Time in a Bubble

I often try to assess whether we are in an equity bubble (unsustainable price valuations on stocks) to add perspective to the allocation work we do at Phillips & Company. This week in Barron's and during a private investment strategy meeting I attended, one of the more prolific investment firms (GMO) suggested that we may not be in bubble territory yet.

Jeremy Grantham, co-founder of GMO, said the following in Barron’s.[i]

"We are not even that close to a bubble. With the S&P 500 at around 1860 recently, we are at about a 1.4- to 1.5-sigma event. Another way to say that is that we are between one and two standard deviations outside the normal distribution of stock-valuation levels. A two-sigma event would put the S&P 500 at 2350. So using the standard definition, it has to go up another 30% from here to get to a bubble. But you don't know when an ordinary market move is a bubble; you only know that in hindsight."

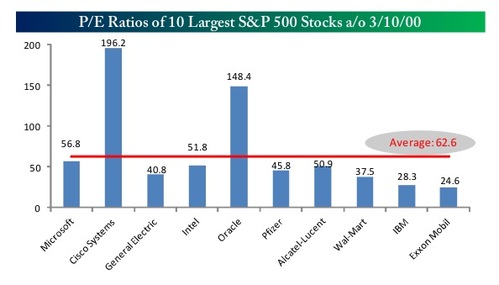

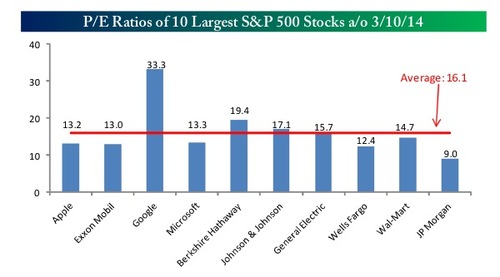

Well, here's some hindsight. In 2000, according to our friends at Bespoke, the 10 largest S&P 500 stocks traded at a whopping PE multiple of 62.6x.[ii]

Today, the 10 largest S&P 500 stocks are trading at a PE multiple of 16.1x.[iii]

Clearly in the words of Jeremy Grantham, we are "not even that close to a bubble" at least relative to the levels in 2000.[i]

One reason that equity valuations have been so strong and certainly not bubble worthy is the record profits corporations are posting.[iv]

![record corporate margins over time]](/files/cache/75d7510692b5fac23fa846874dccfac2_f980.jpg)

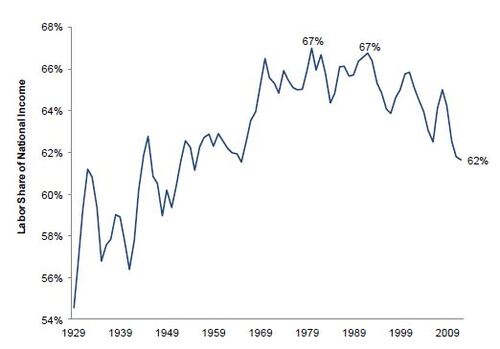

The question I ask is how long can this cycle last? Interestingly, with wage growth being so muted, tremendous slack in the labor force, and labor’s share of national income falling to levels not seen in 50 years, corporations have costs under control. The elevated profits trend could continue for a while.[v]

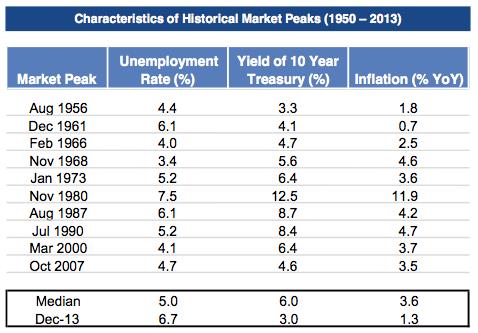

While a normal pull back could and should be expected, especially as interest rates creep higher, it's quite conceivable to see equity prices continue to move higher. Goldman Sachs noted the lack of evidence of the “typical factors that have ended past bull markets in the US.”[vi] As illustrated in the table below, current rates for unemployment, interest, and inflation are not near the median levels for 10 historical market peaks (1950-2013).[vii]

At the same time, any expectation for outsized gains in US stocks in the near term should be put aside...quickly. Goldman Sachs is just one of many capital market expectations that we use. You can see from the data below that expecting less is perhaps the best approach. We are certainly building our portfolios based upon these below-trend expected returns.[viii]

Bubble talk may be premature at this stage of the market cycle. However, the one tool that we use to mitigate some of the bubble risk is portfolio rebalancing. With the stock market reaching record highs, it’s likely that your portfolio’s asset allocation has shifted more toward equities. This is an opportune time to review your portfolio with your advisor and discuss rebalancing.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

[i] Ro, Sam (Mar 15, 2014). GRANTHAM: Stocks Are 65% Overpriced, But They’re Not A Bubble. Business Insider.

[ii] Bespoke Investment Group (Mar 12, 2014). Bubble Talk. p 1.

[iii] Ibid. p 2.

[iv] Investment Strategy Group (Jan 15, 2014). Outlook: Within Sight of the Summit. Goldman Sachs. p 10.

[v] Ibid, p 10.

[vi] Ibid, p 11.

[vii] Ibid, p 13.

[viii] Ibid, p 24.