To Us You’re Clients, Not Data

What should be an all-consuming week of rich data will likely be hijacked by another bout of pandemonium around the drama with GameStop and the Reddit message board.

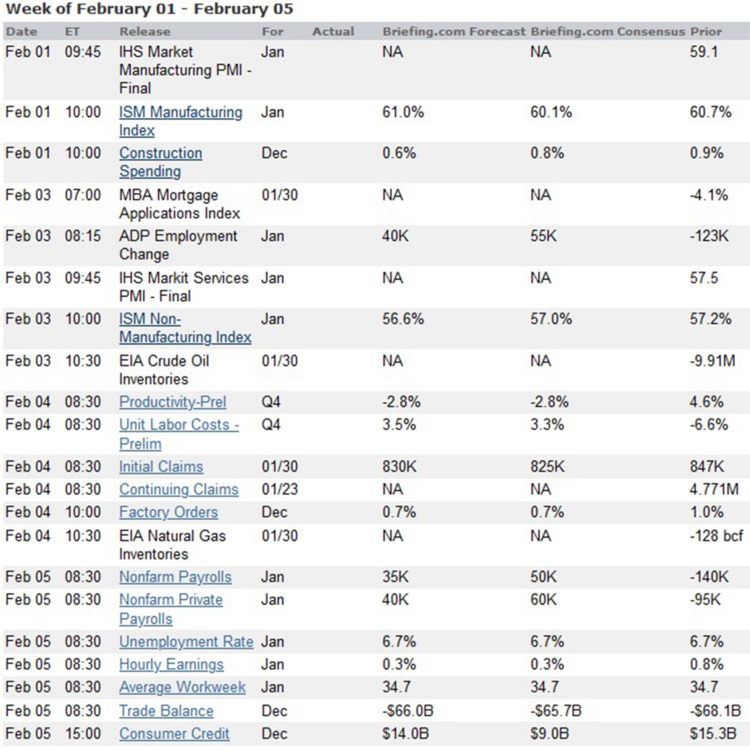

The week ahead is poised to be full of macro economic releases that could provide critical direction on the fragile state of our economy. Just look at the depth of the data being released: [i]

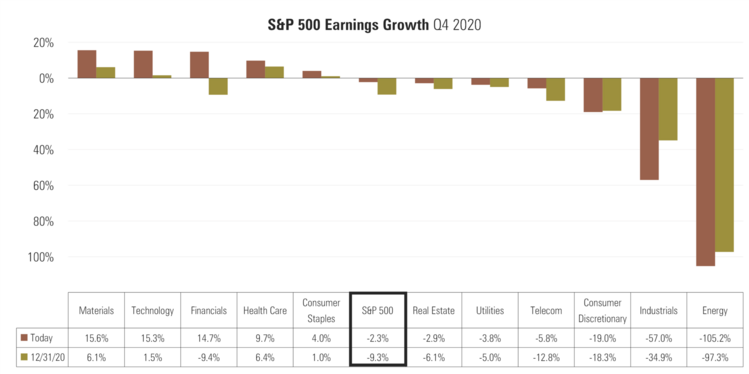

Market participants should also be laser focused on the better-than-expected corporate earnings reports. [ii]

