Wall Street Parlor Tricks – Precisely Inaccurate!

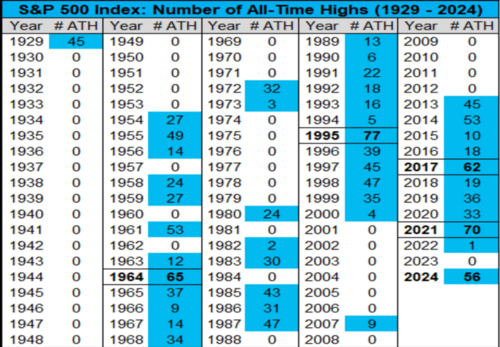

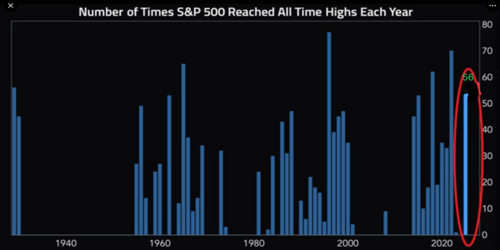

It’s been a remarkable year for equity investors when you consider the S&P 500 has hit an all-time high 56 times so far in 2024. 1

It’s not the best “all-time high” year but it’s near the best in the last 100 years. 2

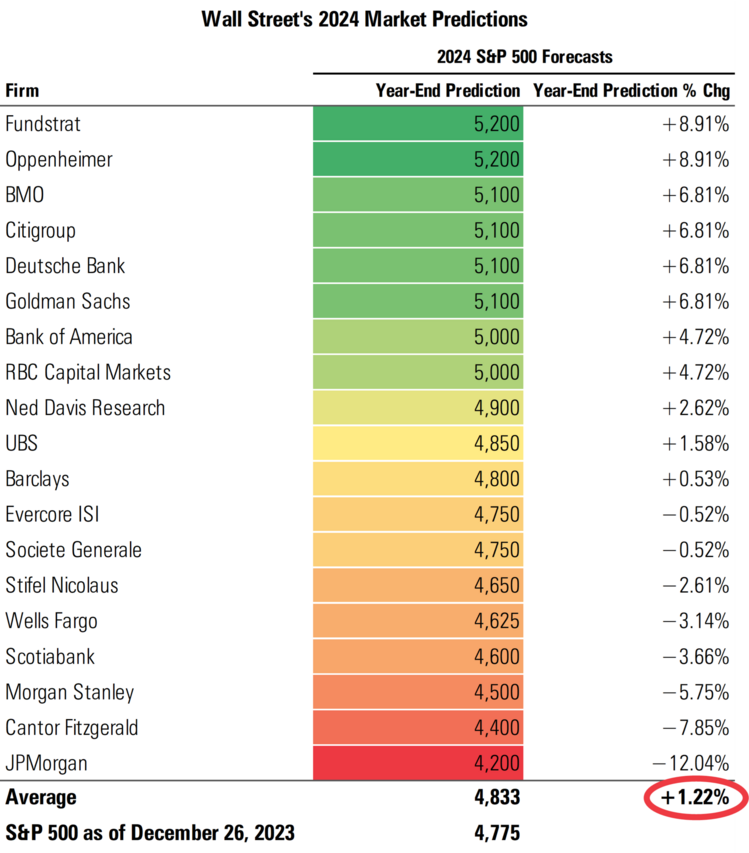

Around this time of year, I always look back at how the major Wall Street firms did with their predictions – especially in a year when the S&P 500 hit so many all-time highs and has rallied almost 25%. 2

Looking at the forecasts for 2024, we just need to review our Q1 2024 Look Ahead to get the picture. 2

You are seeing that correctly! The average forecast for the S&P 500 in 2024 was calling for a 1.22% gain. If you were a believer in the big banks and the power of their collective intelligence you might have just invested in bonds; but then you would have missed one of the best markets in 100 years.

