Threading the Economic Needle

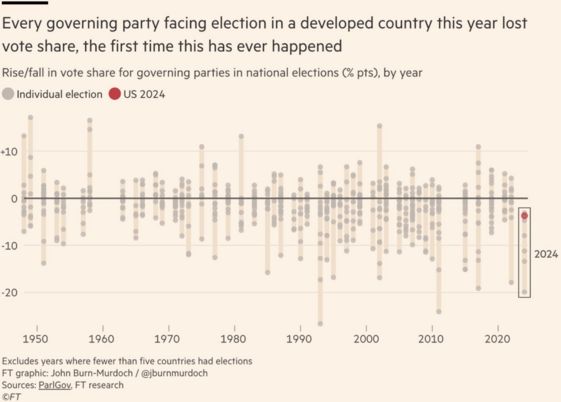

The recent U.S. election is being analyzed a thousand ways. Whatever way you see it, Americans voted for a change, and they were not alone. This year marked the first time that voters worldwide collectively voted for change. 1

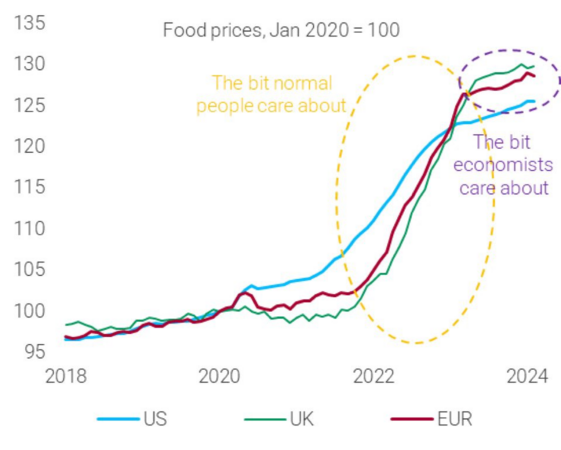

Developed economies around the world faced two primary trends: illegal immigration and high inflation. These issues clearly mattered most to voters both here and abroad. 2

Now what?

President Trump must now balance multiple objectives: lower inflation, lower deficits, lower taxes, reduced illegal immigration, and more manufacturing jobs—all while implementing higher tariffs. Let me frame this situation for you.

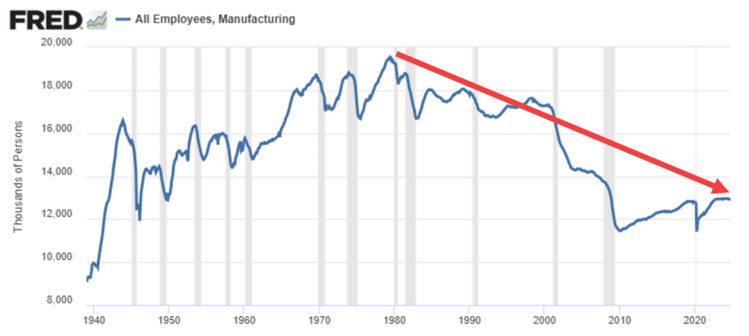

Manufacturing jobs in the U.S. have seen a precipitous decline over the last several decades, and this trend is undisputed. 3

Job openings in manufacturing tell the story as well. While both Trump and Biden saw expansions in manufacturing during their terms, the last couple of years have been dismal as openings are reverting to the mean. 4

Trump was chosen, in part, to address our decline in manufacturing as a source for jobs and wages.

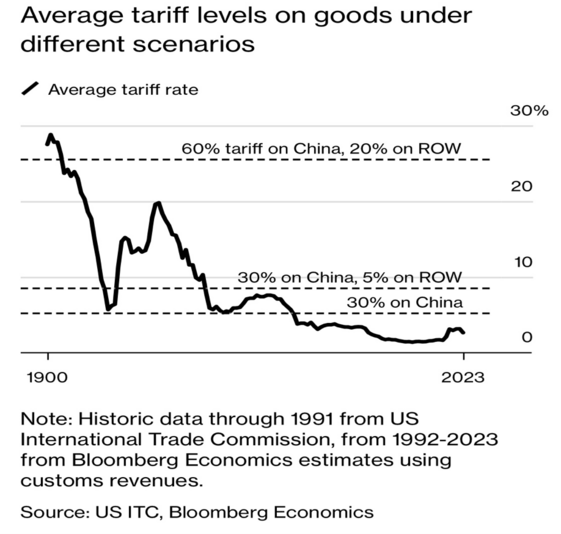

Tariffs represent his primary industrial policy to drive manufacturing “onshore” and create the jobs, wages, and growth we demanded. 5

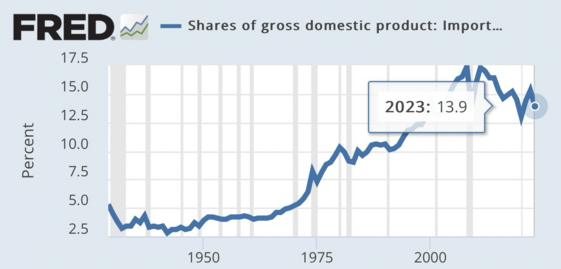

With imports representing approximately 14% of GDP, he will need to successfully establish manufacturing jobs and growth as tariffs naturally limit imports. It’s a tricky play. 6

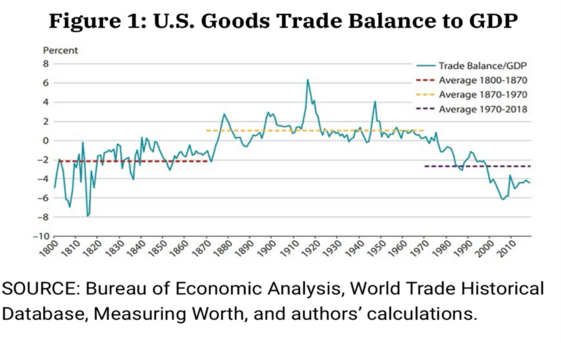

Historically, when we’ve been a large exporter – from the 1870s to the 1970s – tariffs were a drag on our economy. The tit for tat nature of trade wars was not great for our exporters. 7

However, given the decline in our manufacturing base and our transition to an import-driven economy, there may be room for strategic, targeted tariffs.