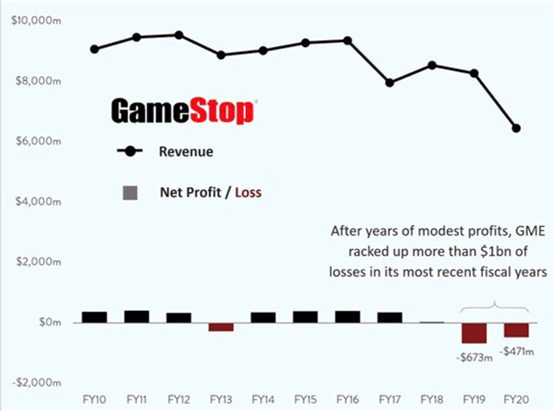

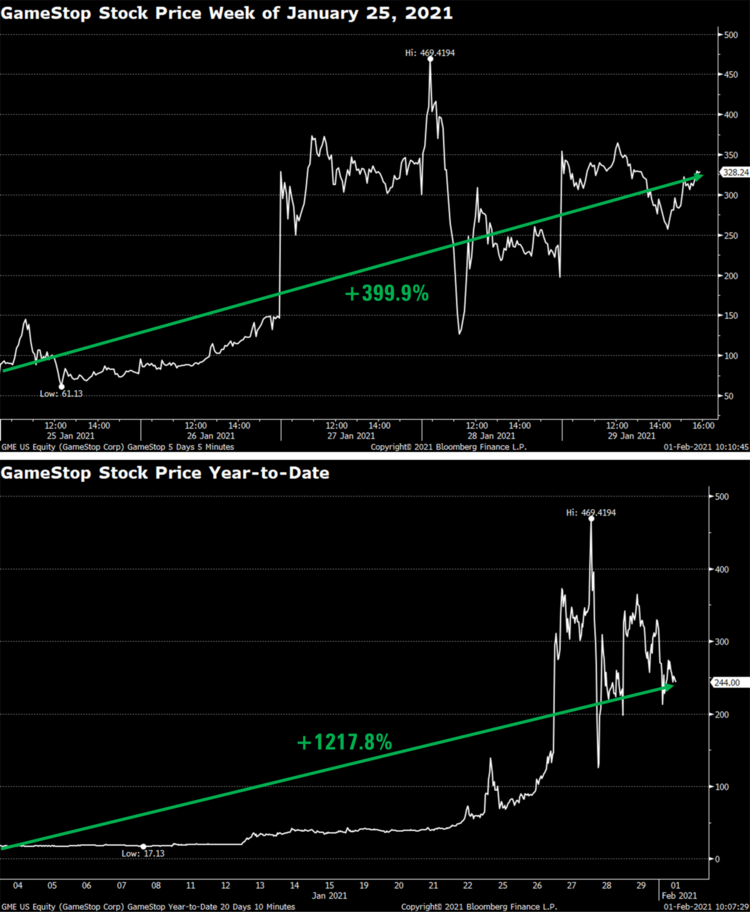

Instead, many in the investor class are entirely consumed with greed. Greed in the form of a company that has been losing money for several years (GameStop) seeing its stock price rise almost 400% last week and over 1,200% since the start of the year. [iii]

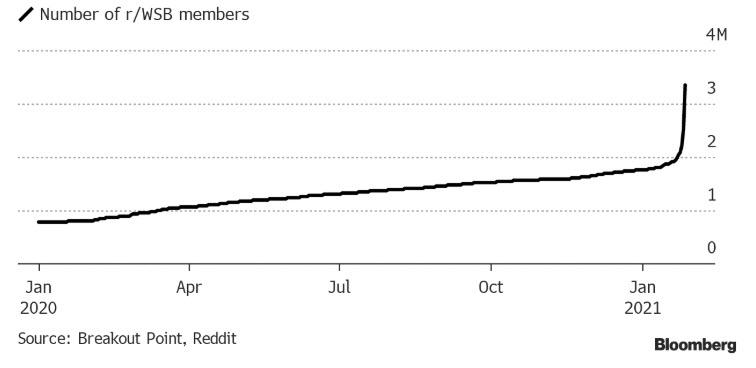

All of that pent up hype and “irrational exuberance” fueled by a message board on Reddit. The r/wallstreetbets Reddit community has focused on GameStop in an effort to squeeze short sellers (those selling a stock first then buying to cover) into buying which, in turn, drives up the stock price. In fact, the community that engaged in this speculative behavior has grown exponentially in the last week or two by nearly 1 million users. [iv]

Just look at a few of the r/wallstreetbets messages that hype GameStop and note the number of people engaging (“upvotes”) with these messages: [v]

“Buy more during dips if you can, but at least hold. We just have to hold until they fold. Today’s actions by several brokers just show how desperate the hedge funds are getting. Hold with your immovable diamond hands for all that you hold dear and we will be breaking Wall Street TOGETHER while making gargantuan tendies in the end!” – from WSB user 'uwillmire' 135k upvotes

“IMPORTANT!! THERE ARE NO SELLERS!!! DO NOT PANIC IF YOU SEE PRICE DROP HOLD THE LINE! UPVOTE SO PEOPLE DON’T PANIC.” – from WSB user 'SaintHakop' 150k upvotes

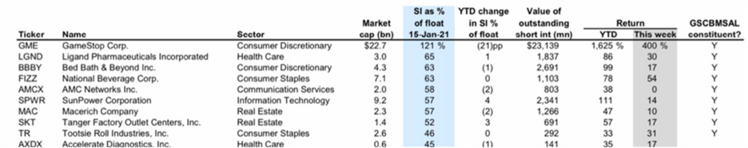

It is not hard to understand why these members chose GameStop to be the object of their desire – it is one of the most shorted stocks: [vi]

Many of the members of this message board tend to trade in small quantities and it is clear they launched a decentralized, yet coordinated, attack on those short sellers.

In fact, many of them use options contracts to leverage their buys and therefore leverage their risk and return. Since the start of the pandemic, it would appear small investors have “gamified” speculative trading. [vii]

Small call (right to buy) contracts have exploded by nearly 500% since the beginning of the pandemic. GameStop option contracts have skyrocketed by 600% in the last few months.

