Uniquely American

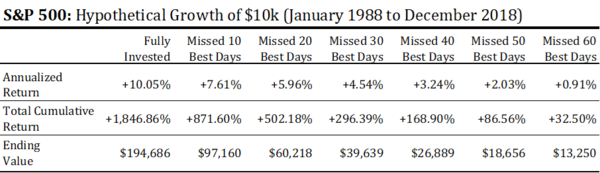

If you’ve read this blog in the past, you know we always evoke a few key themes; one of which being that markets move in brief bursts. If you miss just a few key days over a long period of time you lose all your advantage. [i]

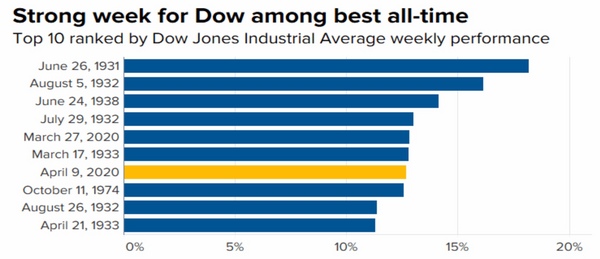

Last week was a perfect example, as the Dow Jones Industrial Average rallied 12% and had one of its best weeks in history. [ii]

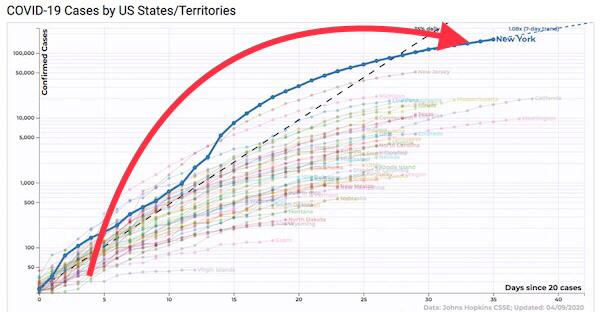

Glimmers of good news in the wake of tragic loss of life and economic hardship were catalysts to drive investors back into equities.

Good news came in the form of a deceleration of death and devastation from the virus. [iii]

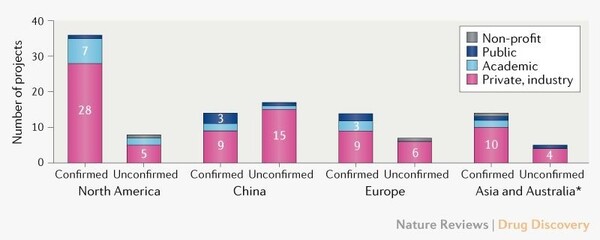

Good news also came in the form of progress being made in the search for the ultimate economic and health prophylactic—a vaccine. This excerpt from an article in Nature describes the progress. [iv]

“As of 8 April 2020, the global COVID-19 vaccine R&D landscape includes 115 vaccine candidates, of which 78 are confirmed as active and 37 are unconfirmed (development status cannot be determined from publicly available or proprietary information sources). Of the 78 confirmed active projects, 73 are currently at exploratory or preclinical stages. The most advanced candidates have recently moved into clinical development, including mRNA-1273 from Moderna, Ad5-nCoV from CanSino Biologicals, INO-4800 from Inovio, LV-SMENP-DC and pathogen-specific aAPC from Shenzhen Geno-Immune Medical Institute.”

115 different vaccine candidates improve our odds of successfully defeating this fierce enemy and perhaps sooner than previous expectations were suggesting.

