Wall Street Parlor Tricks

With the end of 2017 quickly approaching, let’s see what parlor tricks Wall Street played on us this year.

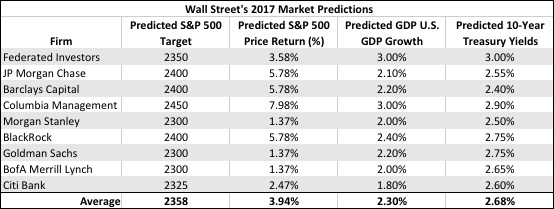

Last year we reported Wall Street’s market forecasts for 2017 in our Q1 2017 Look Ahead. In our slide titled “Wall Street Parlor Tricks,” Wall Street’s most influential banks provided forecasts for the S&P 500, GDP growth, as well as their predicted level for 10-year Treasury Yields. Here’s what those forecasts looked like. [i]

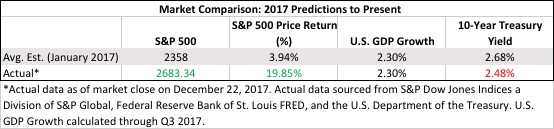

As of the market close on Friday, December 22, 2017, the S&P 500 closed at 2683.34, besting the average predicted S&P 500 level by more than 325 points, which exceeds the average predicted gain by 15.91 percent. Here’s how the other predicted metrics fared against current market data. [ii] [iii] [iv]

This is a swing and a miss for Wall Street expectations, but that comes as no surprise. I have rarely ever seen accurate market forecasts. As you can see, estimates were missed in every category. Despite GDP growth equaling estimates, it’s important to keep in mind that the actual data used for this measure is through the third quarter of 2017, and after Q4 GDP is released next month, that number will most likely change as well.

In fact, all of this just goes to show that the market will do whatever the market is going to do. Not even the Wall Street banks have a crystal ball that can predict the market’s behavior with any certainty. Yet, Wall Street will continue to spin its parlor tricks in hopes that one day, it may get it right.

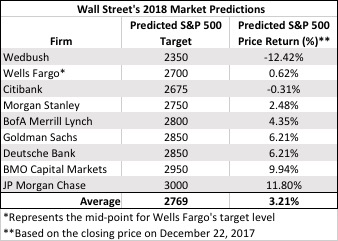

So, in honor of our last commentary of 2017, here are the 2018 predictions.

Wall Street banks are predicting an average level of the S&P 500 of 2769, representing only a 3.21 percent return in 2018. [v]

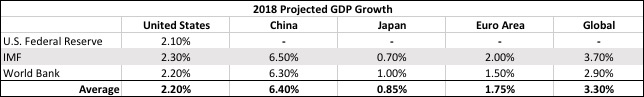

The U.S. Federal Reserve, the International Monetary Fund, and World Bank are predicting average U.S. GDP growth of 2.20 percent and average world GDP growth of 3.30 percent. [vi] [vii] [viii]

Keep an eye out for our upcoming Q1 2018 Look Ahead, in which we’ll discuss these projections in further detail. In the meantime, I want to wish everyone a happy, healthy, and safe New Years!

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Robert Dinelli, Investment Analyst, Phillips & Company

Tim Phillips, CEO, Phillips & Company

References:

i. https://phillipsandco.com/files/5014/8346/4459/2017_Q1_Look_Ahead_-_Final.pdf

ii. http://us.spindices.com/indices/equity/sp-500

iii. https://fred.stlouisfed.org/series/GDPC1

iv. https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

v. https://www.marketwatch.com/story/wall-street-expects-bull-market-to-make-history-in-2018-2017-12-18

vi. https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20170920.pdf

vii. http://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD/USA/EUQ

viii. http://www.worldbank.org/en/publication/global-economic-prospects