Triple Play

The odds of seeing a triple play in baseball are something like 1 in 325. It’s an incredibly rare event—on par with passing important legislation in Congress. [i]

It is remarkable the U.S. has completed what I consider the unlikely economic triple play: passing important fiscal policy legislation, extremely accommodative monetary policy, and individual spending support.

The Fiscal

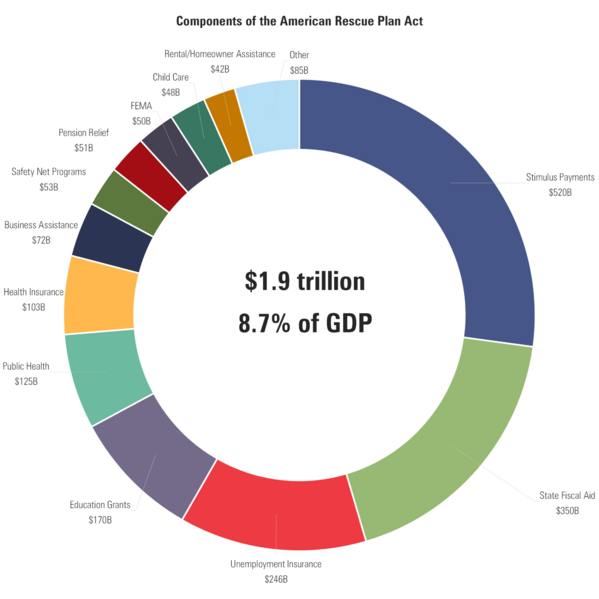

With the passage of the $1.9 trillion fiscal package last week, congress and the President will continue to fuel extensive stimulus to the American economy. [ii]

The $300/week in extra federal unemployment benefits will create an implicit increase in the current minimum wage. [iii]

To get those currently unemployed “off the couch” and back to work, the American employer will need to match that wage between now and September when we wean off the supplemental benefits. Remember, wages, once earned, are rarely ever taken away.

The Monetary

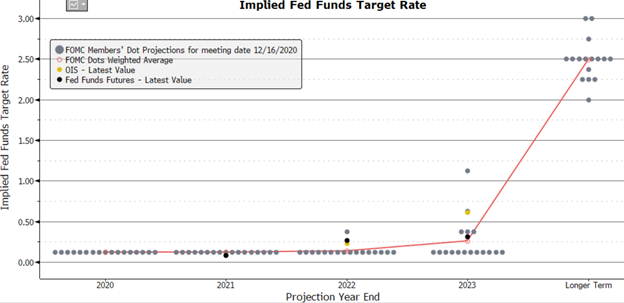

The Federal Reserve adds to this incredible triple play by continuing to promise to keep interest rates lower for longer. [iv]

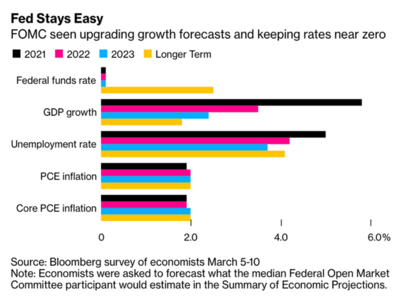

A recent Bloomberg survey of economists confirmed the general expectation that the Fed will be on hold regarding interest rates until 2023. [v]

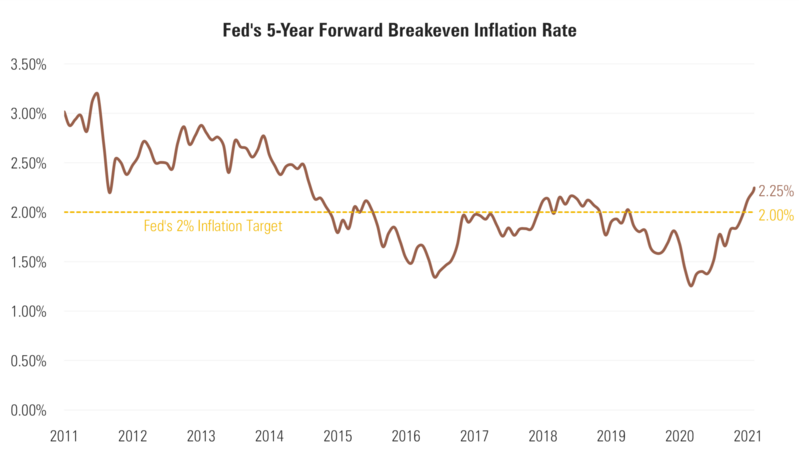

Even with slightly higher inflation expectations based upon the 5-year inflation breakeven rate over 2%. [vi]

