Wall Street Parlor Tricks - Precisely Inaccurate

This time of year brings out some of the strangest behavior Wall Street can exhibit. Despite being wrong year in and year out, Wall Street analysts continue to make wild guesses at where the markets will be in the coming year.

We at Phillips and Company avoid this ludicrous tradition, as intentionally being wrong is not part of our job description. However, Wall Street firms use these wild predictions to prey upon investors irrational behavior in a couple of ways.

First, they know investors rarely go back and check the accuracy of their predictions. Little in the way of consequences are felt by the "big firms".

Two, Wall Street knows investors love certainty, even when it's wildly inaccurate. You see, big firms believe the perceived value of their brand names, such as Goldman Sachs, Merrill Lynch or Wells Fargo, far outweighs their ability to accurately forecast outcomes 12 months from now.

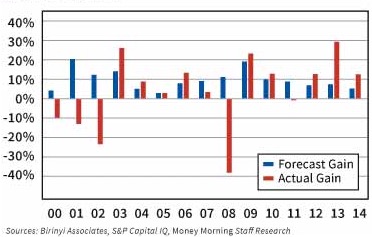

Take a look at this chart as an example of their bold face inaccuracy. On average, these “expert” analysts have been off by 14.7 percentage points a year. You would be better off guessing the average market return each year of 9% and you would be off only 14.1%. [i]

For a more specific example review our 2015 Q1 Look Ahead when we posted the results of the full year for 2014.

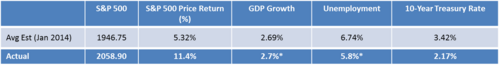

You can see Wall Street forecasted the S&P 500 to be up 5.32% in 2014 and the S&P 500 was actually up 11.4%. Not a small miss by any measure, Wall Street missed by 113%. [ii]

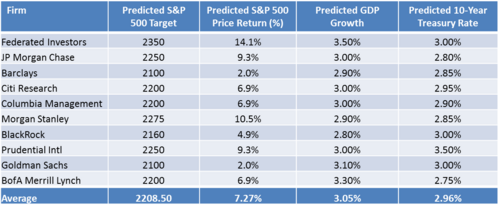

Roll forward to 2015. On average, analysts forecast the S&P 500 to be up 7.27%. Unless the market rallies almost 8% this coming week Wall Street will miss their forecast by 107%. We can reasonably assume once again, Wall Street will be wrong. [iii]

Amazingly, forecasters were equally wrong when it came to predicting interest rates. The median forecast calls for the 10-year Treasury to be at 2.96% at the end of 2015 and we will likely end around 2.25% a whopping 24% off. [iv]

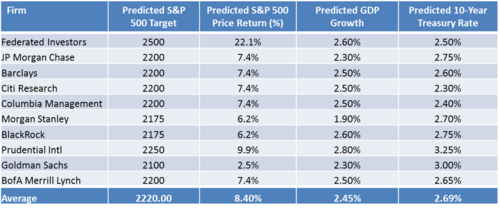

Let's take a look at upcoming forecasts for 2016. [v]

You can see from the table above Wall Street is forecasting just below average returns for the S&P 500. It's not hard to calculate. 4% EPS growth, 2% dividend and 2% from the shrink in shares due to stock buy-backs. Add all these up and you get 8% returns with no expansion in P/E multiples.

While logical, it's unlikely accurate. Let's not play the Wall Street Parlor Trick, let's invest in the long range averages.

Stay tuned for our 2016 Look Ahead where we will lay out our case for the coming quarter and year.

Wishing you a happy healthy and prosperous 2016.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] hhttp://wallstreetexaminer.com/2015/04/heres-how-wrong-wall-street-stock-market-predictions-are/

[ii] Phillips and Company Q1 2015 Look Ahead

[iii] Phillips and Company Q1 2015 Look Ahead

[iv] https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

[v] http://www.barrons.com/articles/stocks-could-rise-10-in-2016-according-to-market-strategists-1449899461