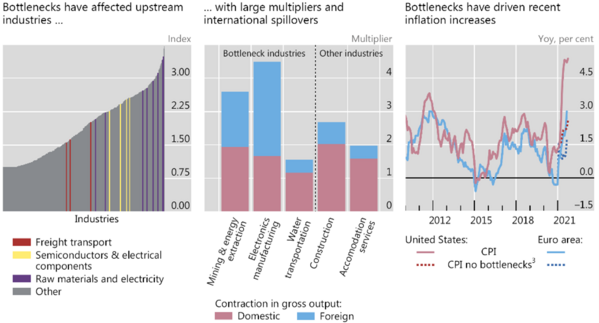

Third, bottlenecks continue to drive much of the current inflationary pressures. According to the Bank of International Settlements, electronics, energy, and commodities are impacted the most by bottlenecks in transportation. Without bottlenecks, CPI may be closer to 2.5%. [v]

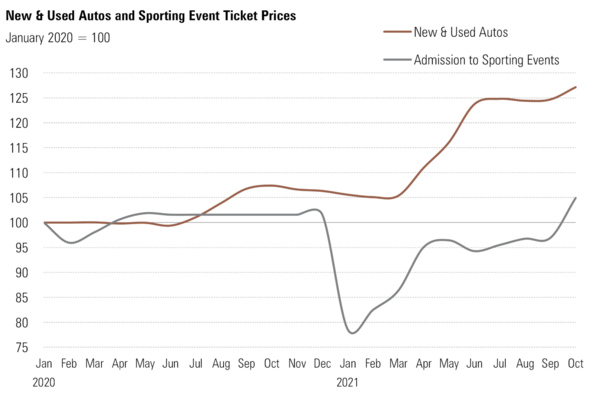

Breaking down current inflation readings also points to large inflation in New and Used Autos and admissions to sporting events. [i]

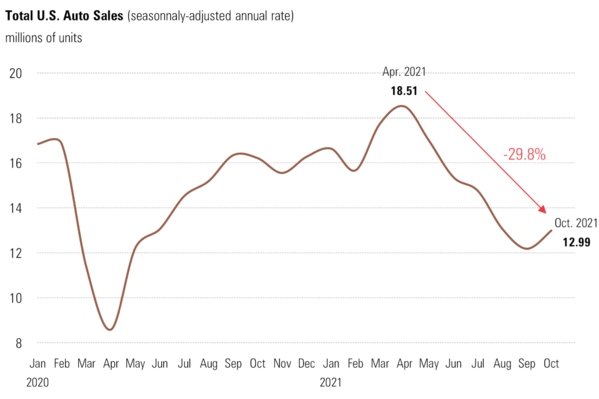

As a final point, rising prices drives down demand for elastic products like autos. While prices are much higher for cars, demand is softening. [vi]

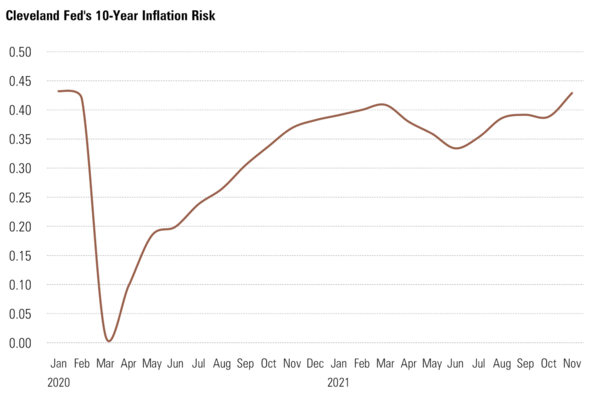

Further, eroding consumer confidence will drive down demand and perhaps normalize the supply/demand shifts sooner than the “hyperinflation” bears expect. In fact, the Cleveland Fed risk of recession index spiked lately. [vii]

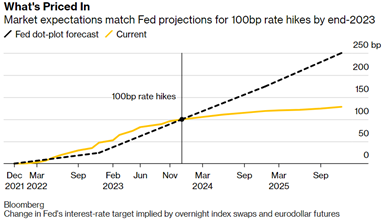

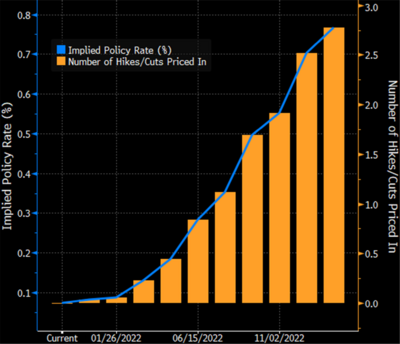

The threat that the Federal Reserve might make a policy mistake and raise rates sooner than market participants currently expect is real and being baked into the cake. [viii]

Current expectations are for three rate increases next year, commencing in June. [viii]

The Fed is walking a tight rope by allowing market forces to cool inflationary pressures or snap back the current recovery with unexpected rate increases.

Our protection from an unexpected bump in policy rates is forward guidance and the fact that both nominees for Fed Chair are of the view that inflation will be transitory suggests that we should not expect any immediate policy change to interest rates.

Things change, and that’s especially true for inflation.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bls.gov/cpi/

ii. https://data.sca.isr.umich.edu/

iii. https://dailyshotbrief.com/

iv. https://gasprices.aaa.com/todays-state-averages/

v. https://www.bis.org/publ/bisbull48.htm

vi. https://wardsintelligence.informa.com/datacenter

vii. https://www.clevelandfed.org/our-research/indicators-and-data/inflation-expectations/background-and-resources.aspx

viii. https://www.bloomberg.com/news/articles/2021-11-09/traders-are-betting-that-fed-rates-will-peak-shortly-after-2023