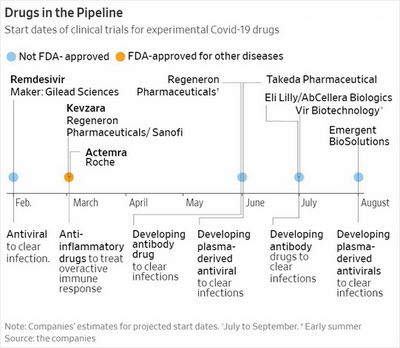

There is also good news in the form of various treatment protocols gaining ground to offer better outcomes for those that suffer the worst ailments by contracting COVID-19. [iv]

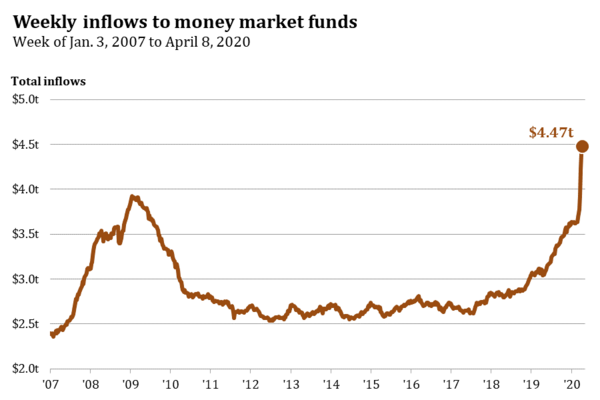

Good news is a powerful elixir for investors – especially with a record amount of cash sitting on the sidelines. [v]

It doesn’t take much good news to push this cash back into equities. As the famed investor Howard Marks once said, “Investors face twin risks every day… one in which they lose money and one in which they miss opportunity.” [vi]

With the current “suspension-of-revenue” status in the global economy, investors can only look ahead as there is almost nothing to evaluate right now. Economic and corporate earnings data is virtually meaningless as it relates to a forced shutdown. A self-induced recession has no precedent so, all investors can look forward to is an economy that will start to function again.

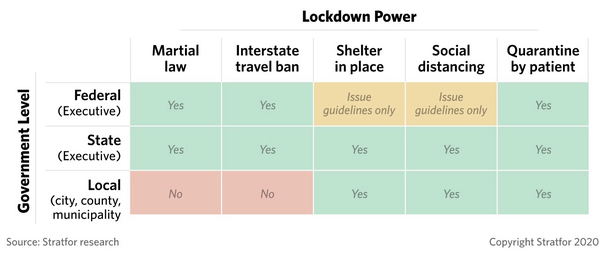

Therein lies the risk. The risk is our form of governance. Unlike China, we do not have an imperial executive branch. The President has limited authority over states unless he declares martial law (which would create its own set of economic risks.) [vii]

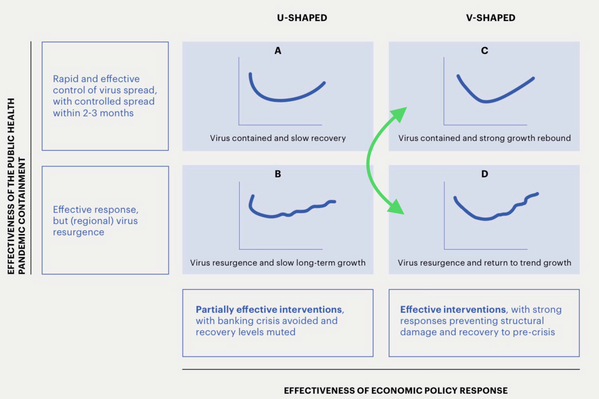

The governance risk will lead to an uneven return to normal by individual states and the risk of reoccurrence is higher for the United States due to our Republic form of governance. Our friends at McKinsey are suggesting the shape of the recovery based upon the effectiveness of our reopening. [viii]

Currently, investors are expecting an economic recovery in either option C or D above. It is my view that we likely see something closer to option D, with some regional fits and starts based upon our form of governance and supply chain issues that lack universal testing.

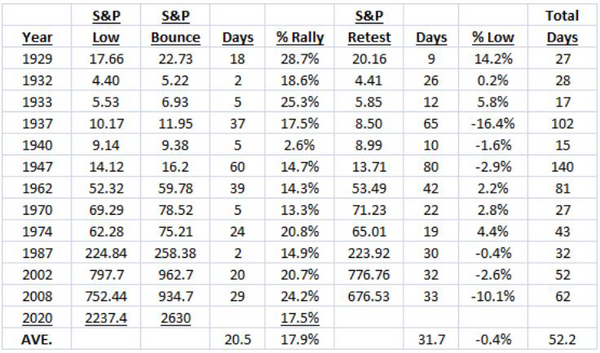

The risk of loss is real and the consensus view is equity markets will retest prior lows. It’s quite common and certainly creates a damper to the optimism from last week. [ix]

As the table above suggests, the rallies off bottoms occur quickly (20 days) and the retest can occur with near equal speed (31 days). It’s simply too hard to time and, bluntly, only favors the foolish who try to time the bounce. While this gives the illusion of control, it’s just that; an illusion.