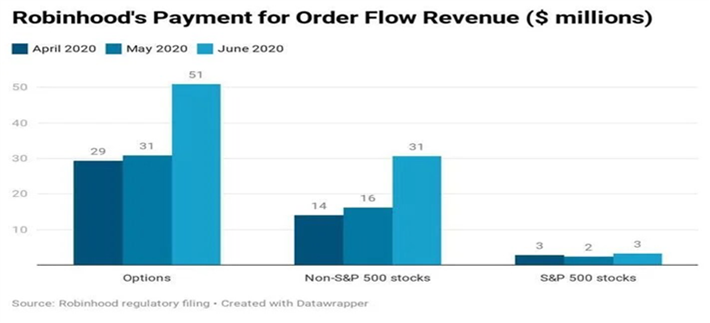

The vehicle that has allowed small, individual investors to engage in this highly speculative behavior is trading platforms like Robinhood that allow you to trade small quantities of shares or options contracts for “free.”

After 35 years of professional investing, I can assure you nothing is free on Wall Street and that is the case with these trading platforms. These sites sell your trades and trading data to other firms for a small fee. [viii]

Those firms buying Robinhood’s order flow then use that data to tip off their high frequency trading funds or clients, of course for a fee.

So, who does Robinhood sell your data to? Citadel Securities – a sister company to one of the largest hedge funds in the world run by famed investor Ken Griffin.

One hedge fund, Melvin Capital Management, is suspected of losing approximately $7 billion in one week or just over 53% of the firm’s investors capital. [ix]

Gabriel Plotkin is the infamous CEO of this firm. I am sure it won’t surprise anyone to discover Plotkin got his start at Citadel. Hmm.

So, when Robinhood ran into liquidity problems with all their shorts they had to turn to none other than Citadel to beef up their balance sheet. Realize Melvin Capital was short GameStop.

When I say, “You’re not clients of Robinhood, you’re data,” you can now understand what I am referencing.

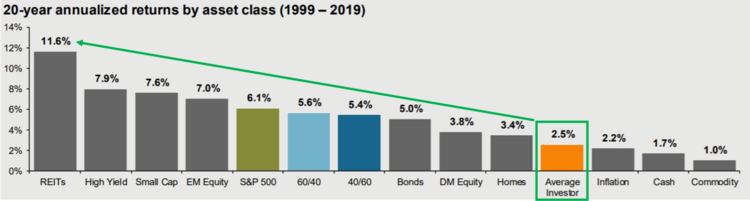

Let’s reset. Individual investors tend to do very poorly as a cohort over long periods of time. [x]

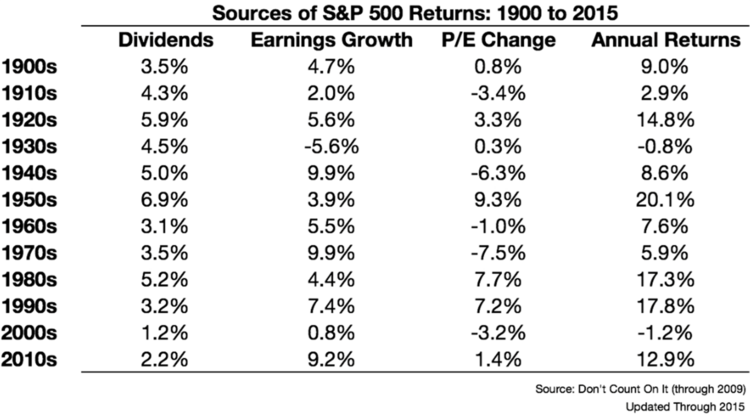

They try to chase returns, time markets, and maybe let greed drive strategy. Fundamentally, it’s still earnings growth plus dividends that drive returns, not short squeezes and Wall Street pirates.

Famed investor and founder of Vanguard John Boggle had the best algorithm: [xi]

Future Market Returns = Dividend Yield + Earnings Growth +/- Change in P/E Ratio

And here is his proof:

Our job is simple; move you much further left on the bar chart of returns to meet real needs like retirement, a foundation payout, a child’s college education, or a charitable cause. Treating you like data is someone else’s game and I hope you do not play into their hands.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.briefing.com/calendars/economic?Filter=Week1

ii. https://insight.factset.com/sp-500-earnings-season-update-january-29-2021

iii. https://www.bloomberg.com/quote/GME:US

iv. https://finance.yahoo.com/news/reddit-wallstreetbets-goes-dark-fueling-001959330.html

v. https://www.reddit.com/r/wallstreetbets/

vi. https://research.gs.com/

vii. https://www.ft.com/content/ae1ecff4-9019-4a2a-97ea-55a3cd15c36a

viii. https://cdn.robinhood.com/

ix. https://www.wsj.com/articles/melvin-capital-lost-53-in-january-hurt-by-gamestop-and-other-bets-11612103117

x. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

xi. https://awealthofcommonsense.com/2016/09/the-john-bogle-expected-return-formula/