It’s been abundantly clear the Federal Reserve wants to do their part to lift wages on the lower end of the income spectrum. Chairman Powell’s said as much on August 27th, 2020: [vii]

“Inflation that is persistently low can pose risks…The result can be worse economic outcomes in…both employment and price stability…with the costs likely falling hardest on those least able to bear them.” –Jerome Powell

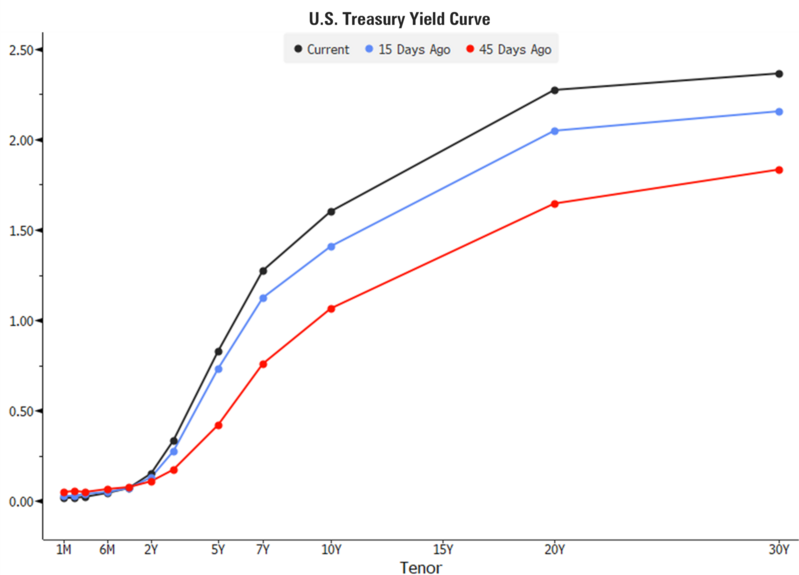

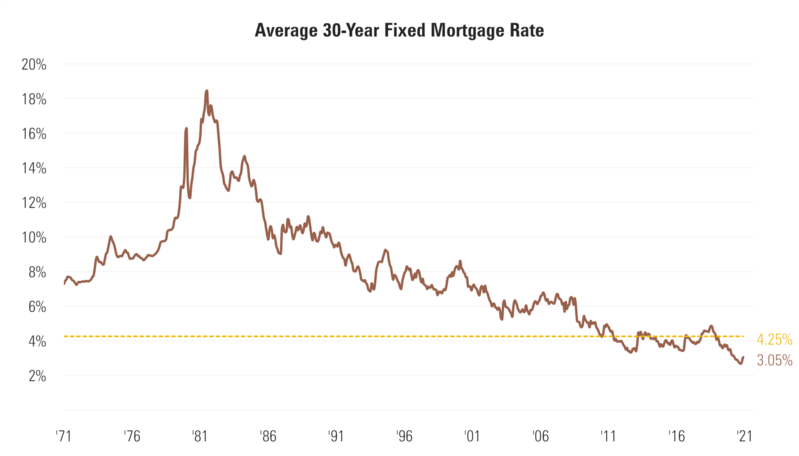

However, the Fed will need to balance the increase in long-term interest rates within the real economy juxtaposed against an ongoing economic expansion. [viii]

To that end we expect the Fed to manage the long-end of the yield curve through the purchase of additional longer-dated treasures, pushing down interest rates. This could occur when mortgage rates spike above 4.25%. [ix]

