Wall Street Parlor Tricks – Precisely Inaccurate

As the Christmas holiday fast approaches, Wall Street gears up for their annual tradition of predicting how markets will do in the coming year.

The tradition is rooted in two very important investor behaviors: Investors love predictions and historically they forget inaccuracies.

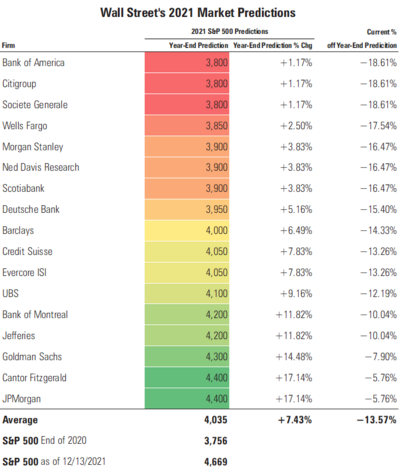

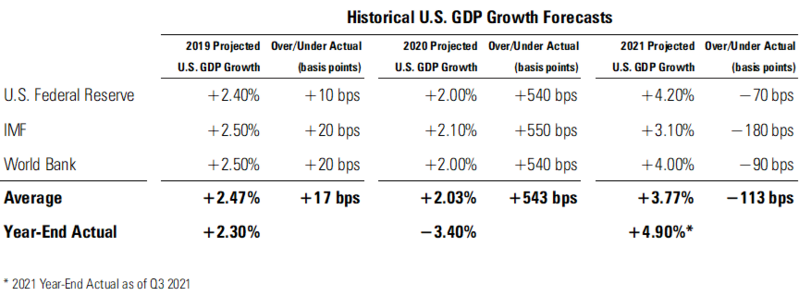

Last year, the major Wall Street firms published their prognostications for 2021. In the table below, you can see what was predicted compared to where those predictions stand at the time of this writing. 1

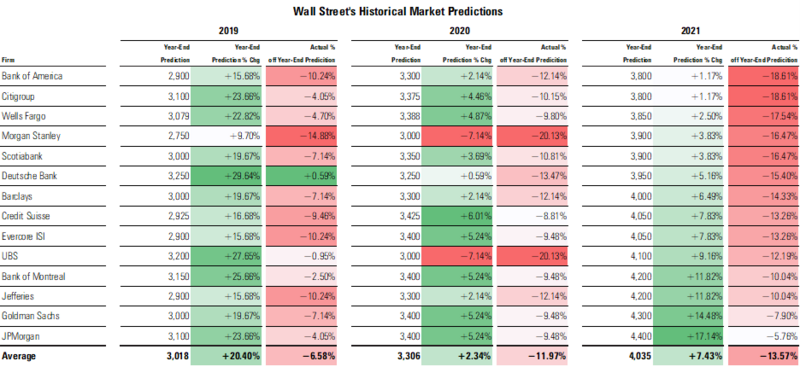

Since we have been calling out those forecast for several years, below is the published batting averages for each firm over a three-year period.

One thing is consistent, none of the firms regularly get it right.

