Tough Medicine

Risk is such an uncertain concept. Most view it as an emotional event— as evidenced by recent outcomes with the current coronavirus pandemic. How can anyone contemplate the risk of something they have never experienced?

We tend to amplify the worst case outcome, even if it has very low odds. Lacking certainty in the face of a high-risk outcome—however unlikely—leads to some very erratic behavior. However unlikely, death is the infinite risk and the world is reacting accordingly.

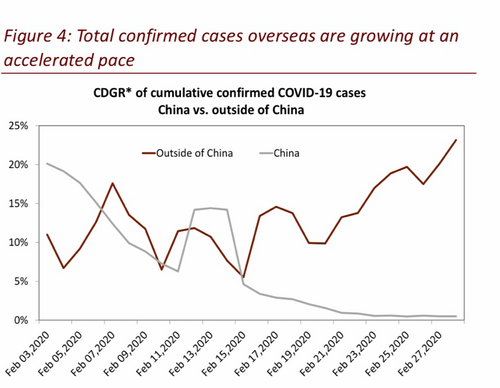

Countries around the world have responded to the coronavirus outbreak by following the China model.

Shutting Down to Open Up

China shutdown their entire economic engine for a few weeks to allow the virus to recede, allowing them to reopen sooner rather than later. The “drip drip drip” method of isolating people was not the formula they chose. They chose to take a one-time, massive economic hit quickly versus allowing the virus to slowly erode confidence and now they are through the worst. In fact, they reported just ten new cases in the entire country on Saturday. [i]

My view is that we are about to adopt a similar approach in the United States. Shut down quickly to reopen quickly. At the time of this writing, large swaths of our economy are being shut down. I suspect domestic air travel might be next, along with quarantine zones.

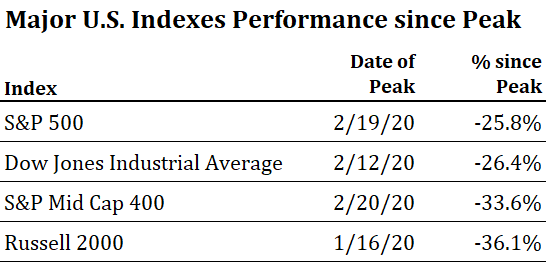

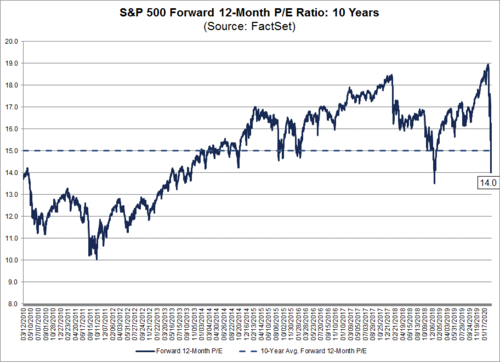

Based upon the current performance of the major U.S. stock indexes, we have priced-in a recession, using history as our guide. [ii]

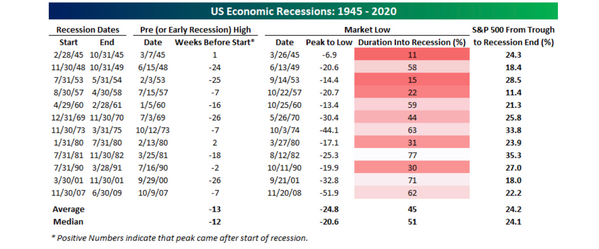

Based upon history, equity market corrections precede recessions. The average time to the start of a recession is 13 weeks from a pre-recession high in the markets. Further, the average decline is 24.8% for the S&P 500 and occurs about 45% of the way through a recession. [iii]

In our current case, we are down about 26% from the high on February 19th on the S&P 500 and we are only four weeks from that high. It is possible that this turns into the quickest recession on record if the draconian measures being taken to arrest the virus work.

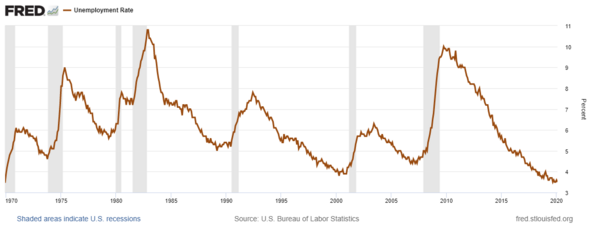

This might also be the first full-employment recession, as we are at the highest employment levels in the last 50 years. [iv]

The risk of recession has been growing over the last several weeks, so much of what we are seeing has been baked into current expectations. [v]

Now think about our economy with a couple simple formulas in mind:

Jobs = Wages = Consumption = GDP growth

Consider consumption being about 68% of GDP and federal spending is another 20%. [vi]

Unless we see mass layoffs, the recovery should be quick as consumers have money to spend; that is if we even enter a recession.

With the following monetary and fiscal policies already implemented or proposed, the pain points might be limited in time frame:

Implemented

- 50 basis point Fed Funds Rate cut on March 3

- 100 basis point Fed Funds Rate cut on March 16

- Waiving interest on federal student loans

- Federal government open-market purchases of U.S. Treasuries

Proposed

- Payroll tax cut

- Deferring federal tax payments

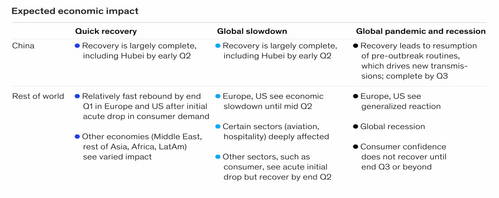

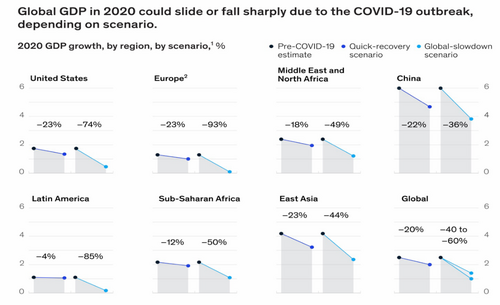

Further, McKinsey & Company suggests the following in a recent study on the impact on our economy: [vii]

You can see the McKinsey data shows vastly different economic outcomes based upon the speed in dealing with the virus and its economic shocks. A quick resolution is only a 23% hit to GDP growth (emphasis on growth) while a protracted scenario might take GDP growth down by 74%.

We’ve certainly already discounted a significant hit to corporate earnings, with a 26% drop in valuations based upon forward price to earnings ratios. We went from the S&P 500 trading at a forward multiple of 19 on February 19th to a multiple of 14 today. [viii]

What if we, as normal risk averse humans, respond to draconian measures as a positive? Put simply, the greater the shutdown, the greater the economic impact, the less likely we feel exposed to unmeasured risk, the better we respond.

We are certainly facing some tough medicine in the coming weeks. However, the tougher the medicine the quicker we get through this. That might just be the surprise that drives equity prices higher sooner than we might expect.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://research.cicc.com

ii. https://www.bloomberg.com/quote/SPX:IND

iii. https://www.bespokepremium.com/interactive/research/all

iv. https://fred.stlouisfed.org/series/UNRATE

v. https://blogs.wsj.com/dailyshot/

vi. https://fred.stlouisfed.org/series/FYONGDA188S

vii. https://www.mckinsey.com/business-functions/risk/our-insights/covid-19-implications-for-business

viii. https://www.factset.com/hubfs/Resources Section/Research Desk/Earnings Insight/EarningsInsight_031320.pdf