Things Should Be OK!

How to Cope with Shocking Events and Your Portfolio.

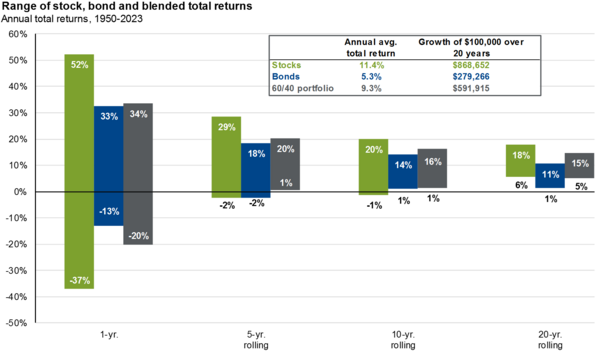

I have often called Presidential election years the ‘Silly Season.’ All the posturing, political speech, and empty promises make for a cynical consumer. However, things got serious this season. The attempt on former President Trump’s life that also cost an innocent American his life is serious and shocking. It’s hard to evaluate the impact and consequences of such a graphic event. In nearly 40 years of professional investing, I’ve developed a feel for the extraordinary. That is a long way of saying I have adopted some basic coping skills. First, I always remind myself that time shapes risk. If you can hold a quality asset, like stocks, long enough the risk is greatly mitigated. 1

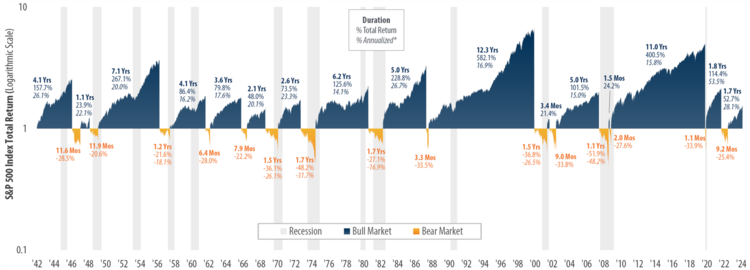

I am in no way making light of or simplifying a grave situation. In some respects, when I see such shocking events, I need to ground myself in history and my experience. I like to reflect on charts like this one. 2

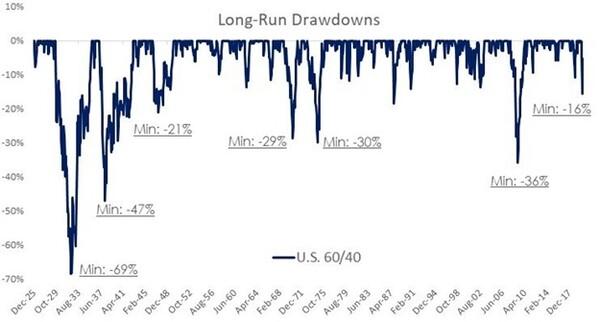

I ask myself if I can withstand a portfolio drawdown over a 1.5 to 3-year period of time? Will I be able to support my family and business? Since I utilize fixed income, I also think about the types of max drawdowns I could experience in a blended portfolio. 3

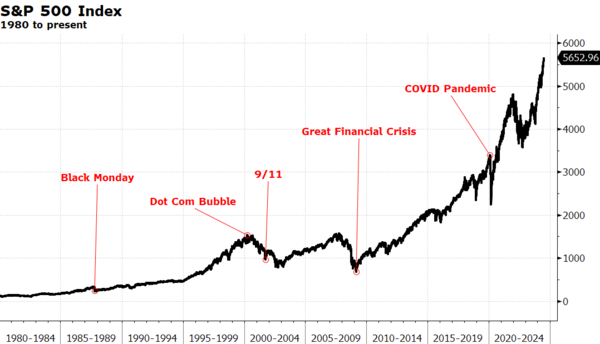

What I try and do is ground myself back to the long history of unpredictable events that have transpired in America and even over my investing career. When I was very young in the business, I thought Black Monday was the worst thing I would ever experience. Now look at it – Black Monday hardly shows up. 4