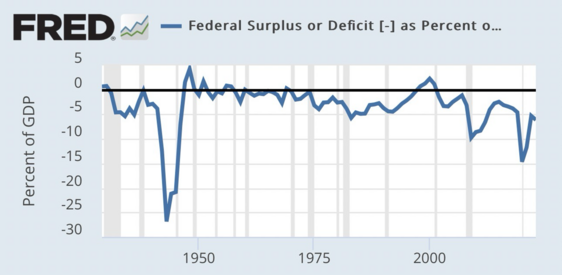

Now, consider how the tariffs to manufacturing jobs paradigm combines with President Trump’s desired tax cuts, which will drive deficit spending. Currently, the U.S. Government is borrowing about 6% of GDP to fund its programs. Further expansion of borrowing is limited unless economic growth increases substantially. This brings us back to the necessity of manufacturing base growth and the role of tariffs and other industrial policies. 8

There are two things President Trump can do that can provide a little backstop to the tariffs and tax cuts he wants:

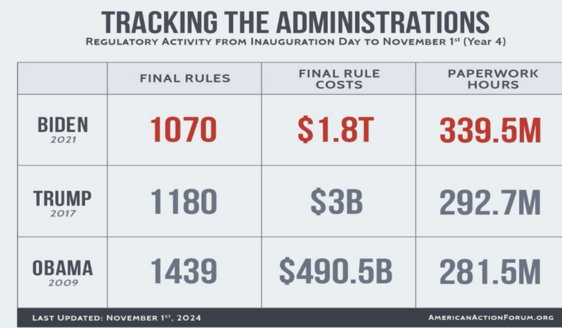

First, Trump can reduce regulations, an area where he has demonstrated success. Under the Congressional Review Act, Biden’s regulatory state added $1.8 trillion over 4 years – approximately 1.5% of GDP annually. If Trump can cut that, we would get a significant boost to growth. 9

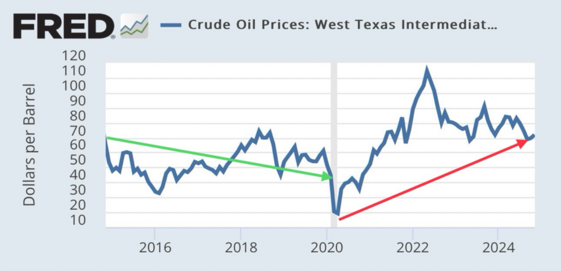

Second, by reducing regulations, he can facilitate a massive energy surplus in our country, driving down oil and gas prices. By the way, he has a history of doing that as well (Trump-Green, Biden-Red). 10

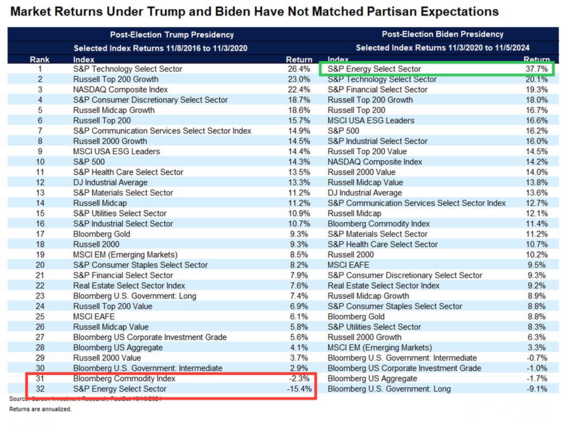

Equity performance reflected each president’s industrial policies. The “Drill, Baby, Drill” approach increased supply and lowered consumer prices, reducing inflation but impacting corporate profits and equity performance for energy companies. Oil and gas are in everything we consume, including transportation costs for manufactured goods and groceries. In contrast, the “Green Energy” revolution under Biden increased energy prices, inflation, and profits for energy companies. 11

So Trump’s playbook, in my estimation, is to cut regulations on day one, which should promptly reduce energy prices and lower inflation. He will then implement targeted tariffs to encourage manufacturing jobs and investment to return onshore while negotiating targeted tax cut extensions. This is the path I see for President Trump to thread the economic needle.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.ft.com/content/e8ac09ea-c300-4249-af7d-109003afb893

- https://x.com/DarioCpx/status/1854506697806778470

- https://fred.stlouisfed.org/graph/?g=1Amxx

- https://fred.stlouisfed.org/graph/?g=1Amz8

- https://www.bloomberg.com/features/2024-trump-day-one-agenda

- https://fred.stlouisfed.org/graph/?g=1AmDG

- https://www.stlouisfed.org/on-the-economy/2019/may/historical-u-s-trade-deficits

- https://fred.stlouisfed.org/graph/?g=1AmHV

- https://www.americanactionforum.org/daily-dish/what-next/

- https://fred.stlouisfed.org/graph/?g=1AmNz

- https://x.com/RyanDetrick/status/1854536099068067916

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.