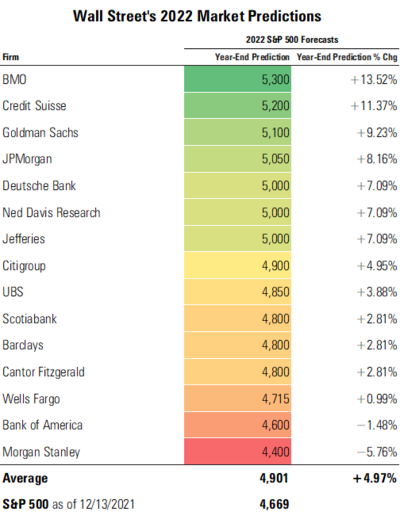

2022 is no different when it comes to market forecast. 2

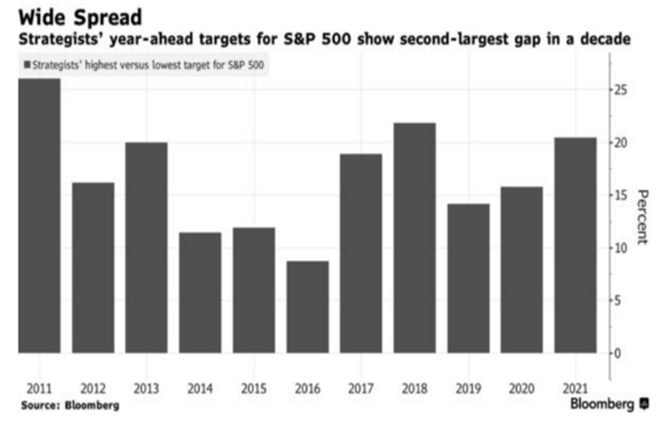

The range in forecasts is noteworthy in as much as they demonstrate the fact that even the “experts” can’t agree. In fact, the range in forecasts is the second-largest gap in the past decade, according to Bloomberg. 2

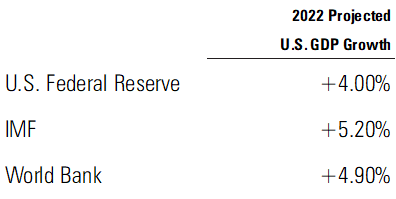

Pivoting to GDP growth, next year looks very promising according to leading banks like the World Bank, IMF, and the U.S. Federal Reserve. 3 4 5

So, how accurate are they at predicting macroeconomic outcomes with their combined hundreds of economists on staff?

The typical Wall Street parlor trick consists of offering precision in terms of forecasts and inaccuracy in terms of outcomes.

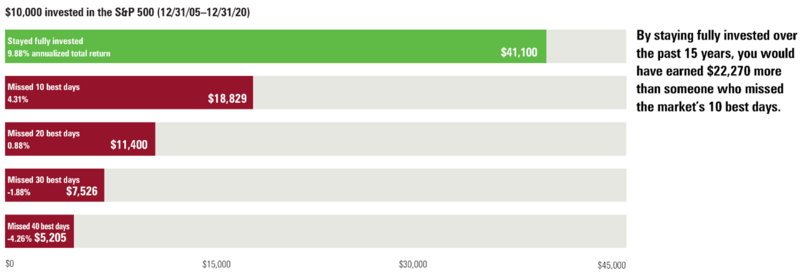

This is why the individual investor often forgets that time in the market matters much more than timing the market which generates more risk and much less reward. Missing just a few days is all it takes to lose the advantage. 6

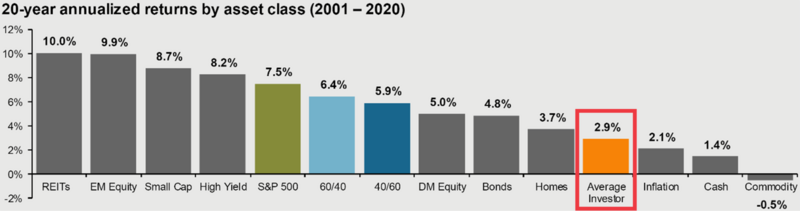

Put another way by J.P. Morgan, the individual investor underperforms almost all asset classes based upon mutual find transaction data. 7

This is going to be a heavy year for predictions. So, let’s make sure we know what investing game we are playing. Sometimes the Wall Street parlor trick looks tasty but, it’s full of empty calories.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1. https://phillipsandco.com/files/9616/1004/1772/Quarterly_Look_Ahead_-_Q1_2021_-_Final.pdf

2. https://www.bloomberg.com/news/articles/2021-12-08/strategist-forecasts-for-2022-diverge-by-second-most-in-10-years

3. https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20210922.pdf

4. https://www.imf.org/en/Publications/WEO/Issues/2021/10/12/world-economic-outlook-october-2021#Projections

5. https://data.worldbank.org/country/united-states?view=chart

6. https://www.putnam.com/literature/pdf/II508-ec7166a52bb89b4621f3d2525199b64b.pdf

7. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/