“This Too Shall Pass”

There’s hardly an hour that goes by without hearing someone panicking about the upcoming Presidential election and their investments. It’s not a Democrat or Republican thing; it’s a human nature thing.

Our brains are not well adapted to accepting inherent risks and, in fact, we’re trained to avoid them―especially if they are near-term risks. Think about stepping on a snake versus eating fatty foods or smoking. Both are bad, just one is a more immediate risk to your health. Immediacy is the problem with our current political environment. Investors are concerned about the more immediate risk of an election and its outcomes than their long-term financial plan or simple compounding.

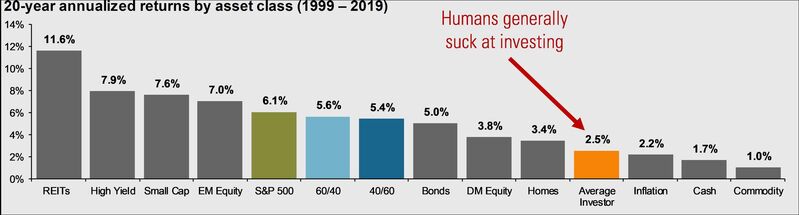

Let’s look at this simple chart and see if we are well-equipped to deal with risk when it comes to our investments. [i]

The data suggests our constant reactions to perceived investment risks leads to some bad outcomes. I don’t want to minimize this behavior, because it’s real and perhaps you feel that sense of panic as the election approaches.

Let me reassure you that after nearly 35 years of professional investing, when it comes to electoral politics, I have learned one thing: investors generally get over who wins or who loses. What they want is the cloud of uncertainty lifted and a degree of political certainty is a welcomed relief.

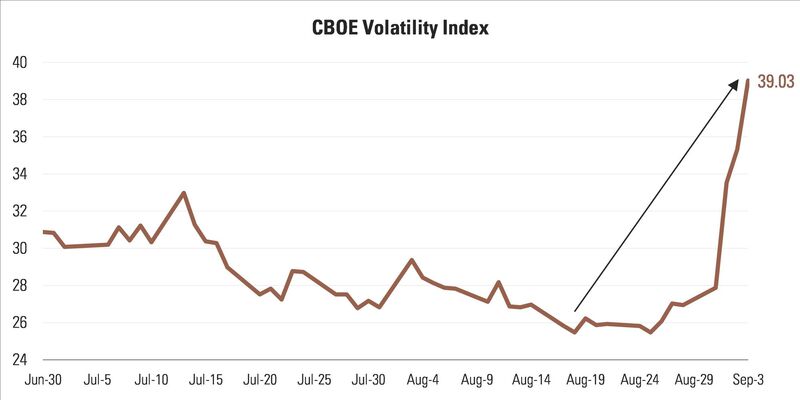

Just look at the VIX Index―which measures volatility in the markets and is a great proxy for investor sentiment―this year. As we approached the election this summer without a clear favorite in the polling, uncertainty had grown and investors were becoming more nervous. [ii]

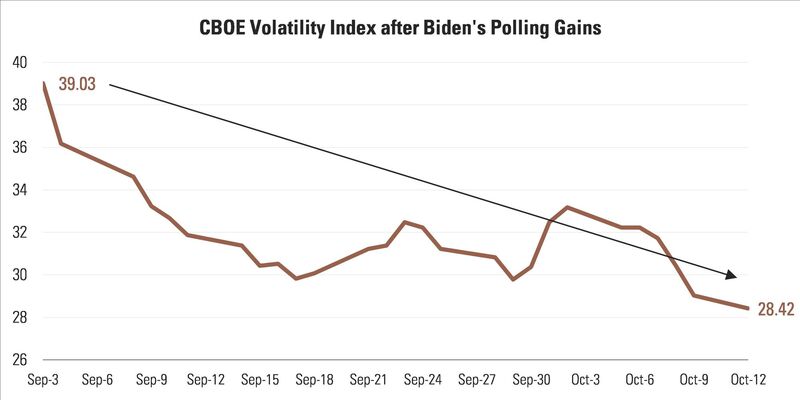

Now look at the VIX Index going forward after Biden gained in the polls and you can see sentiment beginning to moderate. [ii]

My translation is investors want to know who the candidates are and what they are going to do. In our current political environment, we know who these two candidates are, and we generally know what they are going to do economically. When one of them began leading in the polls, uncertainty started to subside.

