Two Thumbs Up

Last week provided critical data supporting where we are in the economic cycle and earnings recovery.

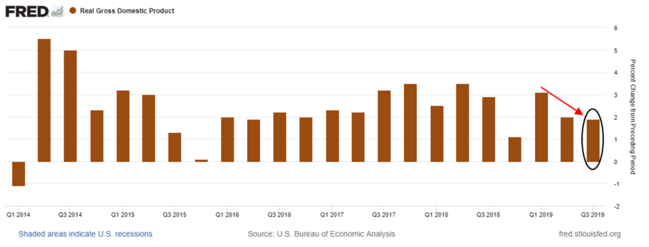

On Wednesday, the first estimate of third quarter gross domestic product (GDP) was released, showing the U.S. economy grew 1.9% year-over-year. While growth has moderated from prior quarters, we are still clipping along at a reasonable rate. [i]

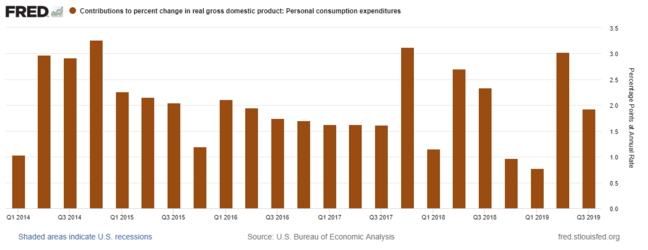

When you breakdown the components of GDP, you can see the underpinnings of our economic supremacy – consumption.

The U.S. consumer continues to fuel macro growth by expanding consumption by 1.94% and, although the trend has drifted lower, it’s still remarkably strong. [ii]

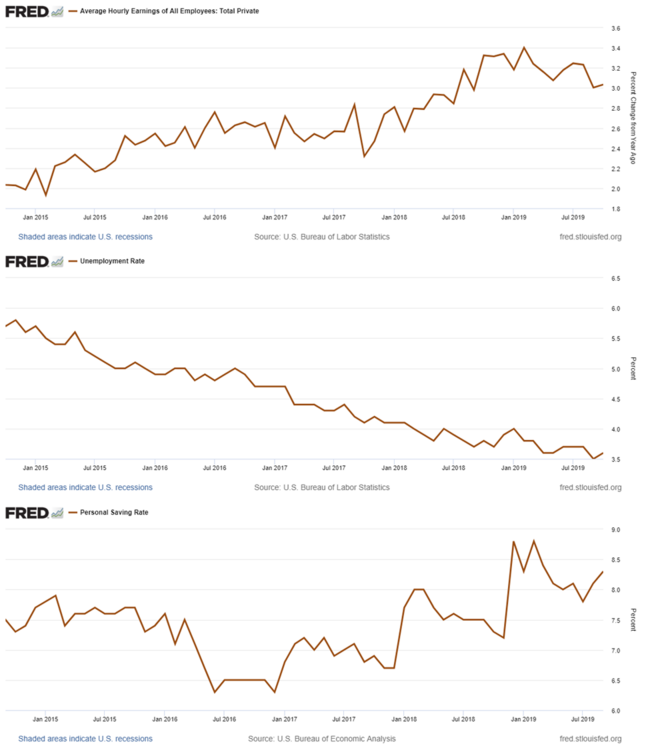

Looking at the most recent jobs report on Friday, you can see that wages, jobs and savings are all fueling our continued confidence that the U.S. worker can continue to consume. [iii] [iv] [v]

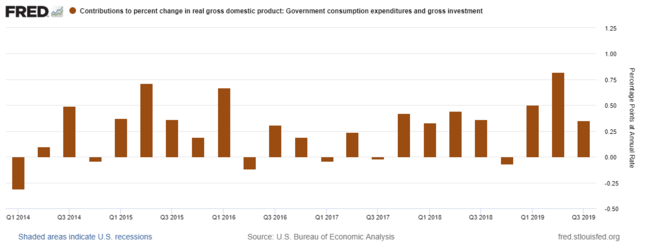

Government expenditures continue to be additive to GDP as well. [vi]

It would be foolish to think the government won’t continue to expand their spending in the coming years. Nothing coming out of Washington, DC tells me anyone is truly concerned about deficit spending.

While earnings growth continues to be ephemeral, it’s much better than expected.

