Twin Kickers to Growth

Fourth quarter earnings season is beginning to ramp up, with consensus expecting S&P 500 companies to report a year-over-year earnings decline of -6.8% per FactSet. [i]

While this would mark the fourth-largest decline since Q3 2009, we are entering a period of very easy year-over-year growth comparisons and there are a couple of kickers that could lead to outperformance.

First, the U.S. Dollar continues its downward trend, falling 12% since March. [ii]

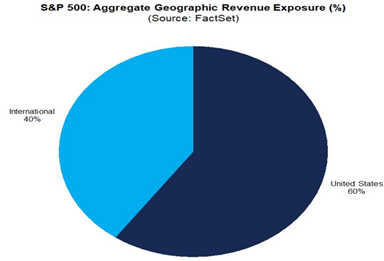

A weaker dollar makes U.S. exports cheaper and more competitive abroad. With S&P 500 companies generating approximately 40% of revenues overseas, this could help drive additional EPS growth and lead to further outperformance versus the -6.8% earnings decline analysts are forecasting for Q4. [i]

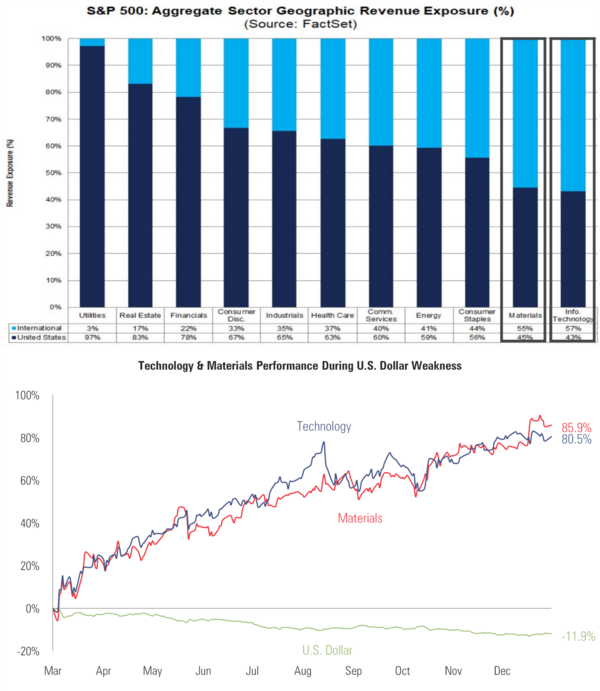

Sectors and industries with the largest share of international sales (Technology, Materials/Commodities) generally outperform in a weak-dollar environment. [i]

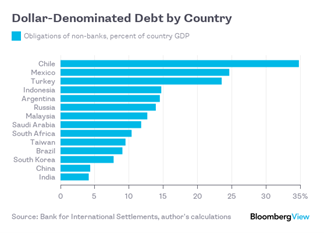

Dollar weakness also helps foreign companies that borrow in U.S. dollars. A weaker dollar means it is less expensive for them to pay back their U.S. dollar-denominated debt. As you can see from the chart below, the countries with the largest share of dollar-denominated debt as a percent of GDP are overwhelmingly Emerging Market economies. [iv]

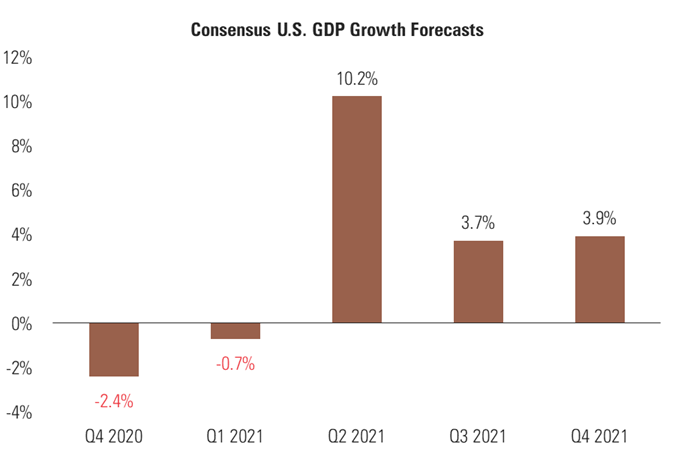

The second kicker could help fuel better than expected GDP growth. [v]

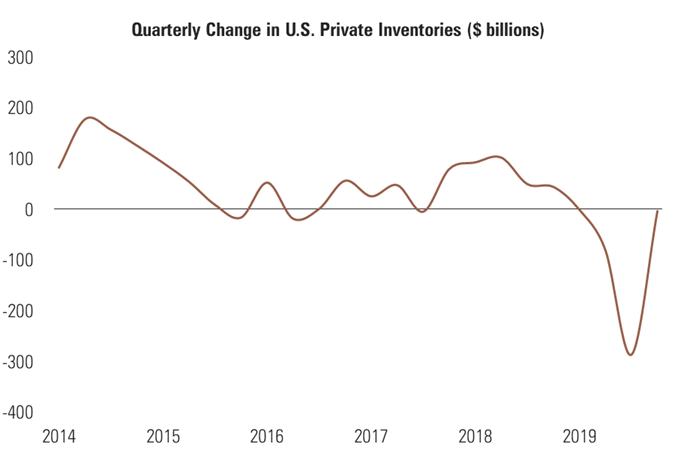

Business inventories have been in a downtrend since 2019 and fell through the floor during the height of the COVID crisis. [vi]

Those inventories will have to be rebuilt, potentially clearing the way for an extra boost to GDP growth in Q4 2020 and Q1 2021 beyond what is already built in.

If the U.S. consumer confirms the underlying health of the economy by returning to pre-pandemic consumption patterns, these additional “twin kickers of growth” could lead to material upside to expectations for corporate earnings in Q4 and the first half of 2021.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://insight.factset.com/topic/earnings

ii. https://www.bloomberg.com/quote/DXY:CUR

iii. https://www.bis.org/publ/work819.pdf

iv. https://www.bloomberg.com/opinion/articles/2017-09-25/the-world-can-t-stop-borrowing-dollars

v. https://www.bloomberg.com/quote/EHGDUSY:IND

vi. https://fred.stlouisfed.org/series/CBI