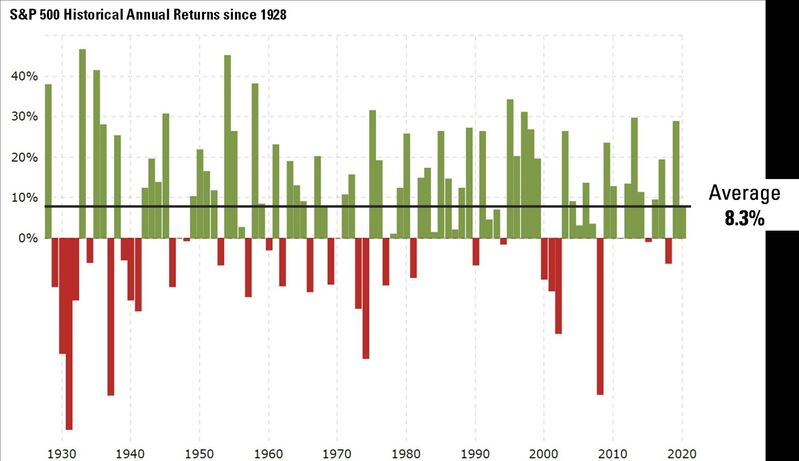

Let’s look at some historical market data. Since 1928 the S&P 500 has returned an average of 8.3%. [iii]

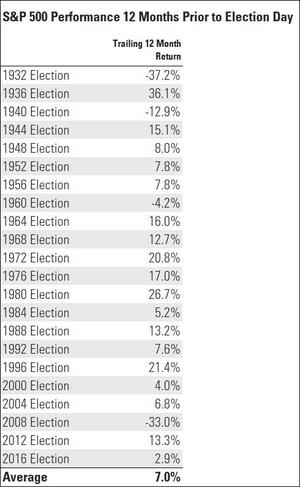

Now compare that to the 12 months prior to the 22 Presidential elections since 1928 and you can see a muted return of just over 7%. Again, investors don’t like uncertainty, especially uncertainty surrounding Presidential leadership. [iv]

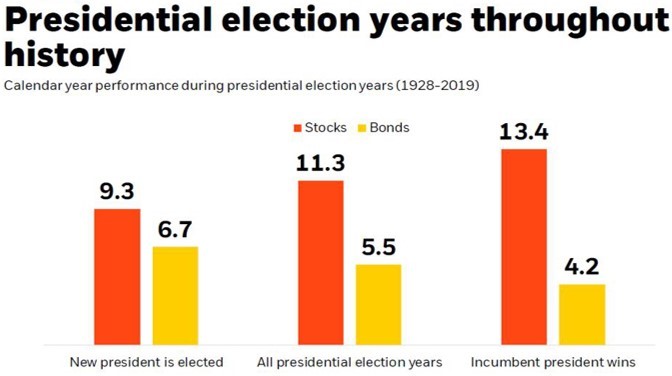

Another macro view on what investors favor when it comes to their Presidential preferences suggests they would rather have an incumbent than a new President. [v]

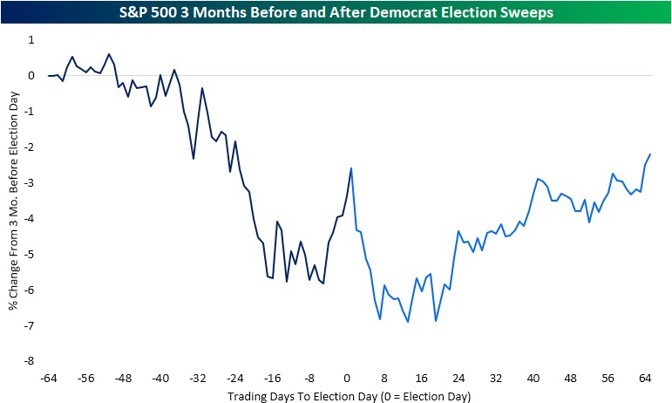

Let’s face it, the current optics suggests there is a big “Blue Wave” that will sweep Democrats into undivided control of the Presidency and the Legislative branches. From our friends at Bespoke you can see how the markets reacted to that specific scenario in the past. Prior to elections, a sell-off; and post-elections―over a number of months―a recovery. [vi]

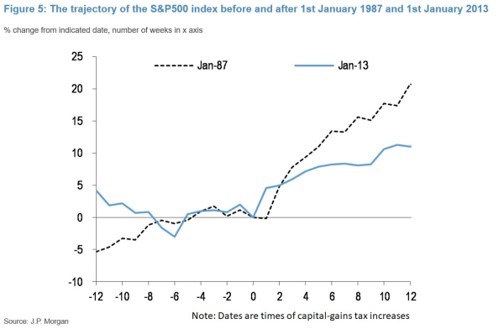

If indeed the polls are right―and that’s a big if―then the obvious question would be investor reactions to an increase in capital gains taxes, as it is Candidate Biden’s intention to raise taxes on capital gains. [vii]

Surprisingly investors shake off that reality quite well. In both cases (1987 and 2013) investors 12 months prior to the proposed tax hike have sold stocks and then subsequently moved on to bid them higher. [viii]

It would appear investors’ preference is for certainty on higher taxes rather than the threat of higher taxes.