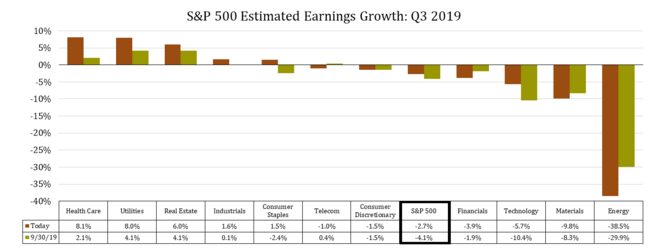

With 71% of S&P 500 companies having reported Q3 earnings as of Friday, we can see a few positive trends. One is the fact that earnings, while not growing, are coming in better-than-expected. According to FactSet, on September 30th expectations were for S&P 500 companies to report a decline in earnings growth of -4.1%. As of Friday, it now looks like that rate of decline is going to come in around -2.7%. [vii]

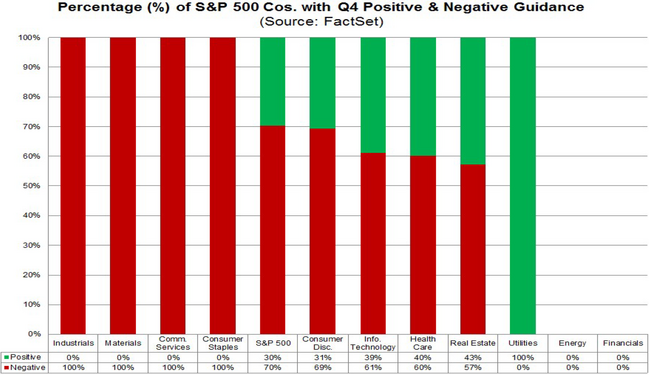

Further, earnings guidance for Q4 has been slightly stronger than average. Of the 64 S&P 500 companies that had issued Q4 earnings guidance as of Friday, 19 had issued positive guidance (30%) and 45 had issued negative guidance (70%). The 5-year average of companies issuing negative guidance is about 74%. [vii]

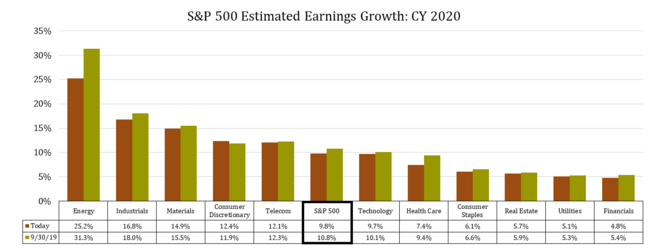

If this trend continues, we may emerge from the recent earnings recession with a return to growth in calendar year 2020. Current estimates are calling for full-year 2020 earnings growth of 9.8% for the S&P 500. [vii]

Even better news came out of the Fed last week, as they cut the benchmark interest rate by another 25 basis points and suggested they are not contemplating any rate changes in the near future. [viii]

“We think the current stance of policy is likely to remain appropriate, as long as incoming information remains broadly consistent with our outlook.”

Fair warning, anything can happen when investing in equities and it certainly has. There are legitimate threats to the economy like:

- Business investment continues to lag leading to layoffs

- Trade war is being underestimated in US Manufacturing and Agriculture

- Corporate debt bubble pops and leaves a large hole in availability of capital

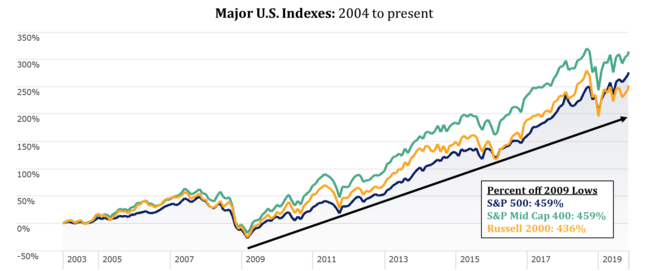

However, our view is we are nearing all-time highs on the major U.S. equity indexes and we are anticipating an earnings recovery.

Two thumbs up.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/graph/?graph_id=630388

ii. https://fred.stlouisfed.org/series/DPCERY2Q224SBEA

iii. https://fred.stlouisfed.org/series/CES0500000003

iv. https://fred.stlouisfed.org/series/UNRATE

v. https://fred.stlouisfed.org/series/PSAVERT

vi. https://fred.stlouisfed.org/series/A822RY2Q224SBEA

vii. https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_110119.pdf

viii. https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20191030.pdf