Tis The Season – Precisely Inaccurate

Around the holidays, you might enjoy eggnog, mistletoe, or other traditions. Wall Street enjoys traditions as well.

One of the most dubious is the end-of-year tradition of making meaningless predictions. What will happen in the world of finance? Where will markets end 2020? And, of course, the age-old tradition of dower stock market crash prognostications. We will certainly accumulate many of those market forecasts and present them to you in the coming weeks, however, I think a quick historical review of the most ominous predictions might be in order. Let’s get it out of the way before we get too close to the holidays.

In 2018, these famed investors made some imprecise forecasts:

David Stockman (Regan Budget Director, former Salomon Brothers partner)

January 2018 – “Bubble Finance…leads to bubble crashes, of which there is surely a doozy just around the bend; or that speculators get the painful deserts they fully deserve, which is coming big time, too; or even that the retail homegamers are always drawn into the slaughter at the very end, as is playing out in spades once again. Daily.” [i]

Scott Minerd (Chief Investment Officer, Guggenheim Partners) March 26, 2018 – “By the time we get to the end of 2019, when the overnight rate is between 3.25–3.5 percent, corporate America will be in worse shape than it is today. It will be in worse shape than it was last year. It will be in worse shape than in 2007.” [ii]

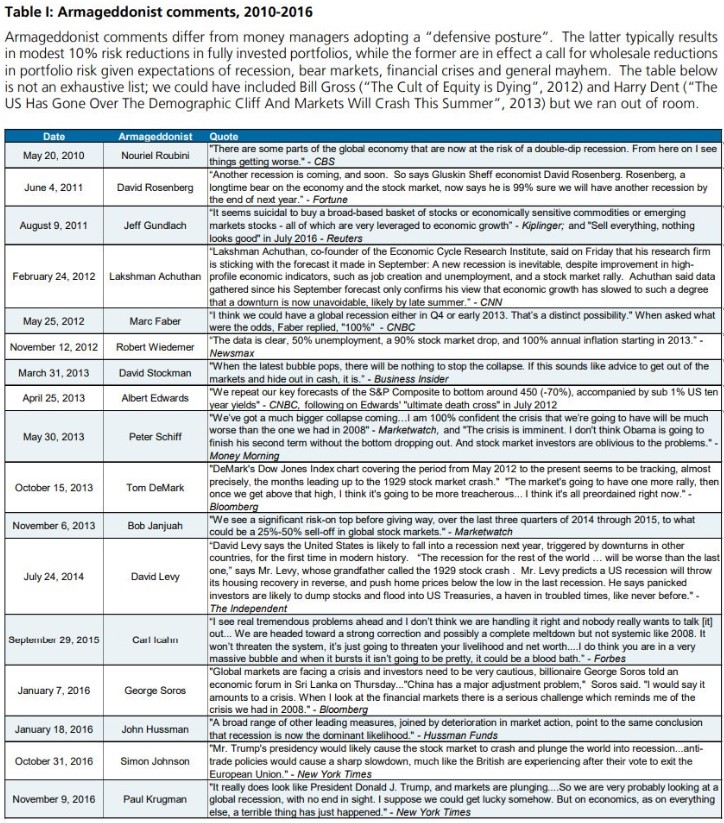

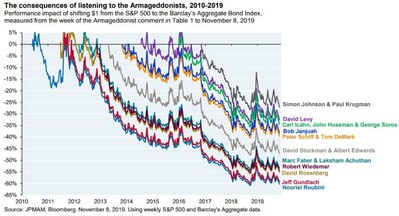

While these investors made some foolish predictions, they are not alone. One of my colleagues sent me a fascinating blog that highlights some of the foolishness in a tidy format. I’ve pulled some of the data tables for your reading pleasure: [iii]

Had you heeded that advice, here’s how you would have done: Not so hot! [iii]

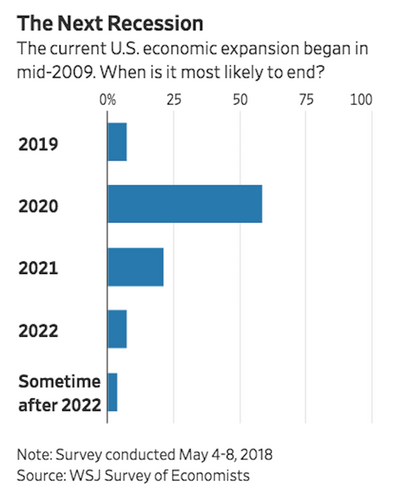

It would be pretty hard for the U.S. worker to retire when taking advice from these “Armageddonists”, yet many of them manage money for large institutions, pensions, and university endowments. It is no wonder we are working longer and paying higher tuitions. Make no mistake, all of these prognosticators have massive amounts of wealth, but it’s clearly not due to the accuracy of their predictions. More recently, the majority of economists taking a Wall Street Journal survey predicted a recession starting in 2020. [iv]