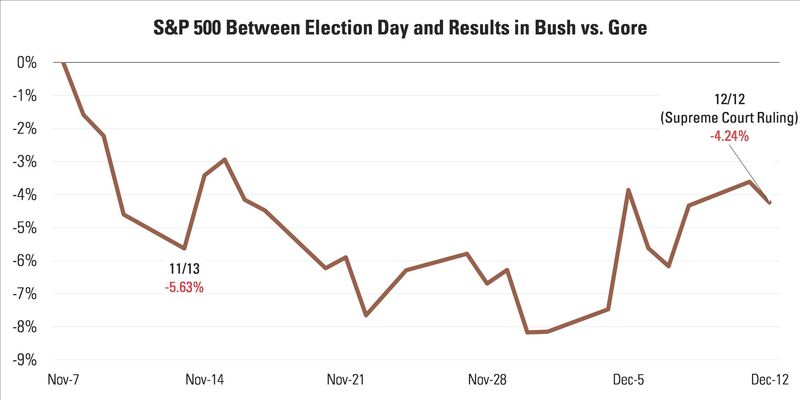

Let’s remember anything can happen in electoral politics and usually does. In our current case, that could be a contested election due to the mail-in ballot controversy. Reflecting on the last election outcome dispute with President Bush and Candidate Gore you see investors did not like that episode very much.

In the days after the 2000 election the S&P 500 sold off sharply―down almost 6% in the subsequent week after Election Day―and continued to sell off until the Supreme Court made its ruling on December 12th. [iv]

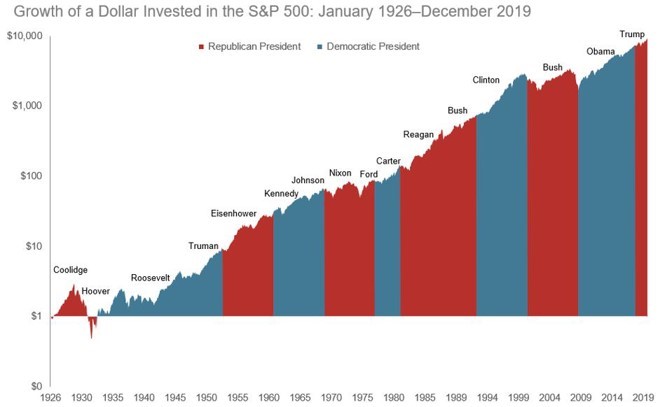

I leave you with this one view that always reminds me of the futility of trying to time the election if you have a long-term view regarding your investments. [vi]

All this is to say, “this too shall pass.” Investors know this round of uncertainty will pass and will fundamentally bet on the durability of our free enterprise system to drive earnings and prosperity for the investor class.

The lessons are simple:

• Let your investments compound over long periods of time

• Ignore the current political noise

• Remember Warren Buffett has held some of his investments through 14 recessions

• Manage your expenses and debt so you can glide though these periods of uncertainty

Abraham Lincoln lifted a timeless quote from ancient Persia to express his views during troubling times: “This too shall pass.”

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://am.jpmorgan.com/us/en/asset-management/gim/protected/adv/insights/guide-to-the-markets

ii. http://www.cboe.com/products/vix-index-volatility/vix-options-and-futures/vix-index/vix-historical-data

iii. https://www.macrotrends.net/2526/sp-500-historical-annual-returns

iv. https://www.spglobal.com/spdji/en/indices/equity/sp-500/

v. https://www.forbes.com/sites/kristinmckenna/2020/08/18/heres-how-the-stock-market-has-performed-before-during-and-after-presidential-elections/#6a4e051d4f86

vi. https://www.bespokepremium.com/interactive/research/think-big-blog/

vii. https://taxfoundation.org/joe-biden-tax-plan-2020/#Updates

viii. https://www.bloomberg.com/news/articles/2020-10-11/jpmorgan-says-u-s-capital-gains-tax-hike-may-briefly-hit-stocks