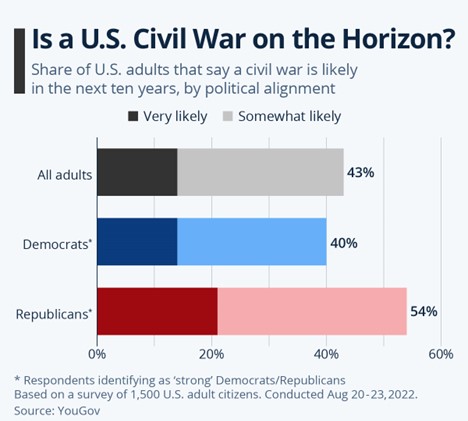

It’s easy to take a terrible event and “horriblize” it even further. My imagination can run wild with speculation, linear thinking, and black swan event scenarios. Civil unrest and civil war are within the scope of various scenarios I can imagine. It’s also easy to find data that supports that thinking. It looks like there are large swaths of the population that share some of my outlier thoughts. 5

Before I let that line of thinking ruminate, I catch myself and look at history. Past Presidential assassinations/attempted assassinations regrettably have some precedent.

Past Presidential Assassinations/Attempted Assassinations & Market Performance*

- James Garfield (1881): +0.23% 6

- William McKinley (1901): +19.44% 6

- John F. Kennedy (1963): +21.21% 6

- Ronald Regan (1981): -7.22% 6

*Note: Returns are for the full year when the Presidential assassination or attempted assassination took place

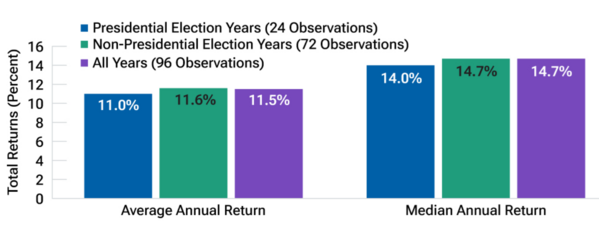

Further, Presidential election years have historically had strong equity performance. 7

You can take a look at several data points from our Q3 2024 Look Ahead here.

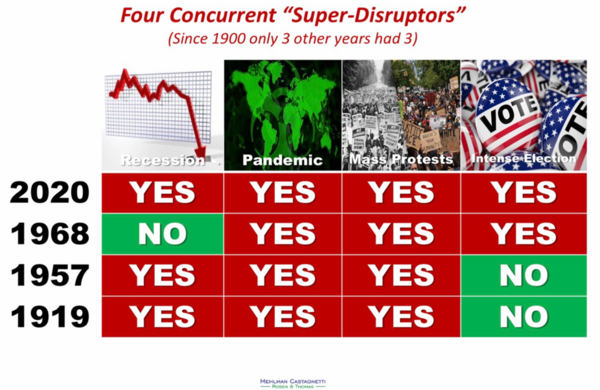

In the 2020 cycle, we had a swath of issues compared to prior cycles. It was almost unimaginable how many multiple shocks we were facing. It’s easy to forget (thank goodness) but it was a frightful year. 8

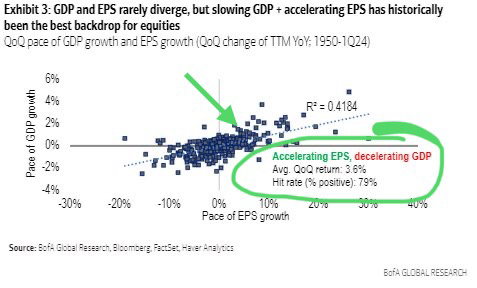

Finally, I will take another look at where we are in the broader economic and earnings cycle. We are in a slowing GDP growth phase and a recovery in corporate earnings. That is usually a pretty decent period for stocks. 9

As long as the recent tragic event does not disrupt the consumption or jobs cycle too much, things should be ok.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/?slideId=investing-principles/gtm-histreturns

- https://www.ftportfolios.com/Common/ContentFileLoader.aspx?ContentGUID=4ecfa978-d0bb-4924-92c8-628ff9bfe12d

- https://www.twocenturies.com/blog/2020/7/13/sixty-forty-over-the-long-run

- Bloomberg

- https://www.statista.com/chart/28200/is-a-us-civil-war-likely/

- https://www.officialdata.org/us/stocks/s-p-500/

- https://www.troweprice.com/financial-intermediary/us/en/insights/articles/2024/q2/how-do-us-elections-affect-stock-market-performance.html

- https://www.axios.com/2020/07/14/coronavirus-2020-accelerated-future-slideshow

- https://x.com/MikeZaccardi/status/1807548692758487174