The Personal

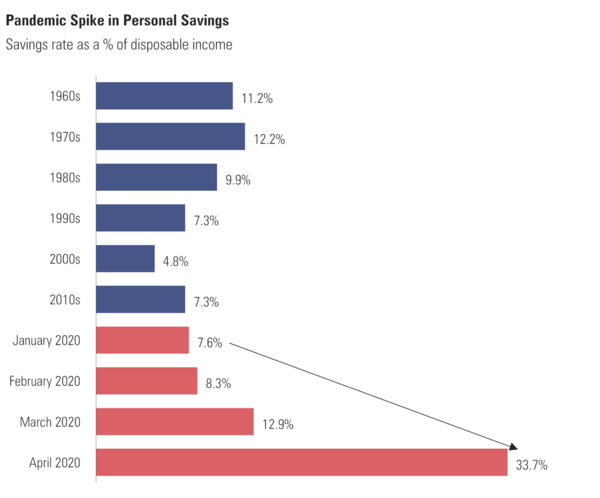

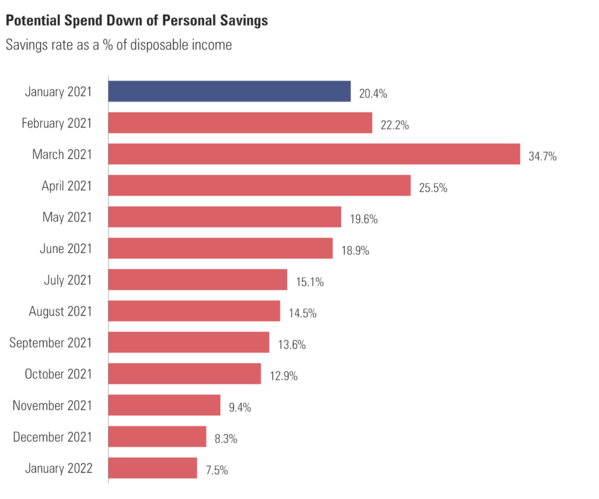

The U.S. consumer, much through the extraordinary pandemic-driven fiscal policy, has been sitting on a pile of cash. Personal savings rates were immediately elevated after the passage of the CARES Act in March 2020. [xi]

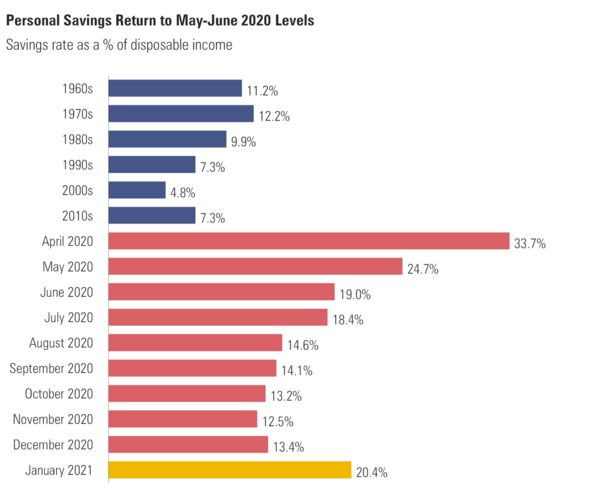

It’s fair to extrapolate that the spend-down rate was around 13.8% per month during the critical lockdown months of April through November. [x]

Walking that thinking forward, the passage of the $900 billion second stimulus package in December boosted personal savings back up to the levels last seen in May and June. [xi]

Moving forward we should see another massive boost to savings from the recent passage of the $1.9 trillion American Rescue Plan, with $520 billion of that in the form of direct payments.

It is not hard to imagine that the extra boost to savings will become much less precautionary and more opportunistic spending. Following a similar trajectory to the CARES Act, we should expect the monthly spend down to look like the chart below.

The overall boost to economy could be $2.65 trillion or 12.1% of GDP.

We expect that spending down of savings back to pre-COVID levels to take 10 months and will continue to fuel consumption well into the Summer.

It’s a very rare event when we have an economic triple play that could add 12.5% to GDP, fuel a long-term spend down of personal savings, and boost the minimum wage combined.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.onlinecasino.ca/congress-odds

ii. https://www.congress.gov/bill/117th-congress/house-bill/1319/text

iii. https://fileunemployment.org/dataview/

iv. https://www.frbatlanta.org/research/data-and-tools

v. https://www.bloomberg.com/news/articles/2021-03-14/fed-to-hike-rates-in-2023-but-dots-won-t-show-it-economists-say

vi. https://fred.stlouisfed.org/series/T5YIE

vii. https://www.federalreserve.gov/newsevents/speech/powell20200827a.htm

viii. https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

ix. https://fred.stlouisfed.org/series/MORTGAGE30US

x. https://auravision.ai/covid19-lockdown-tracker/

xi. https://fred.stlouisfed.org/series/PSAVERT