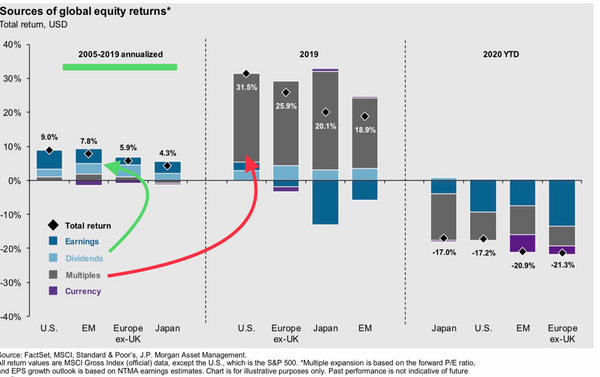

Equity prices are derived over long periods of time based upon earnings and dividends. Multiple expansion is generally much more speculative and short term. [x]

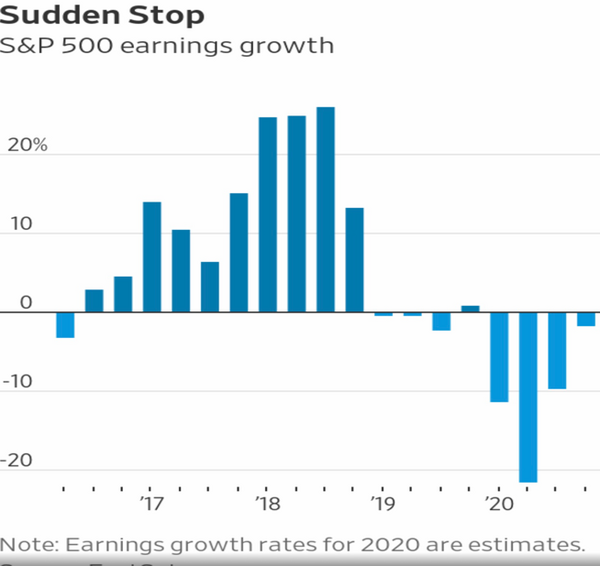

This coming week we will see the beginning of some terrible corporate earnings. That should be expected and frankly shouldn’t matter all that much as completely shutting down an economy has a “no duh” outcome on corporate earnings. [xi]

Investors will look ahead and come to terms with the economic and health realities of opening up in a uniquely American way. While that might not be the most efficient way, it will likely preserve our independent “States Rights” libertarian rebellious streak.

If investors look far enough ahead, that independent-minded ethos is the exact culture we will need for a return to normal consumption. That is what has fueled our growth miracle in the past and will drive our consumption-oriented growth miracle going forward.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.zacksim.com/perils-moving-investments-cash/

ii. https://www.cnbc.com/2020/04/09/stock-market-today-live.html

iii. https://www.nakedcapitalism.com/2020/04/200pm-water-cooler-4-10-2020.html

iv. https://www.nature.com/articles/d41573-020-00073-5

v. https://www.ici.org/ops/ta/mmfs

vi. https://www.oaktreecapital.com/docs/default-source/memos/calibrating.pdf

vii. https://worldview.stratfor.com/article/us-s-piecemeal-covid-19-response-portends-long-recovery-coronavirus-lockdown-united-states-economy

viii. https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/safeguarding-our-lives-and-our-livelihoods-the-imperative-of-our-time

ix. http://econintersect.com/pages/investing/investing.php?post=202004070427

x. https://am.jpmorgan.com/us/en/asset-management/gim/adv/insights/guide-to-the-markets

xi. https://www.wsj.com/articles/looming-earnings-season-offers-next-test-for-rebounding-stock-market-11586683802