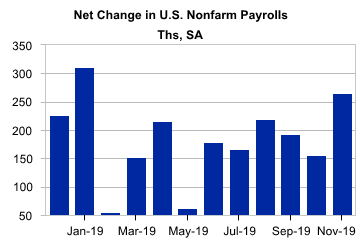

Juxtapose the recession call with the most recent economic data. I’ll just quote from Moody’s Analytics: [v]

“Payroll employment rebounded strongly in November, adding 266,000 jobs. September and October totals were revised higher from 180,000 to 193,000 and from 128,000 to 156,000, respectively. The three-month moving average of 205,000 is the strongest since January.”

“Average hourly earnings for all workers grew to $28.29, a 3.1% gain over the year.” [vi]

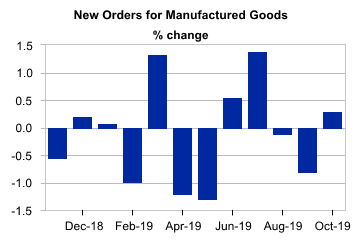

“Factory orders were up 0.3% in October after falling in each of the prior two months.” [vii]

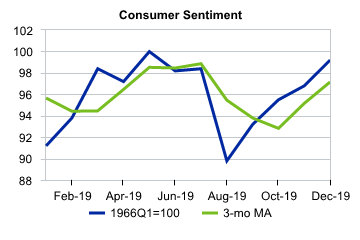

“The University of Michigan Consumer Sentiment Index rose 2.4 points to 99.2 in December, according to the preliminary reading. This took the index to its highest level since May.” [viii]

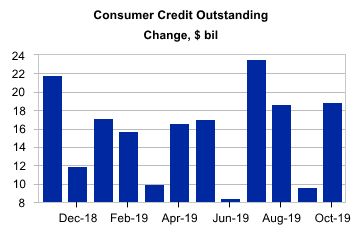

“Consumer credit growth picked up in October, rising $18.9 billion. This was slightly above consensus expectations of a $16 billion gain and above the average for the past two years. Both sectors grew, with the non-revolving sector adding $11 billion and the revolving sector growing by $7.9 billion.” [ix]

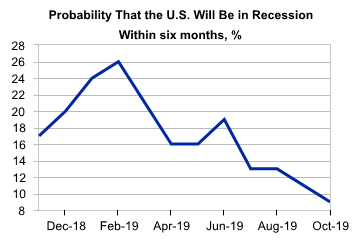

Finally, all of this data leads to the fact that “the odds of a recession in the next six months fell to 9% in October from 11% in September” and that “the odds of a recession are lower than the historical average of 22%.” [x]

In our upcoming Q1 2020 Look Ahead, we will detail many of Wall Street’s predictions. They will be deceivingly convincing in their precision, but always remember when it comes to equity investing the more precise, the more inaccurate.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://money.com/just-around-the-bend-this-is-when-the-stock-market-will-crash-according-to-5-famous-investors/

ii. https://www.guggenheimpartners.com/perspectives/global-cio-outlook/when-fiscal-and-monetary-policy-collide

iii. https://awealthofcommonsense.com/2019/11/the-5-types-of-market-crash-predictions/

iv. https://www.wsj.com/articles/economists-think-the-next-u-s-recession-could-begin-in-2020-1525961127

v. https://www.economy.com/dismal/indicators/releases/usa_employ/United-States-Employment-Situation

vi. https://fred.stlouisfed.org/series/CES0500000003

vii. https://www.economy.com/dismal/indicators/releases/usa_factory/United-States-Factory-Orders-M3

viii. https://www.economy.com/dismal/indicators/releases/usa_csent/United-States-University-of-Michigan-Consumer-Sentiment-Survey

ix. https://www.economy.com/dismal/indicators/releases/usa_credit/United-States-Consumer-Credit-G19

x. https://www.economy.com/dismal/indicators/releases/usa_recession/United-States-Risk-of-Recession