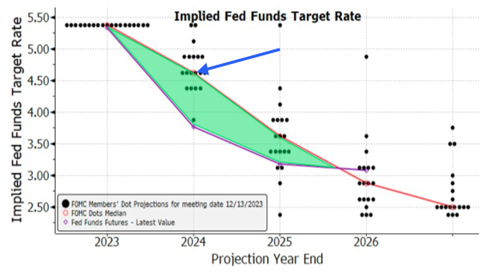

At least the Fed got their interest rate cut projection on target when they called for 100 basis points (1%) of cuts in 2024. That’s exactly what we got. 2

I find it curious how the “big bank, big brains” folks predicted only a 1.22% S&P 500 rally despite the Fed's 100bp rate cut and especially the behemoth J.P. Morgan who was forecasting a 12% decline.

So what’s the call for 2025? 2

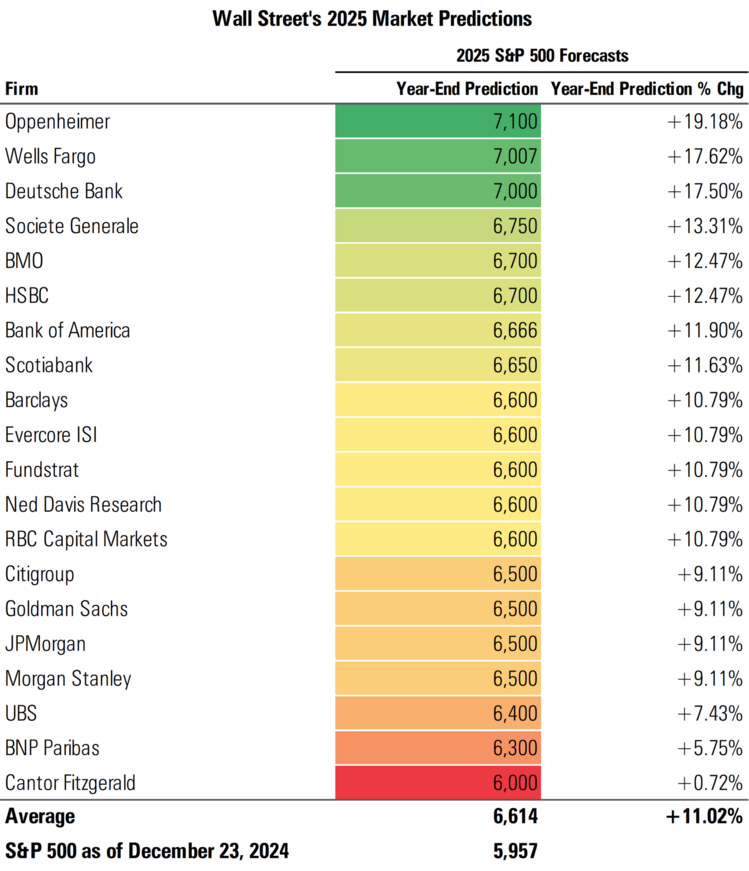

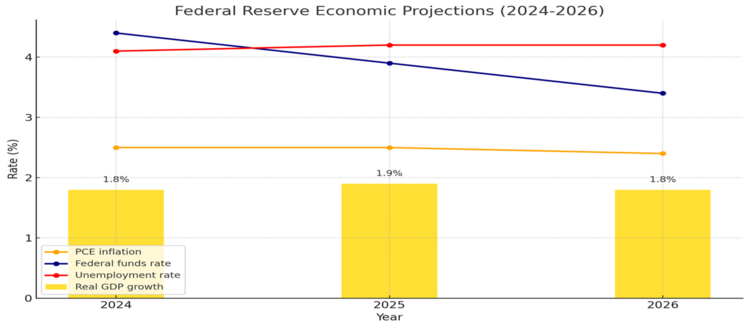

On average Wall Street “experts” are calling for a slightly above average return of 11% which seems reasonable when you consider S&P 500 earnings growth is expected to be at 15%. Further, the Fed is forecasting GDP growth of 1.9%, an unemployment rate of 4.3%, and a Fed Funds rate cut of approximately 60bp to 3.9% in 2025.

It raises the question: what should investors do with all of this precision-driven inaccuracy?

For me it is simple, I take Wall Street with a grain of salt and gaze my eye toward a much longer time horizon and skip their parlor trick games all together.

On behalf of our entire team at Phillips and Company we want to wish you and your family a wonderful Christmas and holiday season.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.